Image: howtotradeonforex.github.io

In the realm of international travel, the ability to manage your finances effortlessly is paramount. A Forex Card, a convenient and cost-effective alternative to traditional methods, empowers you to seamlessly navigate currency exchanges and transact abroad. This comprehensive guide will equip you with the knowledge and steps to procure a Forex Card in India, opening up a world of financial freedom and peace of mind.

Defining Forex Cards: The Passport to Financial Flexibility

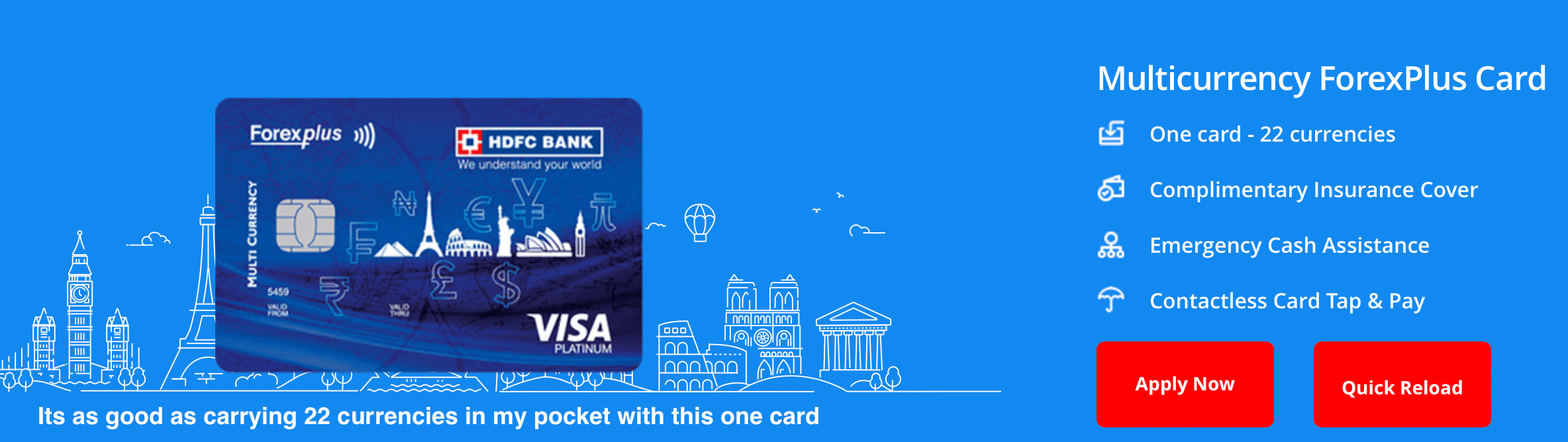

A Forex Card, also known as a Travel Card or Multi-Currency Card, is a prepaid card specifically designed for international transactions. It allows you to load multiple currencies onto a single card, eliminating the hassle of carrying cash or exchanging it at unfavorable rates. By using your Forex Card at ATMs, retail outlets, or online, you can access your funds in any supported currency, ensuring convenient and secure access to local economies.

Unveiling the Benefits: Why Forex Cards Reign Supreme

Embarking on international ventures with a Forex Card offers numerous advantages. Here are some key benefits that distinguish Forex Cards as the preferred choice for discerning travelers:

-

Save on Conversion Fees and Lock in Rates: Forex Cards offer highly competitive exchange rates and low transaction fees, significantly reducing the cost burden typically associated with currency conversion. This enables you to stretch your travel budget further, allowing you to explore more and experience the world without financial constraints.

-

Convenience and Security at Your Fingertips: Forex Cards provide the utmost convenience by consolidating all your travel funds onto a single card. The embedded chip and PIN technology ensures secure transactions, safeguarding your funds from unauthorized access or fraud, giving you peace of mind while abroad.

-

Eliminate Language Barriers and Cultural Nuances: Using a Forex Card transcends language barriers and eliminates the need to navigate unfamiliar local currency systems. This simplifies transactions, allowing you to focus on your travel adventures without the added stress of currency management.

Steps to Acquire Your Forex Card: A Seamless Process

Acquiring a Forex Card in India is a simple and straightforward process. Here’s a step-by-step guide to assist you:

-

Choose a Reputable Provider: Begin by researching and selecting a reliable Forex Card provider. Consider their reputation, exchange rates, transaction fees, and the availability of customer support.

-

Compare and Select the Right Card: Different Forex Card providers offer a range of products tailored to specific needs. Determine the features and benefits that align with your travel plans, such as the number of currencies supported, daily withdrawal limits, and acceptance in various countries.

-

Complete the Application Process: The application process usually involves submitting identity and travel documents, along with proof of address and income. Review the requirements of your chosen provider and adhere to their specific instructions.

-

Fund Your Account: Once your application is approved, you can load funds onto your Forex Card using a linked bank account or credit card. Consider loading multiple currencies to take advantage of favorable exchange rates and reduce transaction costs.

-

Activate Your Card Before Travel: Prior to your departure, activate your Forex Card and set a PIN for secure transactions. This ensures immediate access to your funds upon arrival at your destination.

Additional Tips for Smart Forex Card Usage

-

Monitor Your Balance and Top Up Regularly: Keep track of your Forex Card balance through online portals or mobile apps provided by your card issuer. Top up your card as needed to avoid any inconvenience or additional fees associated with insufficient funds.

-

Utilize ATMs Wisely: When withdrawing cash using your Forex Card at ATMs, choose reputable and secure machines. Be mindful of any surcharges or fees imposed by the ATM operator, and opt for ATMs affiliated with your card provider for optimal rates.

-

Embrace Contactless Payments: Take advantage of contactless payment terminals at retail outlets and restaurants to expedite transactions and minimize the need for physical contact. This feature enhances convenience and streamlines your travel experience.

In conclusion, acquiring a Forex Card in India is a wise move for any international traveler seeking financial flexibility, convenience, and peace of mind. By following the steps outlined in this guide, you can embark on your global adventures with confidence, knowing that your financial needs are met. Embrace the seamless conversion of currencies and revel in the benefits of a Forex Card, allowing you to fully immerse yourself in cultural experiences and cherished memories.

Image: ashivaforex.com

How To Buy Forex Card In India