Introduction

As international travel becomes increasingly common, understanding how to manage your finances abroad is essential. One popular option for handling currency conversions is the forex card. However, if you find yourself with a surplus of funds on your forex card, knowing how to convert it back to your home currency is crucial. In this comprehensive guide, we will explore the process of converting forex cards to INR, shedding light on the various methods available, their associated costs, and the factors to consider for a seamless experience.

Image: www.nicepng.com

Understanding Forex Cards

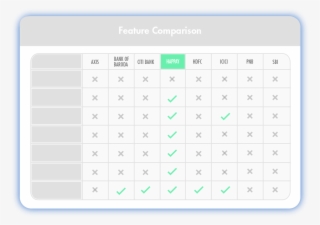

Forex cards are prepaid cards that allow you to load multiple currencies and make transactions worldwide. They offer several advantages over traditional cash or credit cards, including competitive exchange rates, lower transaction fees, and the convenience of managing multiple currencies on a single card. Many banks and financial institutions issue forex cards, and the application process is often straightforward.

Converting Forex Card to INR: Available Methods

When it comes to converting your forex card balance to INR, you have several options at your disposal:

-

Bank Transfer: Transferring funds from your forex card to your bank account is a common method used by many. Typically, you can initiate the transfer through your bank’s online or mobile banking platform. The process may take a few business days depending on your bank’s policies and foreign currency regulations.

-

ATM Withdrawal: Most forex cards allow you to withdraw INR from ATMs abroad. However, it’s essential to be aware of potential fees associated with ATM withdrawals and currency conversion charges. Additionally, daily withdrawal limits may apply, so plan accordingly.

-

Currency Exchange Bureau: You can also use currency exchange bureaus to convert your forex card balance to INR. These bureaus are typically found at airports, major cities, and tourist destinations. While they offer flexibility and convenience, exchange rates may vary depending on the bureau you use.

-

Forex Card Issuer: Some forex card issuers may offer the option to convert your balance directly through their website or app. This method often provides competitive exchange rates and minimal fees but may not be available from all issuers.

Factors to Consider When Converting

When selecting the most suitable method for converting your forex card to INR, consider the following factors:

-

Exchange Rates: Compare exchange rates offered by different banks, currency exchange bureaus, and forex card issuers to get the best possible deal.

-

Transaction Fees: Each method may involve transaction fees or currency conversion charges. Be mindful of these costs to minimize the impact on your funds.

-

Convenience: If immediate access to funds is a priority, using an ATM or currency exchange bureau might be more suitable. However, if cost-effectiveness is the concern, bank transfers or conversion through your forex card issuer may offer better rates.

-

Security: Ensure you convert your funds through reputable channels and avoid unverified or fraudulent service providers to safeguard your financial security.

Image: www.forex.academy

How To Convert Forex Card To Inr

Conclusion

Converting forex cards to INR is a straightforward process once you understand the various methods available. Whether you prefer the convenience of bank transfers, the flexibility of ATM withdrawals, the competitive rates offered by currency exchange bureaus, or the direct conversion option through your forex card issuer, selecting the right option for your needs will facilitate a hassle-free currency exchange experience. By carefully considering the factors discussed in this guide, you can optimize your conversion process and effectively manage your finances abroad.