Dive into the Captivating World of Online Trading

In this digital age, the world of finance has embraced the power of the internet, opening up unprecedented opportunities for investors of all levels. Online trading sites have revolutionized the way we access markets, empowering individuals to trade stocks, currencies, commodities, and more with just a few clicks. This article delves into the captivating realm of online trading, providing you with comprehensive insights, expert advice, and actionable tips to navigate this dynamic landscape.

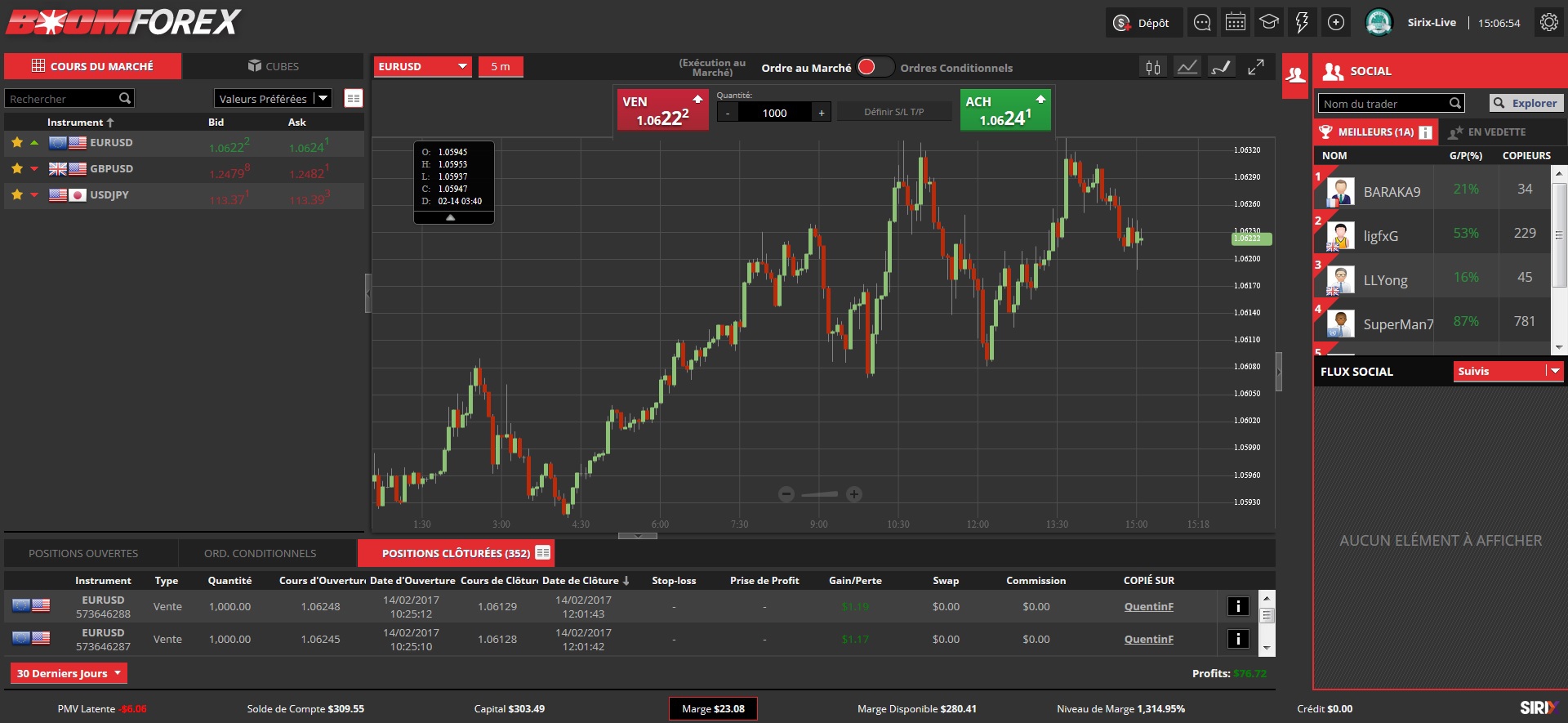

Image: www.forexagone.com

As an avid trader, I have experienced firsthand the transformative impact of online platforms. The convenience, flexibility, and vast selection of financial instruments have empowered me to actively participate in markets that were once inaccessible.

Navigating the Maze of Online Trading Sites

The proliferation of online trading sites presents a vast array of options, each catering to specific needs and preferences. Choosing the right platform is paramount for optimizing your trading experience. Consider factors such as trading fees, platform features, asset offerings, customer support, and security measures. Thorough research and comparisons will guide you towards the site that best aligns with your trading strategy and risk tolerance.

