Unlock the Secrets of Money Management in Forex Mastery

Image: learn.tradimo.com

Imagine stepping into the realm of forex trading with unwavering confidence, knowing your financial ship is guided by a robust money management strategy. This intricate art has the power to transform your trading journey, enabling you to navigate market volatility with grace and optimize your chances of success.

The Pillars of Money Management

In the dynamic world of forex trading, money management serves as the cornerstone of your financial defense. It dictates how you allocate your hard-earned capital, mitigate risks, and safeguard your profits. By embracing these fundamental principles, you can chart a path towards financial freedom and minimize the pitfalls that hinder many traders.

-

Risk Management: Understand the inherent risks of forex trading and implement strategies to contain potential losses.

-

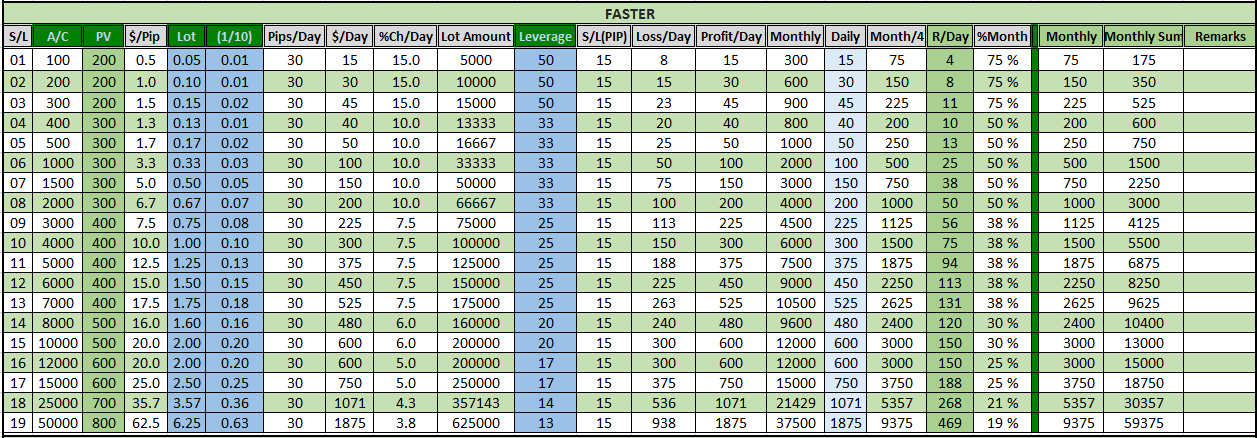

Position Sizing: Determine the optimal trade size proportionate to your account balance, ensuring you don’t overextend your financial position.

-

Stop-Loss Orders: Place these precautionary measures to automatically close losing trades at a predefined level, limiting your losses.

-

Take-Profit Orders: Set targets for potential profits to secure your earnings and avoid holding onto losing positions.

-

Trailing Stops: Dynamic stop-losses that follow the market in a favorable direction, maximizing profits while protecting against sudden reversals.

Expert Insights

Renowned forex trader George Soros emphasizes the importance of “reflexivity” in money management. He argues that market participants’ perceptions and actions can significantly influence market behavior, making it crucial to adapt your strategy accordingly.

Legendary trader Jesse Livermore advises against risk tolerance, emphasizing the need for discipline and a conservative approach. He stresses, “It’s not the amount of money I make that makes me happy, but the fact that I make it honestly and play fair.”

Actionable Tips

-

Define Your Risk Tolerance: Assess your financial circumstances, investment goals, and risk appetite to establish a suitable risk management framework.

-

Implement a Trading Plan: Document your trading strategy, including money management guidelines, risk parameters, and trade triggers to ensure consistency.

-

Use Leverage with Caution: While leverage can magnify profits, it can also amplify losses. Handle it responsibly, understanding its potential consequences.

-

Monitor Market Conditions: Stay informed about economic events, geopolitical developments, and market sentiment to adjust your money management strategy as needed.

-

Seek Mentorship: Learn from experienced forex traders who have mastered the art of money management and can provide valuable guidance.

Embracing the Power

Money management in forex trading is not merely a set of rules but an essential discipline that empowers you to face the markets with confidence and resilience. By embracing its principles, you can transform fear into calculated risk-taking, safeguard your financial well-being, and unlock the full potential of this dynamic financial arena. Remember, the path to forex success lies in the artful fusion of market knowledge and sound money management strategies.

Image: www.mql5.com

Money Management In Forex Trading

https://youtube.com/watch?v=Al4vzcbblhc