Introduction

Image: riset.guru

Navigating the dynamic landscape of foreign exchange (forex) can be a daunting task for aspiring traders. However, unlocking the secrets of forex charts holds the key to informed decision-making and successful trading outcomes. Forex charts are graphical representations of currency pair price movements over a specific period. Understanding how to read these charts is the foundation upon which traders can build their trading strategies and achieve profitability. Let’s embark on a comprehensive journey to decipher the enigmatic world of forex charts, empowering you with the knowledge and tools to become a confident and successful trader.

Unveiling the Essential Elements of a Forex Chart

A forex chart consists of several fundamental elements that work in unison to provide a comprehensive view of price behavior.

-

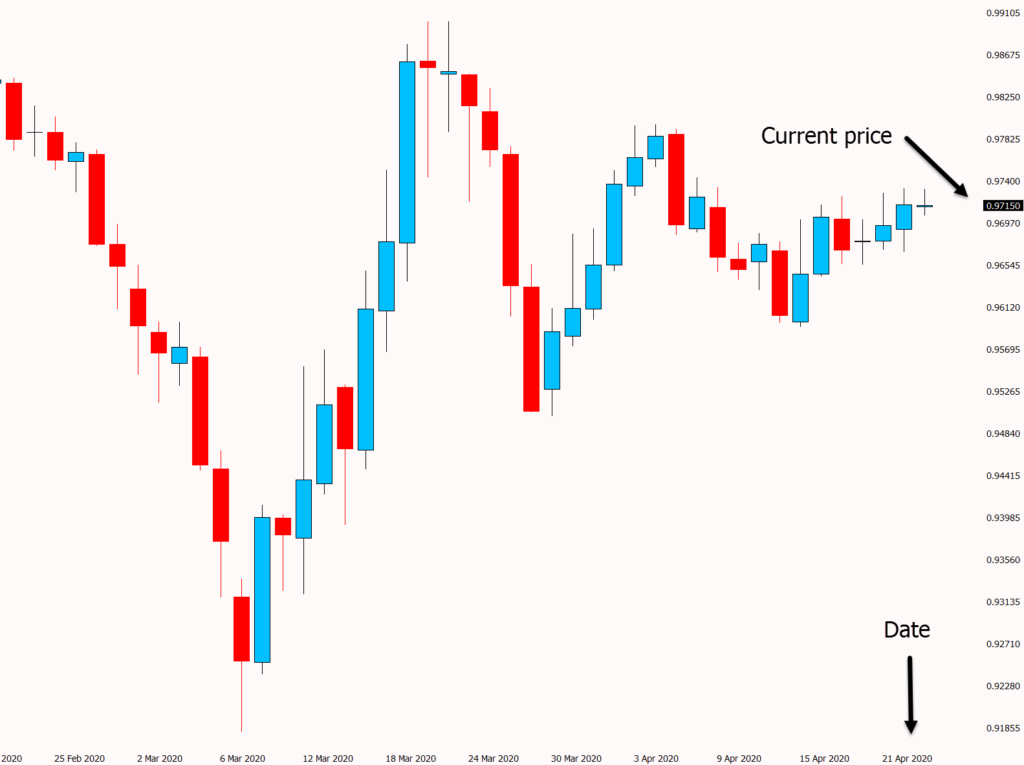

Candlesticks: Candlesticks are the primary visual representation of price movements on a chart. They consist of a body, which depicts the difference between the opening and closing prices of the period, and wicks, which represent the highest and lowest prices reached during the period.

-

Timeframes: Forex charts can be displayed in various timeframes, ranging from minutes to monthly and beyond. Different timeframes provide insights into short-term price fluctuations or long-term trends.

-

Indicators: Traders can overlay indicators onto charts to analyze price movements and identify potential trading opportunities. Indicators can be classified into trend indicators, oscillators, or volatility indicators.

-

Support and Resistance Levels: These represent areas where there is a significant market reaction, typically characterized by a reversal or rejection of price movement. Identi

Image: riset.guru

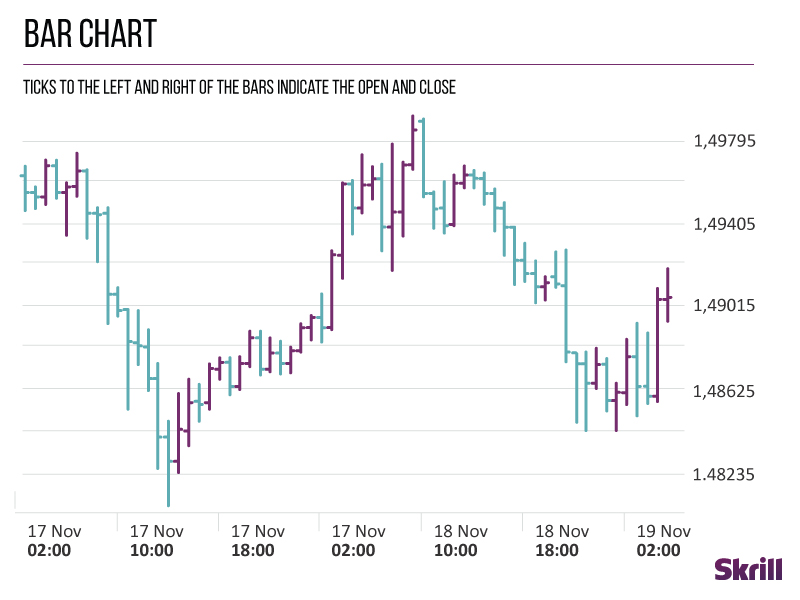

How To See Forex Chart