In the ever-evolving realm of forex trading, knowing how to navigate the market’s complexities is paramount. One indispensable asset in this pursuit is the arsenal of technical indicators, each designed to empower traders with actionable insights. This definitive guide will delve into the comprehensive list of all forex indicators, unlocking their potential and empowering you to make informed trading decisions.

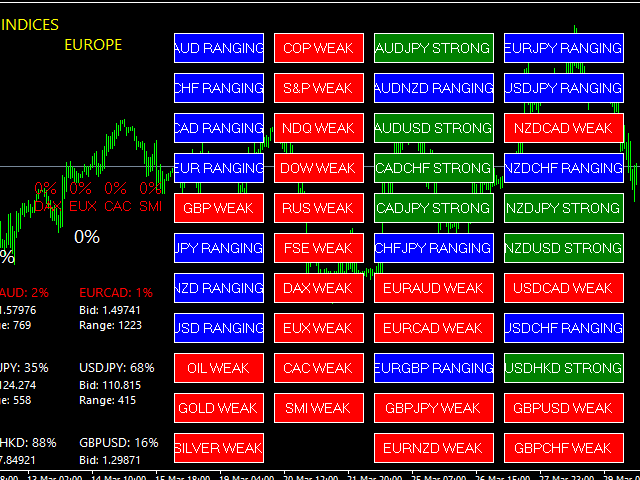

Image: forexindicatorlist.blogspot.com

Part 1: Demystifying Forex Technical Indicators

Technical indicators serve as valuable analytical tools that provide valuable insights into market behavior, price movements, and potential trading opportunities. They draw upon historical data to identify trends, patterns, and anomalies within price charts, equipping traders with a deeper understanding of the market’s ebb and flow.

From identifying overbought or oversold conditions to signaling potential breakouts, forex indicators play a pivotal role in helping traders anticipate market sentiment and make strategic trades. These versatile tools can be categorized into various types, such as:

- Trend Indicators: Gauge the overall trend direction and identify areas of support and resistance.

- Momentum Indicators: Measure the speed and strength of price movements, indicating potential reversals or continuations.

- Volume Indicators: Assess the volume of trading activity, often suggesting market interest and momentum.

- Volatility Indicators: Estimate the extent of price fluctuations, helping traders gauge risk and identify potential breakout zones.

Part 2: Exploring the Arsenal of Forex Indicators

The world of forex indicators is vast and diverse, with each tool offering unique advantages and applications. Let’s embark on a comprehensive journey through this arsenal, exploring some of the most popular and effective indicators that traders rely upon:

a) Moving Averages (MA)

Moving averages smooth out price movements by averaging prices over a defined period, effectively filtering out noise and highlighting the underlying trend. Traders often use different MA periods, such as a 50-day or 200-day MA, to identify trading opportunities.

Image: www.mql5.com

b) Bollinger Bands (BB)

Bollinger Bands are a versatile tool that incorporates standard deviation to create dynamic upper and lower bands around a moving average. When price breaks outside these bands, it can signal a potential breakout or trend continuation.

c) Relative Strength Index (RSI)

The RSI measures the momentum of price movements and indicates potential overbought or oversold conditions. Traders typically use RSI levels above 70 as an overbought signal and levels below 30 as an oversold signal, indicating a potential reversal.

d) Stochastic Oscillator (SO)

The SO compares the current price to the range of prices over a specific period, indicating potential overbought or oversold areas. Traders often use SO divergence between its lines and price action to identify trading signals.

e) Moving Average Convergence Divergence (MACD)

The MACD is a trend-following indicator that measures the relationship between two moving averages. It consists of a MACD line and a signal line, with crossovers between the two indicating potential trading opportunities.

Part 3: Empowering Traders with Actionable Insights

The true power of forex indicators lies in their ability to provide traders with actionable insights that can enhance their trading strategies. By incorporating these indicators into their analysis, traders gain an edge in understanding market behavior and identifying potential trading opportunities:

a) Trend Confirmation:

Combining multiple trend indicators, such as MAs and BBs, can confirm the strength of the trend and provide confluence in identifying potential reversals or continuations.

b) Momentum Identification:

Momentum indicators, such as RSI and SO, can help traders identify overbought or oversold conditions. By combining these indicators with trend indicators, traders can anticipate potential breakouts and fading opportunities.

c) Volatility Assessment:

Volatility indicators, such as Average True Range (ATR), provide insights into price fluctuations. Traders can use this information to adjust their position sizing and risk management strategies accordingly.

d) Divergence Detection:

Divergences between price action and indicator readings can indicate potential trend reversals. For instance, negative divergence between price highs and RSI highs may suggest a potential reversal.

List Of All Forex Indicators

Conclusion: Enhancing Your Trading Journey

The vast world of forex indicators offers invaluable tools that empower traders with actionable insights and strengthen their market analysis. By incorporating these indicators into their trading strategies, traders gain a deeper understanding of market behavior and identify potential trading opportunities with greater precision. This comprehensive guide should have provided you with a solid foundation to navigate the world of forex indicators and enhance your trading journey.

Remember, the effectiveness of indicators depends largely on your trading style, risk appetite, and market conditions. It’s essential to approach technical indicators as valuable tools within a comprehensive trading strategy, rather than relying solely on their signals. By combining technical analysis with fundamental understanding and sound risk management practices, you can maximize your potential for success in the ever-evolving forex market.