As a seasoned forex trader, I’ve experienced firsthand the thrill and potential rewards of this dynamic financial landscape. The Australian market presents a particularly attractive opportunity, boasting a robust regulatory framework and a thriving trading community. In this comprehensive guide, I’ll walk you through the essential steps to open a forex trading account in Australia.

Image: www.compareforexbrokers.com

Before diving in, understanding the regulatory landscape is crucial. The Australian Securities and Investments Commission (ASIC) plays a vital role in ensuring market integrity and protecting traders’ interests. By choosing an ASIC-licensed broker, you can trade with confidence, knowing that your funds are safe and that your trades will be executed fairly.

Selecting a Reputable Forex Broker

The choice of forex broker is paramount. Consider the following factors to ensure you partner with a reputable provider:

- Regulation: Opt for an ASIC-licensed broker to ensure compliance with strict industry standards.

- Reputation: Research the broker’s reputation among traders and online forums to gain insights into their reliability.

- Trading Platform: Look for a broker that offers a robust and user-friendly trading platform that meets your trading style and preferences.

- Customer Support: Assess the availability and quality of the broker’s customer support to ensure prompt assistance when needed.

- Fees and Spreads: Compare the trading costs, including spreads and commissions, offered by different brokers to minimize trading expenses.

Opening Your Account

Once you’ve selected a broker, follow these steps to open your forex trading account:

- Provide Personal Information: Submit your personal details, including your name, address, contact information, and proof of identity.

- Define Trading Objectives: State your trading objectives, such as the amount you intend to trade with, your risk tolerance, and your preferred trading strategy.

- Set Up Funding Source: Choose a secure funding method, such as a bank transfer or credit card, and link it to your account.

- Upload Supporting Documents: Provide any required supporting documents to verify your identity and address.

- Complete the Application: Submit your completed application and wait for the broker to review and verify your information.

Latest Trends and Developments

The forex trading landscape in Australia continues to evolve, driven by technological advancements and regulatory changes. Here are some notable trends:

- Rise of Automated Trading: Automated trading platforms, such as expert advisors (EAs), have gained popularity, enabling traders to execute trades based on pre-defined parameters.

- Regulatory Enhancements: ASIC has implemented stricter regulations to enhance market transparency and protect traders from fraud and manipulation.

- Social Trading: Social trading platforms allow traders to connect with others, share strategies, and copy trades, fostering a sense of community.

- Mobile Trading: Mobile trading apps offer convenient access to trading platforms, allowing traders to execute trades on the go.

- Increase in Retail Traders: The number of retail forex traders in Australia is steadily growing, attracted by the potential profits and flexibility offered by this market.

Image: www.youtube.com

Tips and Expert Advice

To enhance your forex trading journey in Australia, consider these tips from experts:

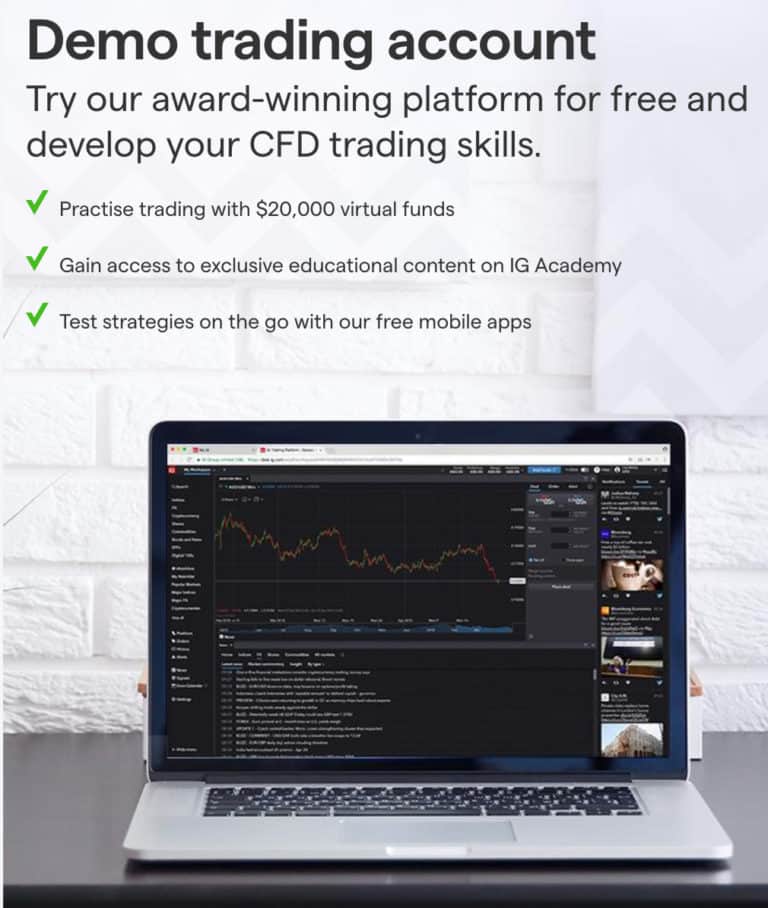

- Practice with a Demo Account: Before trading with real capital, familiarize yourself with the trading platform and test your strategies using a demo account.

- Manage Your Risk: Implement effective risk management strategies, including stop-loss orders and position sizing, to mitigate potential losses.

- Stay Informed: Stay updated with the latest market news and economic data to make informed trading decisions.

- Educate Yourself Continuously: Engage in ongoing learning to enhance your knowledge of the forex market and improve your trading skills.

- Don’t Overtrade: Avoid the temptation to trade excessively. Overtrading can lead to poor decision-making and increased risk.

FAQ

Q: Is forex trading legal in Australia?

A: Yes, forex trading is legal in Australia and regulated by the ASIC.

Q: What is the minimum deposit required to open an account?

A: The minimum deposit required varies depending on the broker you choose, but it typically ranges from $50 to $500.

Q: Can I use multiple trading platforms with one broker?

A: Yes, some brokers offer the option to access multiple trading platforms, providing flexibility for traders.

Q: How long does it take to open a forex trading account?

A: The account opening process can take anywhere from a few hours to several days, depending on the broker’s verification procedures.

Q: Are there any additional fees associated with forex trading?

A: Yes, besides spreads and commissions, some brokers may charge fees for account maintenance, withdrawals, and inactivity.

How To Open A Forex Trading Account In Australia

Conclusion

Opening a forex trading account in Australia is a straightforward process that empowers you to participate in this global financial market. By carefully selecting a broker, understanding the regulatory environment, and implementing sound trading practices, you can position yourself for success in the dynamic world of forex trading. Are you ready to embark on your forex trading journey in Australia?