In the realm of financial markets, the foreign exchange (forex) market stands as a colossal titan, boasting a staggering daily trading volume that outstrips the combined value of all stocks and bonds traded globally. This vibrant and dynamic arena presents immense opportunities for savvy investors to capitalize on currency fluctuations and generate substantial profits. If the prospect of earning from forex trading has piqued your interest, join us as we delve into the intricacies of this captivating financial landscape and unveil the secrets to unlocking its lucrative potential.

Image: www.youtube.com

The genesis of forex trading can be traced back to the Bretton Woods Agreement of 1944, which established a system of fixed exchange rates pegged to the US dollar. However, this system crumbled in 1971 when President Nixon severed the dollar’s convertibility to gold, ushering in an era of floating exchange rates. This newfound flexibility created an environment ripe for currency speculation and trading, giving rise to the modern forex market as we know it today.

At the heart of forex trading lies the simple concept of buying and selling currencies in pairs. As an illustration, when you purchase the EUR/USD currency pair, you are essentially buying the euro and simultaneously selling the US dollar. The goal is to profit from changes in the exchange rate between the two currencies. If the euro strengthens against the dollar, you will realize a profit on your trade. Conversely, if the dollar gains ground against the euro, you will incur a loss.

The mechanics of forex trading are remarkably straightforward. Traders typically utilize specialized platforms provided by brokers to execute their trades. These platforms offer real-time quotes for various currency pairs, enabling traders to place orders with a few clicks. The bid price represents the price at which traders can sell a currency pair, while the ask price indicates the price at which they can buy. The difference between the bid and ask prices, known as the spread, constitutes the broker’s commission.

Navigating the forex market requires a keen understanding of the factors that influence currency values. Economic data, political events, and central bank decisions can all have a profound impact on exchange rates. Traders must diligently monitor these factors and stay abreast of the latest news and developments to make informed trading decisions.

One of the primary advantages of forex trading is the high degree of leverage it offers. Leverage allows traders to control a substantial amount of currency with a relatively small investment. While leverage can amplify profits, it also magnifies potential losses. Therefore, it is crucial for traders to exercise prudence and manage their risk exposure effectively.

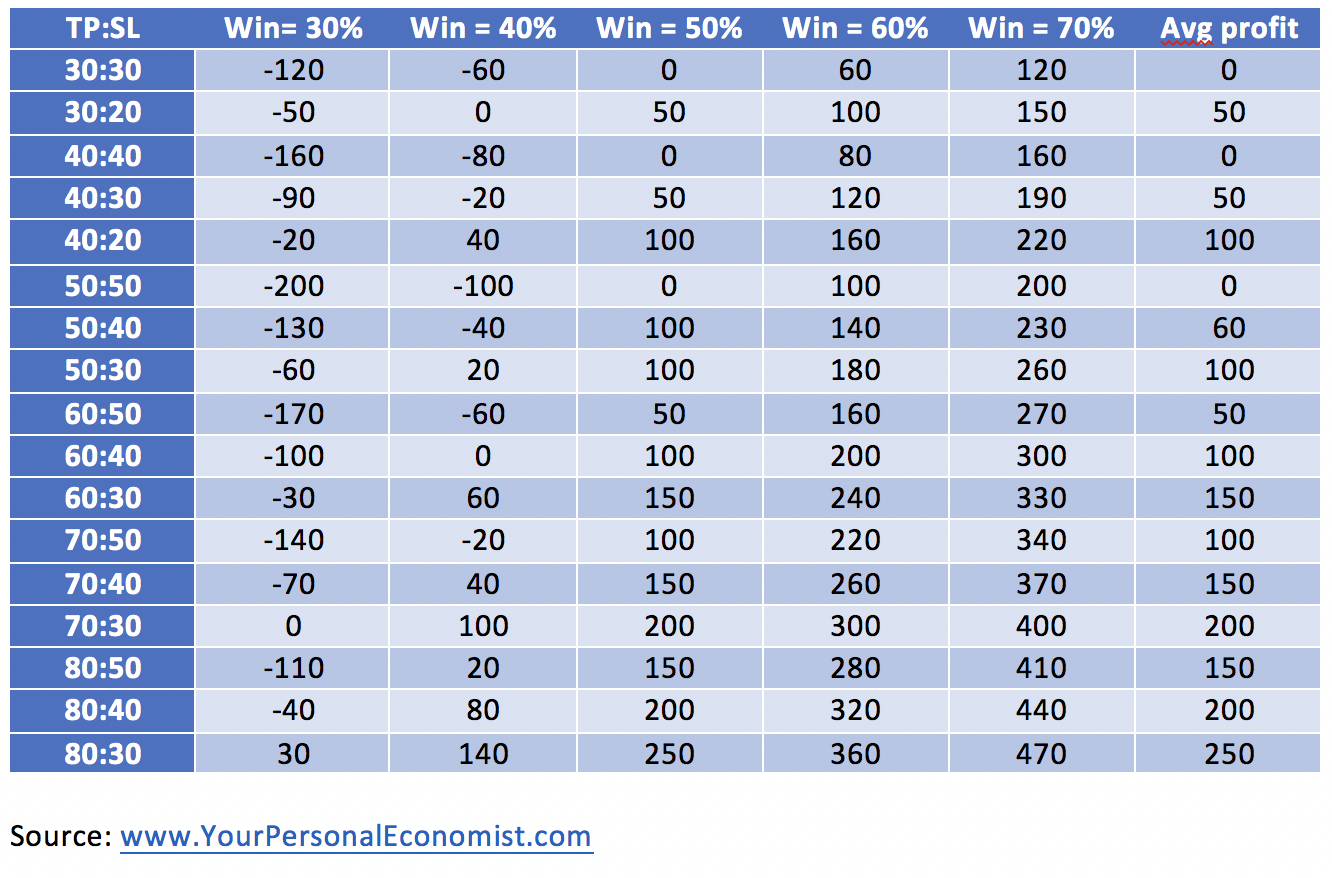

Risk management is paramount in forex trading, as it can help traders mitigate losses and protect their capital. Stop-loss orders and take-profit orders are essential tools for limiting risk. Stop-loss orders automatically close a trade if the market moves against the trader beyond a predetermined level, while take-profit orders close a trade when it reaches a desired profit target.

Becoming a successful forex trader requires a combination of knowledge, skill, and emotional discipline. Aspiring traders must invest time and effort in educating themselves about the market and developing a robust trading strategy that aligns with their risk tolerance and financial goals. Additionally, cultivating emotional resilience is essential to withstand the inevitable ups and downs of trading and make rational decisions even in challenging market conditions.

The allure of forex trading lies in its potential for generating substantial profits. However, it is important to approach this market with realistic expectations. Building a consistent track record of success in forex trading is no walk in the park. It requires dedication, hard work, and a commitment to continuous learning.

If you are intrigued by the prospect of harnessing the financial empowerment that forex trading offers, embark on this journey with a thirst for knowledge and a willingness to embrace the challenges that lie ahead. Immerse yourself in the intricacies of currency markets, develop a robust trading strategy, manage your risk prudently, and maintain emotional discipline. By following these principles, you can increase your chances of reaping the rewards that forex trading has to offer.

Image: db-excel.com

How Is Money Made In Forex Trading