Introduction

Are you wondering what “go to accounts” means or how it can affect your financial well-being? You’re not alone. In this comprehensive guide, we’ll delve into the world of go to accounts, explaining what they are, how they work, and their implications for your financial journey.

Image: www.themeskorner.com

Understanding Go to Accounts

A go to account is a core account linked to a credit card that serves as the primary repository for paying off the outstanding balance on the card. When you use your credit card to make purchases, the charges are typically recorded in the go to account. It’s from this account that funds are automatically withdrawn to cover the minimum payment due or any other amount you choose to pay on your credit card balance.

How Go to Accounts Work

As mentioned earlier, each credit card is usually associated with a designated go to account, which is typically a bank account or payment system like PayPal. When you apply for a credit card, you’ll be asked to provide details of the go to account where your payments will be drawn from.

Once you’ve set up your go to account, payments will automatically be made from this account on the due date specified in your credit card statement. This process continues until the credit card balance is fully paid off.

Benefits of Using Go to Accounts

There are several advantages to using go to accounts, including:

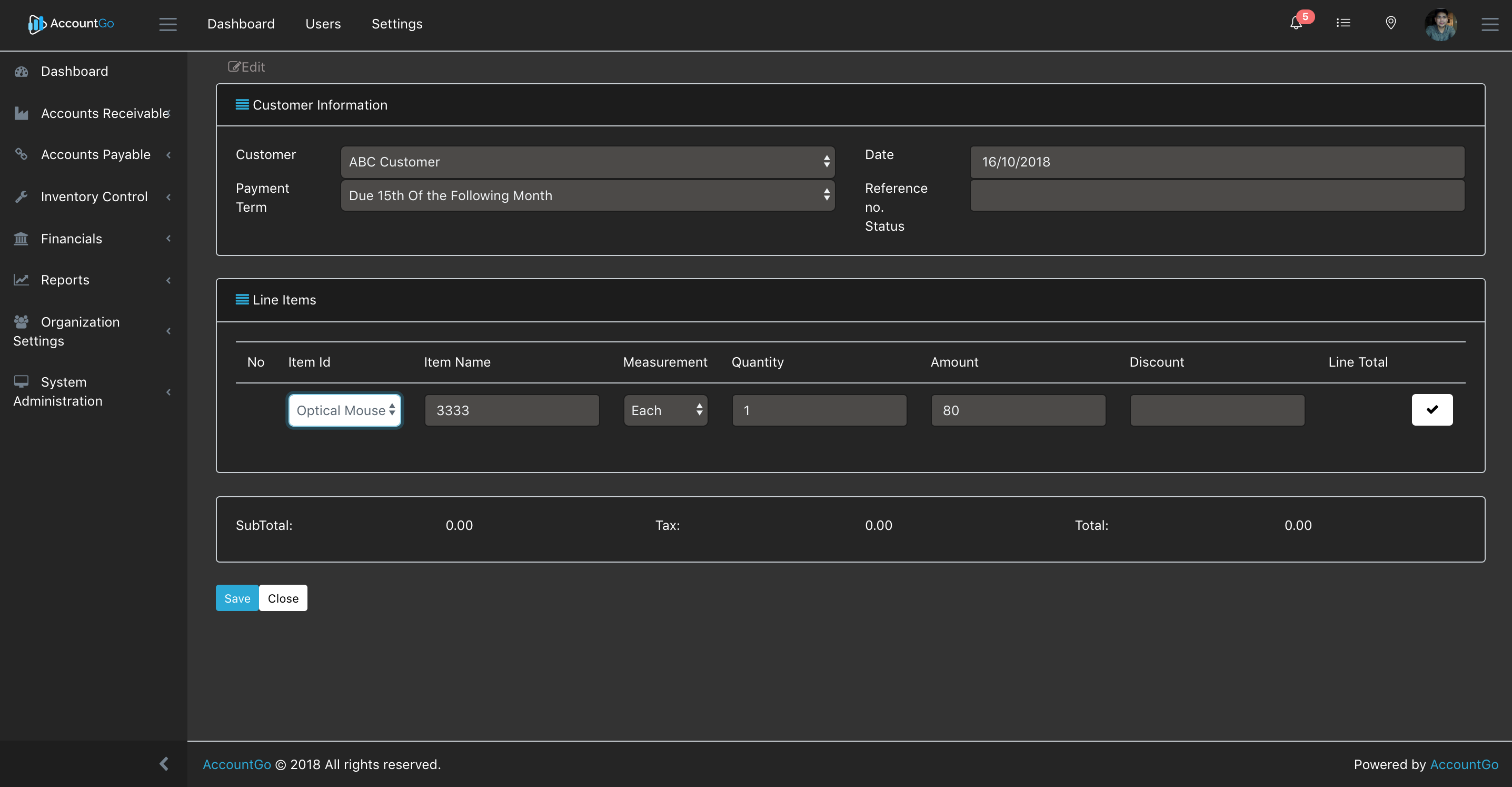

Image: awesomeopensource.com

Convenience:

Go to accounts automate the payment process, eliminating the need for you to manually transfer funds each month. This can save you time and effort, and it helps prevent missed payments that could damage your credit score.

Timeliness:

By automating payments, go to accounts ensure that your credit card balance is paid on time, every time. This helps you avoid late payment fees and interest charges, which can add up over time.

Peace of Mind:

Go to accounts give you peace of mind knowing that your credit card balance is being managed automatically. You don’t have to worry about forgetting to make a payment or making a mistake that could impact your credit.

Challenges of Using Go to Accounts

While go to accounts offer several benefits, there are also some potential challenges to consider:

Insufficient Funds:

If your go to account does not have sufficient funds to cover the scheduled payment, your payment may be declined. This can result in late payment fees and a negative impact on your credit score.

Fraudulent Charges:

If your go to account is compromised by fraud, unauthorized transactions could be made using your funds. It’s crucial to monitor your go to account regularly to detect any suspicious activity.

Overdraft Fees:

If your go to account is a checking account, you may be charged an overdraft fee if the account balance drops below zero due to a scheduled payment.

Expert Tips for Using Go to Accounts

To get the most out of your go to accounts, follow these expert tips:

Maintain Sufficient Funds:

Ensure that your go to account always has enough funds to cover the scheduled payment amount.

Set Up Payment Alerts:

Set up payment alerts to notify you when a payment is scheduled to be withdrawn from your go to account. This will help you stay informed and avoid any potential surprises.

Monitor Your Account Regularly:

Regularly review your go to account to ensure that all transactions are legitimate and that there are no unauthorized charges.

Consider Separate Checking Accounts:

If possible, consider setting up a separate checking account solely for your go to account payments. This helps prevent the risk of overdrafts in your primary checking account.

Go To Accounts

Conclusion

Go to accounts can be a convenient and effective way to manage your credit card payments. By automating the payment process and ensuring timely payment, go to accounts help you avoid late payment fees, maintain a good credit score, and give you peace of mind. By following the tips outlined in this guide, you can harness the benefits of go to accounts while minimizing potential challenges.