Image: www.myxxgirl.com

In the bustling world of forex trading, technical analysts constantly seek patterns that can help them make informed decisions. Among these patterns, the M and W patterns stand out due to their distinctive formations and potential for profitability. In this article, we will delve deep into the world of M and W patterns, exploring their significance in forex trading. Join us as we unravel the intricacies of these patterns and unlock the secrets to enhancing your trading strategies with their help.

M and W Patterns: An Introduction

M and W patterns are technical analysis tools that indicate potential reversals in a trading instrument’s trend. These patterns form when the price action creates a distinct shape resembling the letters “M” or “W,” depending on the prevailing market conditions. M patterns typically signal a bearish reversal, indicating a potential drop in prices, while W patterns signify a bullish reversal, suggesting an upward movement.

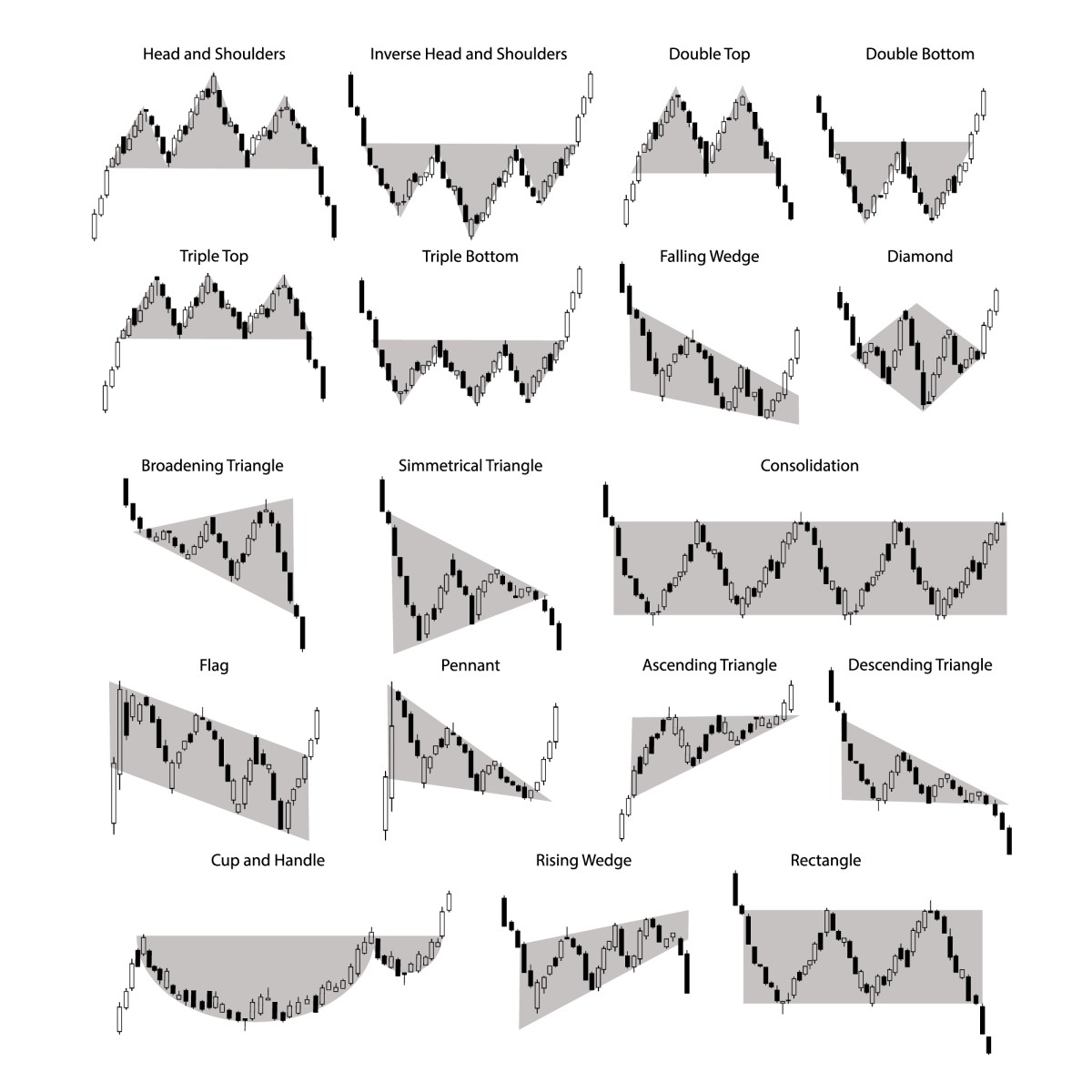

Types of M and W Patterns

There are two primary types of M and W patterns:

1. Standard M and W Patterns

These patterns consist of three peaks and two troughs, with a higher high (peak) and a lower low (trough) in the middle. In an M pattern, the second peak is lower than the first, while in a W pattern, the second trough is higher than the first.

2. Inverse M and W Patterns

The inverse M and W patterns are reverse formations of their standard counterparts. In an inverse M pattern, the second peak is higher than the first, and in an inverse W pattern, the second trough is lower than the first. These patterns signal a potential continuation of the prevailing trend.

How to Identify M and W Patterns

Identifying M and W patterns involves careful observation of the price action on a trading chart:

- Standard M Pattern: Connect the three peaks with lines to form an “M” shape. Ensure that the second peak is lower than the first.

