Introduction

Imagine an economy with a war chest so vast, it could cushion the blow of any unexpected financial storm. This is the remarkable reality for nations with the largest foreign exchange (forex) reserves, a lifeline that offers financial sovereignty and a beacon of stability in an uncertain global economy. In this comprehensive guide, we explore the world’s forex reserve giants, unraveling the strategic importance and far-reaching implications of these towering financial assets.

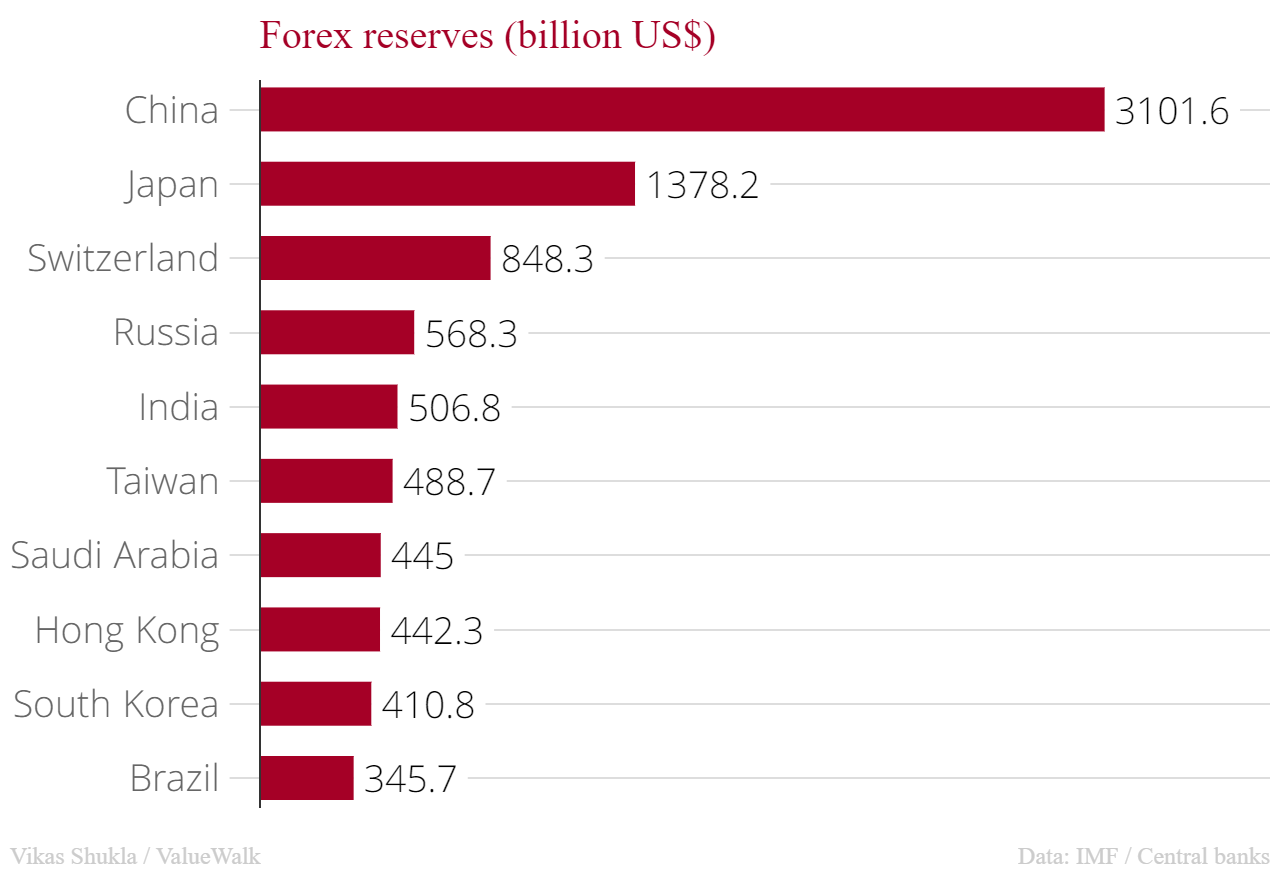

Image: www.valuewalk.com

Top Forex Reserve Holders: Unveiling Economic Powerhouses

China, the undisputed leader, boasts forex reserves that dwarf all others, exceeding $3 trillion. This staggering sum represents a testament to the country’s economic might and its prudent financial management. Japan, the distant runner-up, holds reserves surpassing $1 trillion, serving as a bedrock of stability for its export-driven economy. Switzerland’s reserves, amounting to nearly $800 billion, underscore the country’s reputation as a safe haven for global investors, particularly in times of market turmoil. With forex reserves exceeding $630 billion, India has emerged as a formidable economic force, signaling its growing stature in the global financial landscape.

Strategic Importance: Shielding Against Economic Storms

Forex reserves act as a nation’s financial airbag, protecting it from external economic shocks. By maintaining ample reserves, countries can stabilize their currencies, preventing sharp fluctuations that could harm their economies. This financial buffer also ensures that governments can meet international payment obligations, such as importing essential goods or servicing foreign debt, even during economic downturns.

Economic Sovereignty: Charting an Independent Course

