Embark on a captivating journey into the dynamic world of day trading forex, where fortunes are made and lost in the blink of an eye. Forex, the foreign exchange market, is the colossal global marketplace where currencies are exchanged, boasting a staggering daily trading volume of over $6 trillion. As a day trader, you’ll navigate the perilous waters of currency fluctuations, entering and exiting trades within a single trading day, aiming to profit from these fleeting market movements. This comprehensive guide is your trusty compass, steering you through the intricacies of day trading forex, empowering you to unravel its secrets and potentially reap its lucrative rewards.

Image: blog.bullbear.io

Understanding Forex Day Trading

Forex day trading is a fast-paced, adrenaline-charged endeavor that demands unwavering discipline and a razor-sharp understanding of market dynamics. Unlike traditional long-term investing, day traders capitalize on short-term price shifts, utilizing leverage to magnify their potential gains – and losses. This high-stakes game requires a thorough grasp of the forex market, its currencies, and the interplay of economic factors that shape its ebbs and flows.

Crucial Forex Concepts

Before venturing into the forex day trading arena, it’s imperative to equip yourself with a solid foundation in key concepts:

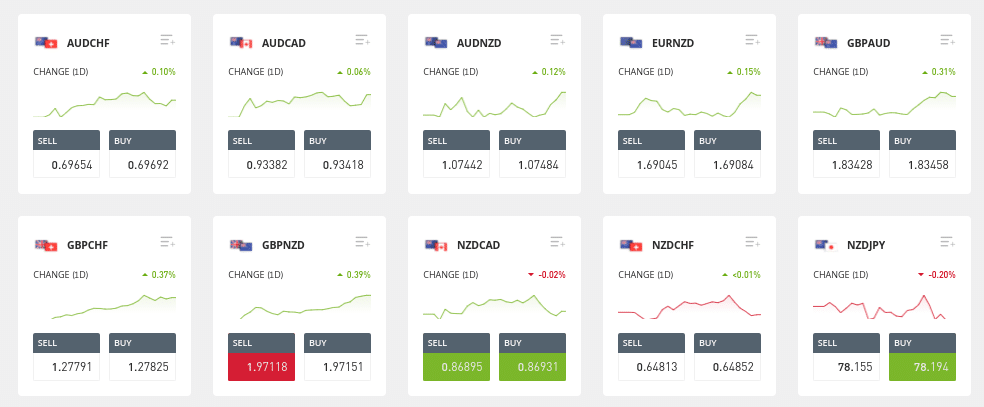

- Currency Pairs: Forex trading revolves around the exchange of currency pairs, such as EUR/USD (Euro vs. US dollar) or GBP/JPY (British pound vs. Japanese yen).

- Leverage: This double-edged sword allows traders to control substantial positions with a fraction of the required capital, magnifying both profits and risks.

- Pip: The smallest price increment in forex, usually representing 0.0001 of a currency pair, serves as the unit of measurement for profit or loss.

- Spread: The difference between the bid price (the price at which you can sell) and the ask price (the price at which you can buy) constitutes the spread, a vital cost to consider in every trade.

Mastering the Day Trading Mindset

Successful day trading in forex requires a unique blend of mental agility and emotional resilience.

- Discipline: Adhere strictly to your trading plan, avoiding impulsive decisions that could derail your strategy and lead to costly mistakes.

- Risk Management: Develop and diligently implement risk management protocols, ensuring you never risk more than you can afford to lose.

- Emotional Control: Overcoming emotional biases is a cornerstone of successful trading. Avoid letting fear or greed cloud your judgment, and maintain a detached, objective perspective.

Image: www.forexcrunch.com

Powerful Day Trading Strategies

Seasoned day traders employ an arsenal of strategies to navigate the turbulent forex market.

- Scalping: Involves numerous rapid-fire trades, capitalizing on minuscule price movements, requiring exceptional speed and precision.

- Range Trading: Exploits currencies that fluctuate within defined price ranges, profiting from predictable oscillations.

- Momentum Trading: Leverages strong trends, riding upward or downward price surges, targeting substantial gains.

- News Trading: Capitalizes on sudden price shifts triggered by major economic news releases, demanding swift execution and news interpretation skills.

Navigating Forex Market Analysis

Informed trading decisions stem from a thorough understanding of market analysis.

- Technical Analysis: Scrutinize historical price data, identifying patterns and trends that may predict future price movements.

- Fundamental Analysis: Examine underlying economic factors, such as interest rates, inflation, and political events, to assess their impact on currency values.

- Sentiment Analysis: Gauge the collective mood of the market, considering investor sentiment and market positioning, to anticipate potential price shifts.

Launching Your Forex Day Trading Journey

Once equipped with knowledge and a trading strategy, you’re ready to launch your day trading odyssey.

- Choose a Reputable Broker: Select a reliable and regulated forex broker, offering competitive spreads and trading conditions.

- Fund Your Account: Determine your initial trading capital, considering your risk tolerance and trading strategy.

- Monitor the Market: Stay abreast of real-time market movements using trading platforms or news feeds, closely monitoring currency pairs of interest.

- Execute Trades: When a trading opportunity arises, execute your trades swiftly and efficiently, adhering to your predefined strategy.

Climbing the Ladder of Success

Aspiring day traders can ascend the ladder of success by honing their skills and embracing continuous learning.

- Simulate Trading: Practice your trading skills in a simulated environment, allowing you to test your strategies without risking real capital.

- Seek Mentorship: Find an experienced forex trader who can guide you, share their wisdom, and provide valuable advice.

- Attend Courses: Enroll in reputable forex trading courses or workshops to enhance your knowledge and gain practical insights.

- Continuously Improve: Never cease learning about the forex market, new strategies, and trading techniques to stay ahead of the curve.

How To Day Trade Forex

Conclusion: Embracing the Challenge

In the realm of day trading forex, immense rewards await those bold enough to embark on this challenging yet potentially lucrative path. Embrace the requisite knowledge, develop a refined trading mindset, and persistently hone your skills, and you’ll find yourself well-equipped to navigate the tumultuous waters of the forex market, potentially unlocking the gateway to financial freedom.