Introduction

In the ever-evolving realm of investments, copy trading has emerged as a game-changer, empowering individuals to harness the wisdom of seasoned traders. This innovative approach bridges the gap between novice investors and market veterans, creating a seamless pathway toward financial prowess. By tapping into the expertise of skilled traders, individuals can replicate their trades and potentially mirror their returns, making copy trading an invaluable strategy in the modern investment landscape.

Image: primexbt.com

Unveiling the Essentials of Copy Trading

Stripped to its core, copy trading is a method of mimicking the trading activity of another trader or group of traders. It typically involves identifying a master trader with a proven track record of success and aligning your investment decisions with theirs. The mechanics are deceptively simple; when the master trader initiates a trade, it is automatically replicated in the copy trader’s account, mirroring the same entry and exit points as the original trade.

Benefits of Leveraging Copy Trading

The allure of copy trading lies in its myriad advantages, which elevate it above traditional investment methods. Firstly, it democratizes financial knowledge, empowering individuals with limited expertise to delve into the world of trading without the steep learning curve. Additionally, copy trading alleviates the burden of constant market monitoring and decision-making, freeing up precious time for other endeavors. It also diversifies portfolios, mitigating risk through exposure to various trades and market conditions.

Navigating the Landscape of Copy Trading Platforms

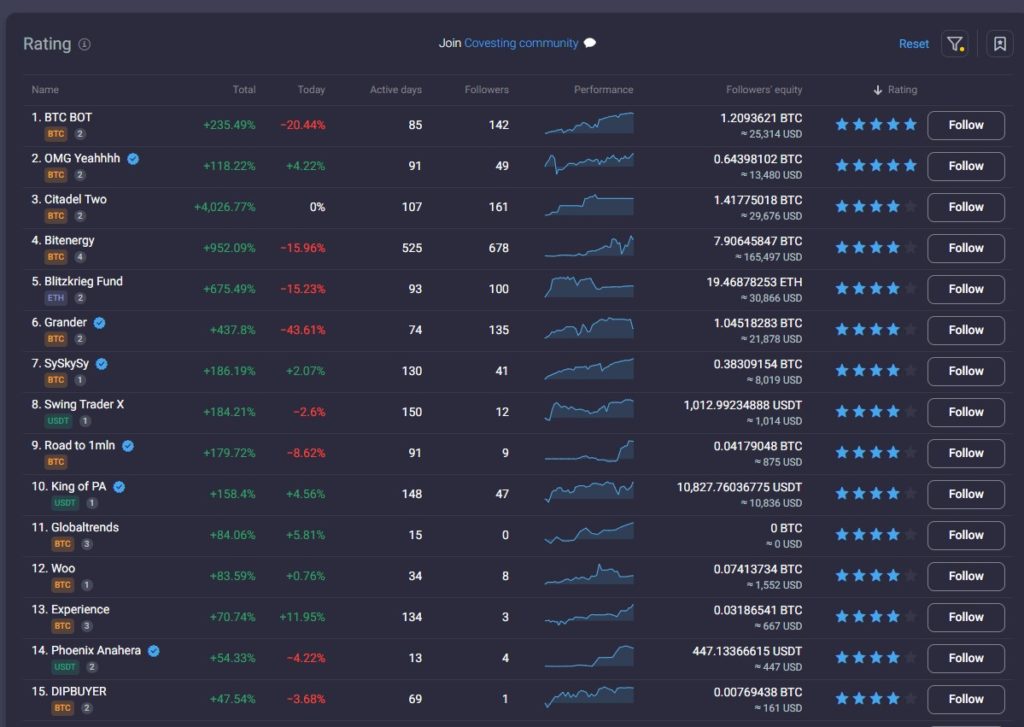

With the rise in popularity of copy trading, numerous platforms have emerged, offering a spectrum of services. These platforms serve as the bridge between master traders and copy traders, providing a secure and automated environment for trade replication. Each platform may have unique features and offerings, so meticulous research and comparison are crucial to finding the ideal match for your investment goals and risk appetite.

Image: forextown.club

Selecting the Right Master Trader: Balancing Skill with Alignment

The key to successful copy trading lies in the judicious selection of the master trader. A plethora of factors should be meticulously evaluated, including:

• Performance History: Scrutinize the master trader’s historical returns, average profitability percentage, and risk tolerance. Align their risk profile with your investment objectives.

• Market Sector Specialization: Identify master traders who specialize in specific market sectors that align with your interests. This ensures congruency in investment decisions.

• Trading Style Compatibility: Ensure that the master trader’s trading style meshes with your own preferences. This includes assessing their trading frequency, holding periods, and leverage strategies.

• Communication and Transparency: Effective communication between master traders and copy traders is paramount. Seek master traders who proactively share their insights, rationale, and any changes in their trading strategy.

Adopting a Prudent Risk Management Approach

While copy trading offers many benefits, it is imperative to approach the endeavor with prudence and effective risk management strategies. Understanding that all investments carry some degree of risk is paramount. Here are some measures to safeguard your financial well-being:

• Start Small: Initially, allocate a small portion of your investment portfolio to copy trading to limit potential losses.

• Diversify Your Masters: Don’t put all your eggs in one basket. Spread your investments across multiple master traders to reduce the impact of any single trader’s underperformance.

• Set Realistic Expectations: Refrain from chasing unrealistic returns. Recognize that market fluctuations are inherent, and returns will vary.

• Monitor and Adjust: Regularly monitor the performance of your master traders and make adjustments to your strategy as needed. Continuously evaluate the viability of the relationships and don’t hesitate to modify or terminate them if performance dips below acceptable levels.

Copy Trading Strategies

Conclusion

Copy trading presents a compelling opportunity to leverage the expertise of seasoned traders and enhance your investment returns. By understanding the intricacies of this strategy, selecting a reliable copy trading platform, and carefully choosing your master traders, you can unlock a world of financial possibilities while mitigating risk through prudent management. Remember, knowledge is power, and by educating yourself about copy trading, you empower yourself to make informed decisions that propel you toward financial success. Embrace the transformative potential of copy trading, and let it guide you on a journey toward financial freedom and prosperity.