Possessing substantial forex reserves empowers nations to chart an independent economic course, free from the undue influence of global financial institutions or speculative investors. This financial autonomy allows countries to implement policies tailored to their unique needs, prioritizing domestic growth and stability over external pressures.

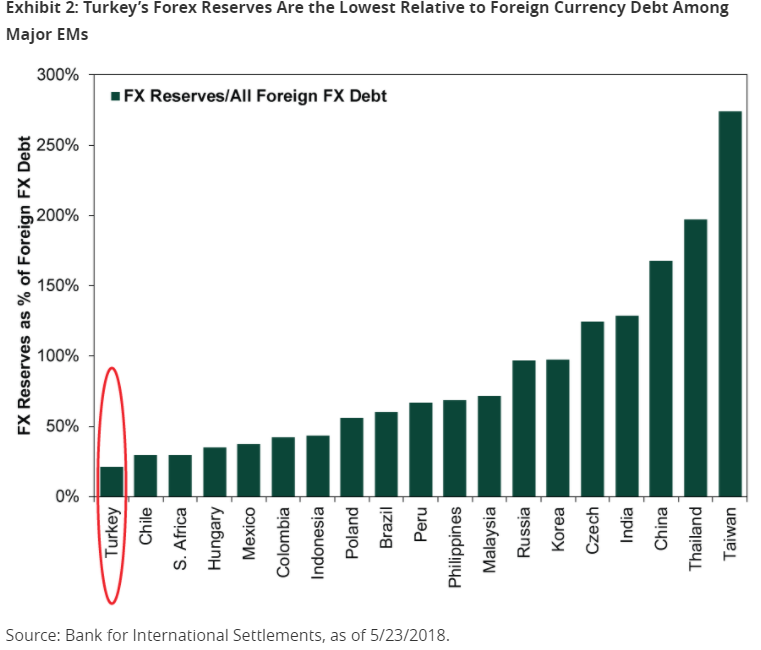

Image: www.alphainvesco.com

Stability Anchor: A Beacon of Confidence

Countries with ample forex reserves inspire confidence in investors and businesses both domestically and internationally. A nation’s financial health, as indicated by its forex reserves, becomes a key indicator of its economic stability and investment attractiveness. This, in turn, attracts foreign direct investment, fuels economic growth, and creates opportunities for citizens.

Challenges and Risks: Navigating the Financial Maze

While forex reserves offer significant benefits, managing them comes with unique challenges and risks. Governments must carefully balance the need to maintain sufficient reserves against the opportunity cost of holding non-yield-bearing assets. Exchange rate fluctuations can also impact the value of reserves, potentially eroding their purchasing power.

Largest Forex Reserves In The World

Conclusion: A Vital Lifeline for Economic Resilience

The world’s largest forex reserves serve as pillars of economic resilience, empowering nations to navigate financial storms, maintain currency stability, and pursue independent economic policies. They embody the strength and stability of the global economy and serve as a beacon of confidence for citizens and investors alike. Understanding the significance of forex reserves is paramount for comprehending the intricate dynamics of the global financial system and its impact on our daily lives.