Embracing the Trading Essentials

Delving into the world of online trading requires a solid understanding of fundamental concepts. Technical analysis involves deciphering market trends and patterns through the study of charts and indicators, providing valuable insights into potential price movements. Fundamental analysis, on the other hand, focuses on examining the financial health of companies and economic indicators to assess their underlying value. Combining these analytical techniques can enhance your decision-making process and increase your chances of success.

Risk Management: The Cornerstone of Successful Trading

Risk management is the cornerstone of responsible trading, ensuring that potential losses are minimized while maximizing profit opportunities. Diversify your portfolio across different asset classes and implement stop-loss orders to automatically exit trades when predefined loss levels are reached. Furthermore, avoid excessive leverage, which amplifies both potential gains and losses, and trade only with capital you can afford to lose.

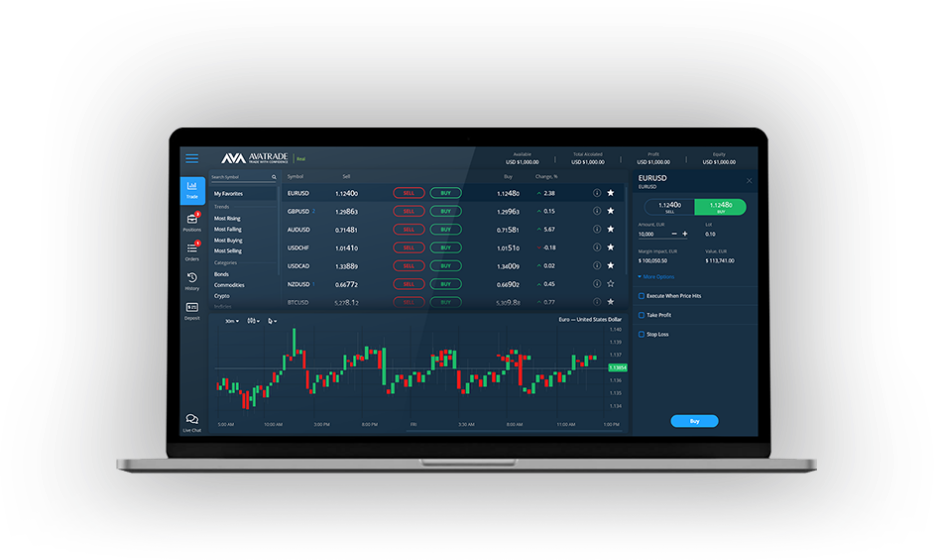

Image: www.avatrade.com

Hone Your Trading Skills with Practice and Discipline

As with any endeavor, trading requires practice and discipline to refine your skills. Utilize paper trading accounts to test your strategies and build confidence in a risk-free environment before committing real capital. Maintain a trading journal to track your trades, analyze your performance, and identify areas for improvement. Emotional control is crucial; avoid impulsive decisions and stick to your trading plan to minimize losses and maximize profits.

Glimpsing into the Future of Online Trading

The future of online trading is poised for exciting advancements, driven by technological innovations and evolving market dynamics. Artificial intelligence and machine learning algorithms are increasingly employed for trade execution, risk analysis, and portfolio management, providing traders with unprecedented insights and automation capabilities. Blockchain technology is also gaining traction, offering secure and transparent settlement systems that can revolutionize the industry.

Embracing a Fulfilling Trading Journey

Whether you are a seasoned trader or just starting your financial adventure, online trading empowers you to take control of your investments and pursue financial independence. By embracing a comprehensive approach that combines market knowledge, risk management, and emotional discipline, you can navigate the complexities of online trading with confidence and potentially unlock your financial aspirations.

Frequently Asked Questions

- Q: What is the best online trading site?

A: The best online trading site depends on your specific needs and preferences. Consider factors such as trading fees, platform features, asset offerings, customer support, and security measures. Compare different sites and choose the one that best aligns with your trading strategy and risk tolerance. - Q: How do I get started with online trading?

A: Choose a reputable online trading site, create an account, and go through their educational materials to understand the platform and trading basics. Familiarize yourself with different asset classes, trading strategies, and risk management techniques. Start with a small amount of capital and gradually increase your involvement as you gain experience and confidence. - Q: How do I become a successful trader?

A: Becoming a successful trader requires a combination of knowledge, skill, and emotional discipline. Continuously educate yourself about market dynamics, technical and fundamental analysis, and risk management. Practice your trading strategies in a risk-free environment, maintain a trading journal to track your progress, and stay emotionally detached from your trades to make rational decisions.

Online Trading Site

Conclusion

The world of online trading offers boundless opportunities to empower individuals with financial freedom and control. By delving into the fundamentals of trading, incorporating sound risk management practices