In the labyrinthine world of international currency exchanges, choosing the right forex card can make navigating the financial waters a smooth or treacherous journey. In this comprehensive guide, we delve into the intriguing dichotomy of single currency vs. multi-currency forex cards, revealing the subtleties and distinctions that can empower you to make informed decisions for your financial endeavors.

Image: onlineforexcard.wordpress.com

Single Currency Forex Cards

As the name suggests, single currency forex cards are tailored for transactions in a single designated currency. They are ideal for frequent travelers who predominantly visit a particular country or region, eliminating the hassle of currency conversions and minimizing transaction fees. Single currency cards offer stability and predictability, ensuring that you always know the exact exchange rate you’re getting. Furthermore, they often come with competitive exchange rates and provide the convenience of locking in a favorable rate for future transactions.

Multi-Currency Forex Cards

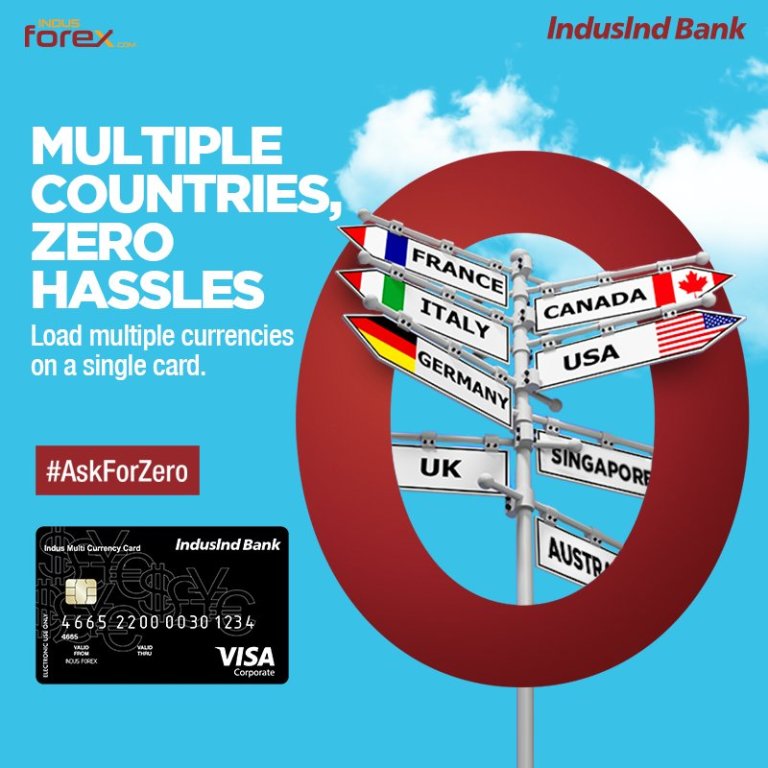

Multi-currency forex cards are the versatile choice for globe-trotting adventurers who traverse multiple countries with fluctuating currencies. These cards allow you to store and manage multiple currencies simultaneously, empowering you to seamlessly navigate a diverse financial landscape without the need for multiple cards. Multi-currency cards offer flexibility and convenience, allowing you to access funds in different currencies at your fingertips with relatively low transaction fees.

Deciding Between the Two

The choice between a single currency or multi-currency forex card depends on your travel patterns and financial needs. If predictability and stability are paramount, a single currency card provides an unwavering foundation for your transactions. However, if flexibility and versatility are more important, a multi-currency card offers the freedom to navigate multiple currencies without the burden of currency conversions.

Image: www.pinterest.com

Expert Insights: Maximizing Your Forex Card Usage

Renowned financial expert, Ms. Anya Petrova, emphasizes the significance of due diligence when choosing a forex card. “Thoroughly research and compare different providers, considering exchange rates, transaction fees, and any additional benefits offered. Remember, it’s not merely about finding the most competitive exchange rate; it’s about finding the card that aligns perfectly with your travel habits and financial objectives.”

Actionable Tips for Smart Forex Card Use

-

Plan your purchases: Determine the currencies you’ll need and preload them onto your card to avoid unfavorable exchange rates at checkout.

-

Maximize local currencies: Use ATMs in local countries to withdraw cash in local currency, often yielding better rates than using your card for direct purchases.

-

Monitor your transactions: Keep track of your expenses and compare exchange rates to ensure you’re getting the best possible deal.

Single Currency Vs Multi Currency Forex Card

Conclusion

Navigating the intricacies of forex cards can be empowering with the right knowledge and guidance. Whether you embrace the stability of single currency cards or relish the versatility of multi-currency options, the key lies in understanding your unique financial needs and choosing the card that resonates with your travel aspirations. Equipped with this multifaceted guide, you can embark on your international adventures with confidence, knowing you have the financial tools to navigate the currency complexities with ease and efficiency.