The Intriguing World of Forex: A Gateway to Financial Empowerment

Welcome to the tantalizing realm of foreign exchange trading, a global marketplace brimming with opportunities for financial freedom. In this arena, currency pairs waltz and tango, presenting a kaleidoscope of possibilities for astute traders. However, before you dive headfirst into this electrifying domain, it’s imperative to navigate the intricacies of opening a forex account, starting with the pivotal question: what’s the minimum amount required?

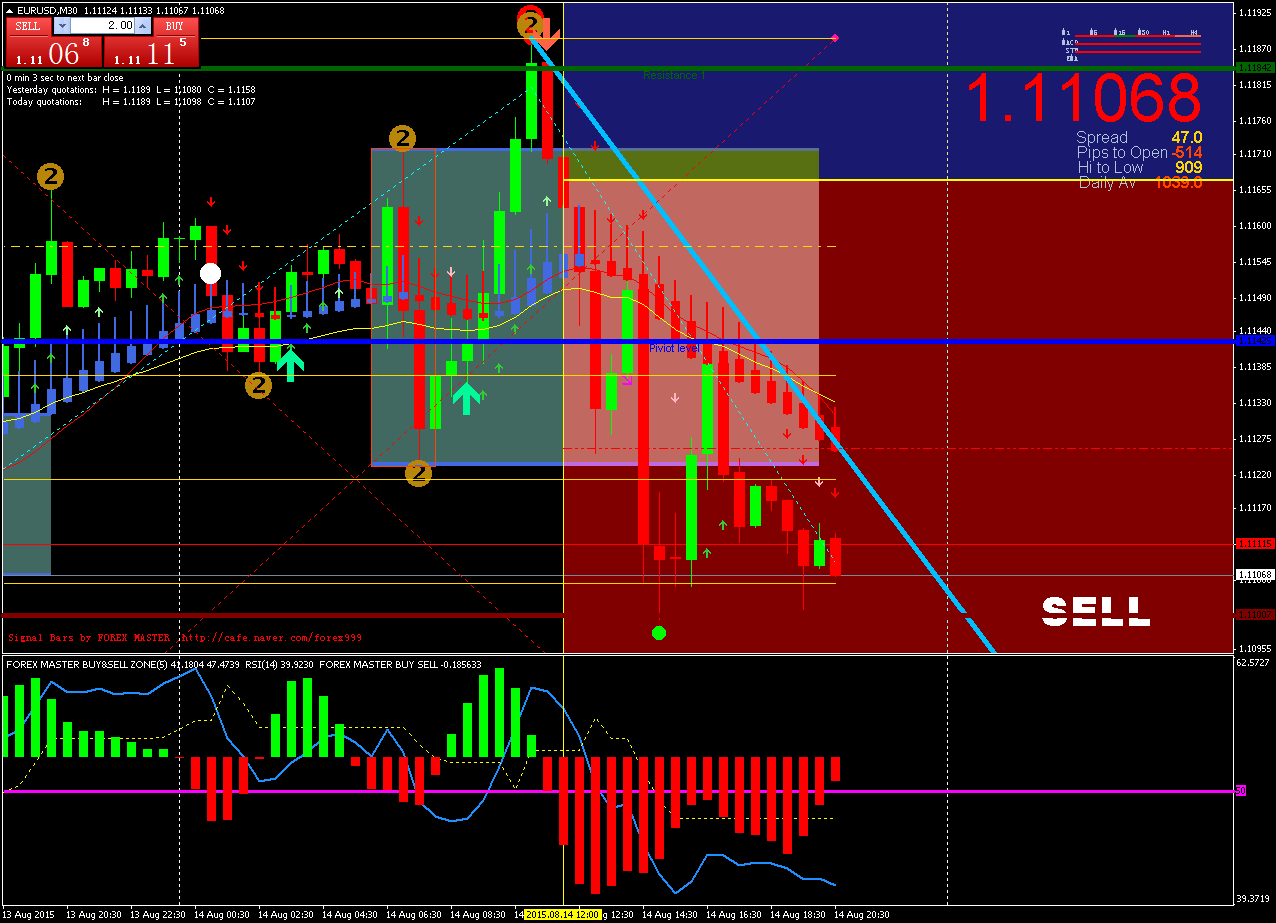

Image: www.myfxbook.com

Embarking on the Forex Journey: Demystifying Account Minimums

The minimum amount to open a forex account varies across different brokers, ranging from as low as $1 to a more substantial figure like $500 or even $1,000. It’s worth noting that these initial contributions act as a form of collateral, safeguarding against potential losses while empowering you to capitalize on profitable trades.

