Leverage: A Double-Edged Sword in Forex Trading

Leverage empowers forex traders to amplify their potential returns by trading with amounts far beyond their initial capital. However, this financial tool is a double-edged sword, offering both benefits and risks. Understanding and calculating the leverage ratio is paramount for successful risk management in forex. This article will provide a comprehensive guide to leverage calculation, empowering you to harness its benefits while mitigating its risks.

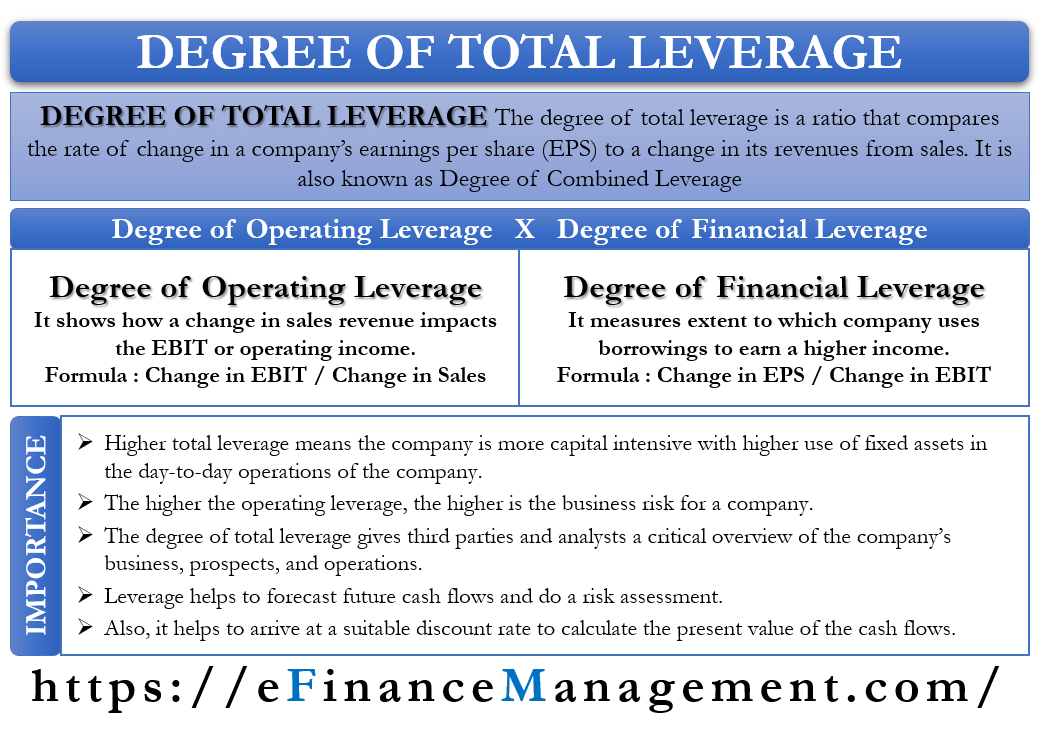

Image: wmhawk.com

Calculating the Leverage Ratio: A Step-by-Step Guide

The leverage ratio quantifies the extent to which a trader’s trading capital is multiplied by leverage. It is typically expressed as a ratio, such as 1:100, 1:200, or even higher. To calculate the leverage ratio:

1. Determine the Position Size: This refers to the total value of the trade being executed.

2. Divide Position Size by Trading Capital: The trading capital represents the amount of funds available in the trading account.

Leverage Ratio = Position Size / Trading Capital

For instance, if you trade with a position size of $100,000 and your trading capital is $1,000, your leverage ratio would be 1:100 (100,000 / 1,000).

Understanding the Impact of Leverage

Leverage can significantly increase potential profits if the market moves in your favor. However, it can also amplify losses if the market moves against you. This is because the leverage ratio multiplies both profits and losses.

For example, if your leverage ratio is 1:100 and the market moves in your favor by 1%, you will earn a 100% return on your investment. Conversely, if the market moves against you by 1%, you will incur a 100% loss.

Tips and Expert Advice for Managing Leverage

To master the art of leverage, follow these tips from experienced forex traders:

-

Start with Low Leverage: Beginners should opt for low leverage ratios until they gain experience and understand risk management techniques.

-

Set Realistic Profit Targets: Avoid aiming for excessive profits. Gradual, achievable targets reduce the risk of catastrophic losses.

-

Manage Risk: Implement stop-loss orders to limit potential losses and maintain discipline while trading.

-

Use Market Research: Conduct thorough market analysis to make informed trading decisions and minimize the chances of adverse market movements.

-

Diversify Trading: Spread your investments across multiple instruments to reduce the impact of any single market fluctuation.

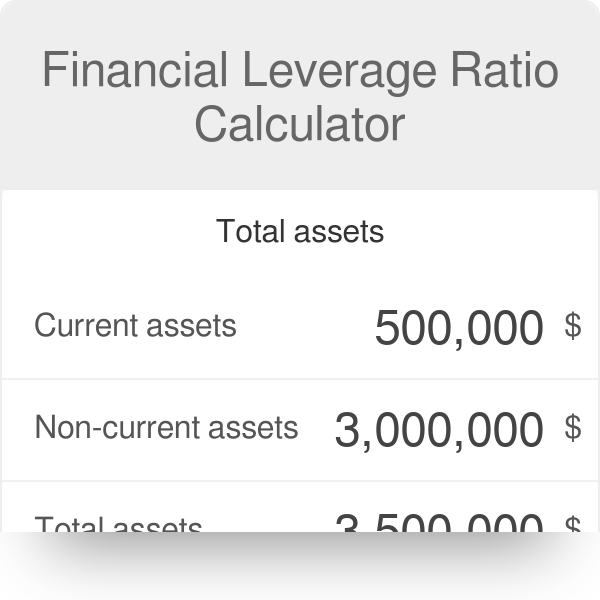

Image: lilianyaoting.blogspot.com

Frequently Asked Questions

Q: What is the maximum leverage ratio allowed?

A: The maximum leverage ratio varies between brokers and may also depend on the traded instrument. Check with your broker for specific details.

Q: How does leverage affect margin requirements?

A: Higher leverage ratios require higher margin requirements. This is because the potential for losses is greater when using leverage.

Q: Can I use leverage in any trading strategy?

A: Leverage can be used in various trading strategies, but it is most commonly employed in short-term, high-frequency trading.

How To Calculate Leverage Ratio In Forex

Conclusion

Leverage can be a powerful tool for forex traders, but it must be handled with caution. By understanding and calculating the leverage ratio, traders can harness its benefits while mitigating its risks. Employ the tips and advice outlined in this article to enhance your risk management skills and optimize your leverage usage.

Is understanding leverage in forex a topic that excites you? Let us know your thoughts and experiences by leaving a comment below.