- Standard W Pattern: Connect the three troughs with lines to form a “W” shape. Ensure that the second trough is higher than the first.

- Inverse M Pattern: Connect the three peaks with lines to form an inverted “M” shape. Ensure that the second peak is higher than the first.

- Inverse W Pattern: Connect the three troughs with lines to form an inverted “W” shape. Ensure that the second trough is lower than the first.

Image: bikotrading.com

Trading M and W Patterns

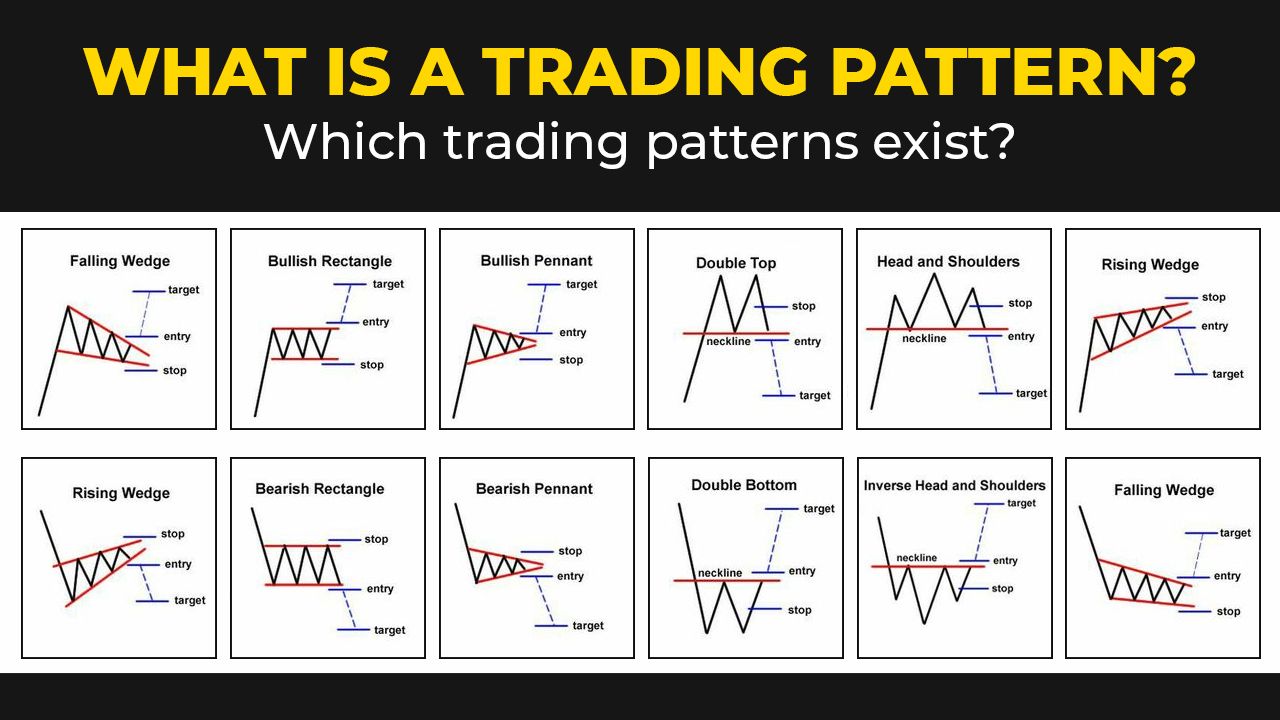

Trading M and W patterns involves identifying the appropriate entry and exit points based on the pattern’s formation:

- Entry: Enter a trade when the price action breaks the neckline of the pattern, which is a horizontal line connecting the highest peak and the lowest trough.

- Stop-Loss: Place a stop-loss order below the neckline for an M pattern and above the neckline for a W pattern.

- Take-Profit: Take-profit levels can be set based on historical data or support and resistance levels.

Tips and Expert Advice

Experienced forex traders offer valuable tips for successful trading with M and W patterns:

- Confirmation: Look for confirmation from other technical indicators before entering a trade.

- Volume: Assess the trading volume during the pattern’s formation; high volume indicates increased volatility and potential breakouts.

- Reversals: Be aware that although M and W patterns suggest potential reversals, they do not guarantee a change in trend.

- Trend Strength: Consider the strength of the prevailing trend; patterns formed during strong trends are more reliable.

- Patience: Be patient when identifying M and W patterns; rush decisions can lead to erroneous trades.

FAQs on M and W Patterns

Q: What are the implications of an inverse M or W pattern?

A: Inverse M and W patterns generally indicate a continuation of the prevailing trend.

Q: How do I determine the strength of a M or W pattern?

A: The strength of the pattern depends on factors such as the height or depth of the peaks and troughs, the volume, and the confirmation from other indicators.

Q: What is the best time frame to trade M or W patterns?

A: M and W patterns can be traded on various time frames, but higher time frames tend to provide more reliable signals.

M And W Patterns In Forex Pdf

https://youtube.com/watch?v=LYib9M7er_I

Conclusion

M and W patterns are valuable tools in the arsenal of forex traders. By understanding the significance and intricacies of these patterns, you can improve your trading strategies and increase your chances of success. Remember to incorporate other technical indicators and expert advice into your analysis for a well-rounded approach. Are you ready to embark on a profitable journey with M and W patterns by your side?