Immerse yourself in the world of forex trading, where volatile markets dance to the rhythm of global economic events. Amidst the whirlwind of price action, there exists a serene haven: the one trade a day forex strategy. Contrary to its name, this approach is not about trading once and retiring; instead, it emphasizes patience, meticulous analysis, and calculated execution.

Image: howtotradeonforex.github.io

Imagine a seasoned hunter patiently waiting for the perfect opportunity, analyzing subtle changes in the surrounding environment. The one trade a day strategy mirrors this approach, involving in-depth market research, precise entry and exit points, and an unwavering focus on preserving capital. By embracing this strategy, traders can mitigate the risks inherent in the forex market while maximizing their profit potential.

The Cornerstones of Success: Ingredients of the One Trade a Day Strategy

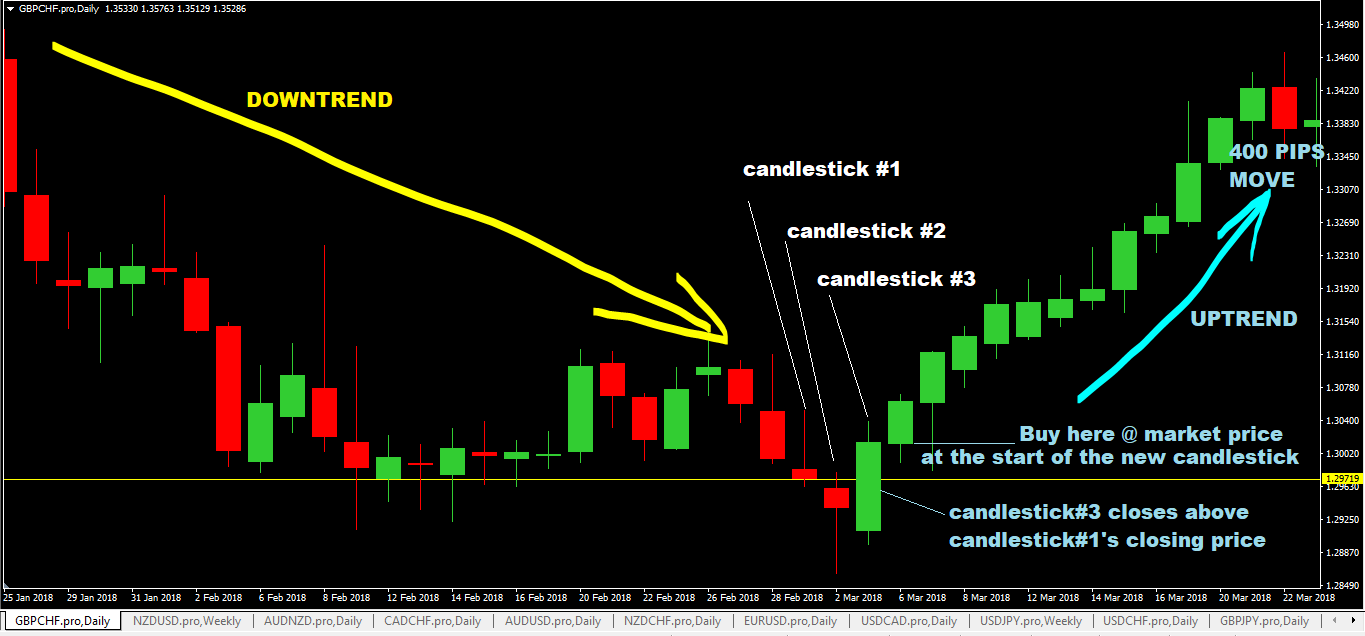

At the heart of the one trade a day strategy lies a rigorous analysis of market trends. Technical analysis takes center stage, with traders scrutinizing charts to identify patterns, trends, and trading opportunities. Support and resistance levels serve as guideposts, painting a clearer picture of price movements and potential reversal points.

Fundamental analysis also plays a pivotal role, delving into economic data, political events, and industry news to gauge market sentiment and potential catalysts for price fluctuations. By synthesizing these two perspectives, traders can make informed trading decisions, enhancing their chances of success.

Another crucial element of the one trade a day strategy is precise entry and exit points. Instead of chasing the market, traders exercise discipline and identify optimal entry points aligned with their analysis. They set clear profit targets and stop-losses, ensuring they lock in profits and protect their capital from adverse market swings.

Lastly, risk management is paramount in the one trade a day strategy. Traders meticulously calculate risk-reward ratios, limiting their exposure on each trade to a tolerable level. Money management techniques, such as position sizing and setting appropriate stop-loss orders, safeguard their trading capital and prevent devastating losses

The Benefits of a Patient Approach: Unlocking the Potential of the One Trade a Day Strategy

Adopting the one trade a day strategy comes with a myriad of benefits that can transform the trading journey. Firstly, it fosters patience, a virtue essential for success in any field. By limiting trades to one per day, traders avoid impulsive decisions and the emotional rollercoaster that often accompanies excessive trading.

Inherent in the one trade a day strategy is a focus on quality over quantity. Traders meticulously analyze the market, selecting only high-probability opportunities that align with their trading plan. This disciplined approach reduces the risk of trading against the trend or falling into the trap of emotional trading.

Furthermore, the one trade a day strategy promotes a sense of calm and control. Traders can avoid the stress and anxiety that can result from constant monitoring of the markets and multiple open positions. By setting clear entry and exit points, they can enjoy peace of mind, knowing that their strategy is diligently working for them.

Additionally, the one trade a day strategy is well-suited for individuals with busy schedules or limited time for trading. By allocating a specific time each day to market analysis and trade execution, traders can maintain a disciplined approach while effectively managing their work-life balance.

Practical Implementation: A Step-by-Step Guide to the One Trade a Day Strategy

Embarking on the one trade a day journey requires a systematic approach and unwavering dedication. Here’s a detailed guide to help you get started:

- Choose your currency pair: Start by selecting a currency pair that aligns with your risk tolerance, trading style, and market knowledge.

- Analyze the market: Conduct thorough technical and fundamental analysis to identify market trends, support and resistance levels, and potential trading opportunities.

- Set entry and exit points: Determine precise entry and exit points based on your analysis, considering profit targets and stop-loss levels to manage risk.

- Execute the trade: Once you identify the right opportunity, execute your trade with discipline, adhering to your trading plan and risk management rules.

- Monitor the trade: Keep a close eye on the market, monitoring the trade’s progress and making adjustments as necessary based on predefined parameters.

- Close the trade: Exit the trade when it reaches your profit target or stop-loss level, ensuring you lock in profits or prevent further losses.

- Evaluate and refine: After each trade, take time to evaluate your decision-making process, identify areas for improvement, and refine your trading strategy accordingly.

Image: ritholtz.com

One Trade A Day Forex Strategy

Conclusion

The one trade a day forex strategy is not a get-rich-quick scheme; rather, it’s a path toward sustainable profitability and personal growth. By embracing patience, meticulous analysis, and calculated execution, traders can navigate the forex market with confidence and resilience. While it does not guarantee success, this strategy provides a solid framework for building a prosperous trading journey.

Remember, the financial journey is not a sprint but a marathon, and the one trade a day strategy empowers traders to pace themselves, make informed decisions, and achieve their long-term financial goals. By embracing this approach, you’re embarking on a path toward financial freedom and a fulfilling trading experience.