Imagine yourself standing in the heart of Sydney’s financial hub, Martin Place. As the clock strikes 7 am local time, a surge of excitement fills the air. The Sydney forex market, one of the world’s largest and most dynamic, springs to life. Traders from across the globe connect their screens, eager to seize opportunities in the ever-fluctuating currency landscape.

Image: www.forex.academy

Sydney Forex Market Opening Hours

The Sydney forex market operates during the following hours (Australian Eastern Standard Time – AEST):

- Weekdays: 7 am – 4 pm

- Saturdays: 8 am – 12 pm (FX settlement only)

The Significance of the Sydney Forex Market

The Sydney forex market holds immense importance in the global financial sphere. As the third-largest trading hub after London and New York, it plays a pivotal role in setting currency rates for the Asia-Pacific region and beyond. The market’s deep liquidity and wide range of currency pairs attract traders seeking both short-term and long-term investment opportunities. With an average daily trading volume exceeding $1 trillion, the Sydney forex market offers unparalleled access to market depth and volatility.

Impact on Global Markets

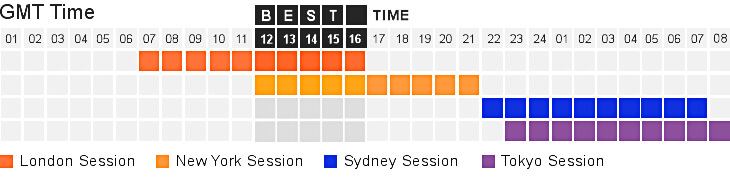

The Sydney forex market’s opening hours align strategically with the Asian trading session. This creates a seamless transition from Western to Eastern markets, ensuring continuous price discovery throughout the 24-hour trading day. The opening bell in Sydney often sets the tone for the rest of the global forex markets, influencing currency valuations and driving market sentiment.

Image: scuba-dawgs.com

Understanding Forex Basics

Foreign exchange (forex) trading involves buying and selling currencies from one another, leveraging differences in their exchange rates. In the forex market, currencies are traded in pairs, each representing one currency’s value against another. For example, the EUR/USD pair indicates the value of the euro relative to the US dollar.

Market Participants and Motives

The Sydney forex market is a melting pot of participants, ranging from large financial institutions and central banks to individual retail traders. Each participant enters the market with unique motives, such as:

- Speculation: Profiting from short-term currency fluctuations

- Hedging: Minimizing risk associated with international business transactions

- Investment: Holding currencies as long-term assets

- Trading: Earning commissions by executing trades for clients

Tips for Trading the Sydney Forex Market

Navigating the Sydney forex market requires careful preparation and sound decision-making. Here are some expert tips to enhance your trading experience:

Technical Analysis and Fundamental Factors

Traders often employ technical analysis, studying historical price data to identify trends and patterns that may predict future market movements. However, it’s crucial not to neglect fundamental factors, such as economic data, interest rate decisions, and geopolitical events. By considering both technical and fundamental analysis, traders can develop a more comprehensive trading strategy.

Managing Risk and Managing Leverage

Forex trading involves inherent risks, and managing those risks is paramount. Implementing stop-loss orders, which automatically close trades when predetermined price levels are reached, is an essential risk management tool. Additionally, understanding the concept of leverage, which magnifies both potential profits and losses, is essential to avoid overexposure to market volatility.

Frequently Asked Questions (FAQs)

Q: Why does the Sydney forex market open at 7 am AEST?

A: The opening hours align with the start of the Asian trading session, allowing for a smooth transition from Western to Eastern markets.

Q: What are the most traded currency pairs in the Sydney forex market?

A: The most actively traded currency pairs include AUD/USD, USD/JPY, EUR/USD, GBP/USD, and NZD/USD.

Q: Can retail traders participate in the Sydney forex market?

A: Yes, retail traders can access the Sydney forex market through online brokers that provide the necessary trading platform and infrastructure.

Sydney Forex Market Open Time

Conclusion

The Sydney forex market presents a dynamic and rewarding trading environment for investors seeking currency exposure. Its strategic opening hours, liquidity, and global influence make it a hub for both short-term and long-term trading opportunities. By adhering to best practices, managing risk, and staying informed about market trends, traders can harness the power of the Sydney forex market to achieve their financial goals. Are you ready to dive into the world of forex trading and explore the opportunities that the Sydney forex market holds?