The Allure of Micro Accounts: A Haven for Beginner Traders

For aspiring forex traders with limited capital, micro accounts beckon as a gateway to financial markets. With minimum deposits hovering around $1 to $10, micro accounts provide a risk-free environment for honing skills and gaining foundational knowledge without substantial financial commitments.

Standard and ECN Accounts: Stepping into the Professional Arena

Seasoned traders often gravitate towards standard accounts, which typically require minimum deposits of $100 to $500. These accounts offer a balance between accessibility and professional features, enabling traders to execute trades with greater precision. On the other hand, ECN accounts, known for their ultra-low spreads, may necessitate higher minimum deposits of $500 or more.

Image: investhub.agency

Navigating the Forex Landscape: Factors Influencing Minimums

A plethora of factors contribute to the variance in minimum account requirements among forex brokers. These include:

- Brokerage Regulations: Regulatory authorities in different jurisdictions often impose minimum deposit requirements for forex brokers operating within their domains.

- Account Types: Different account types offered by brokers (micro, standard, ECN) come with varying minimum deposit stipulations.

- Market Volatility: During periods of heightened market volatility, brokers may adjust minimum deposits to manage risk exposure.

- Broker Stability: Well-established and reputable brokers tend to have higher minimum deposit requirements to ensure financial stability and client protection.

- Trading Strategies: The type of trading strategies employed (scalping, swing trading, etc.) can influence the optimal minimum deposit requirement.

Tips for Selecting a Minimum Deposit Broker: A Strategic Approach

Navigating the forex brokerage landscape requires a keen eye for detail to identify a platform that aligns with your financial goals. Here are some tips to guide your selection:

- Consider Your Trading Style: Assess your trading strategies and determine the minimum deposit amount that aligns with your risk tolerance and capital requirements.

- Compare Regulatory Standards: Opt for brokers regulated by reputable authorities (e.g., FCA, ASIC, CySEC) to ensure financial security and compliance with industry best practices.

- Explore Account Features: Evaluate the broker’s account offerings, including trading platforms, spreads, commissions, and available instruments, to find a match for your trading preferences.

- Check Customer Support: Reliable customer support is paramount for resolving queries and ensuring a seamless trading experience.

- Read Online Reviews: Seek insights from other traders and scour online reviews to gauge the broker’s reputation and service quality.

Frequently Asked Questions: Unraveling Forex Account Minimums

Q: What is the typical range for minimum forex account deposits?

A: The minimum amount to open a forex account typically ranges from $1 to $1,000, depending on the broker and account type.

Q: Are micro accounts suitable for all traders?

A: Micro accounts are ideal for beginner traders with limited capital or those seeking a low-risk trading environment. However, they may not be suitable for experienced traders requiring larger trade sizes.

Q: How do I choose the right broker with the best minimum deposit requirement?

A: Consider your trading style, regulatory compliance, account features, customer support, and online reviews when selecting a broker with an optimal minimum deposit requirement.

Minimum Amount To Open Forex Account

Conclusion: Embracing the Forex Journey with Calculated Steps

Unveiling the minimum amount to open a forex account is a crucial step in embarking on your financial trading odyssey. Whether you’re a novice trader seeking a risk-free environment or an experienced trader seeking professional features, understanding the dynamics of minimum deposits empowers you to make informed decisions. Remember, the choice of broker and account type should align seamlessly with your trading aspirations. So, are you ready to delve into the captivating realm of forex trading? Take the plunge with confidence and embrace the journey towards financial empowerment.