Introduction: Unlocking the Intricacies of Currency Exchange

In today’s interconnected world, cross-border transactions have become an integral part of global commerce. From multinational corporations to individuals sending money to loved ones overseas, the ability to transfer funds across borders efficiently and securely is paramount. Forex money transfers, facilitated by specialized financial institutions, provide a vital lifeline for these transactions, enabling smooth currency exchange and facilitating international business.

Image: newsandstory.com

In this comprehensive guide, we will delve into the fascinating world of forex money transfer, exploring its history, illuminating its basic concepts, and unraveling its practical applications. By understanding the intricacies of this intricate financial mechanism, individuals and businesses alike can harness its power to navigate the complexities of global financial markets and elevate their international transactions.

Section 1: The Dawn of Forex: A Historical Perspective

The roots of forex money transfer can be traced back to the ancient world, where merchants and traders exchanged currencies to facilitate cross-border transactions. However, it was not until the early 20th century that the modern forex market began to take shape, with the establishment of the gold standard and the Bretton Woods system. These agreements standardized currency exchange rates and laid the foundation for a globalized financial system.

In the latter half of the 20th century, the advent of floating exchange rates and the liberalization of financial markets led to a surge in forex trading and paved the way for the emergence of the modern forex market as we know it today.

Section 2: Understanding Forex Fundamentals

At the heart of forex money transfer lies the exchange rate, the value of one currency relative to another. Exchange rates are constantly fluctuating, influenced by a multitude of factors, including economic conditions, political stability, interest rates, and market sentiment.

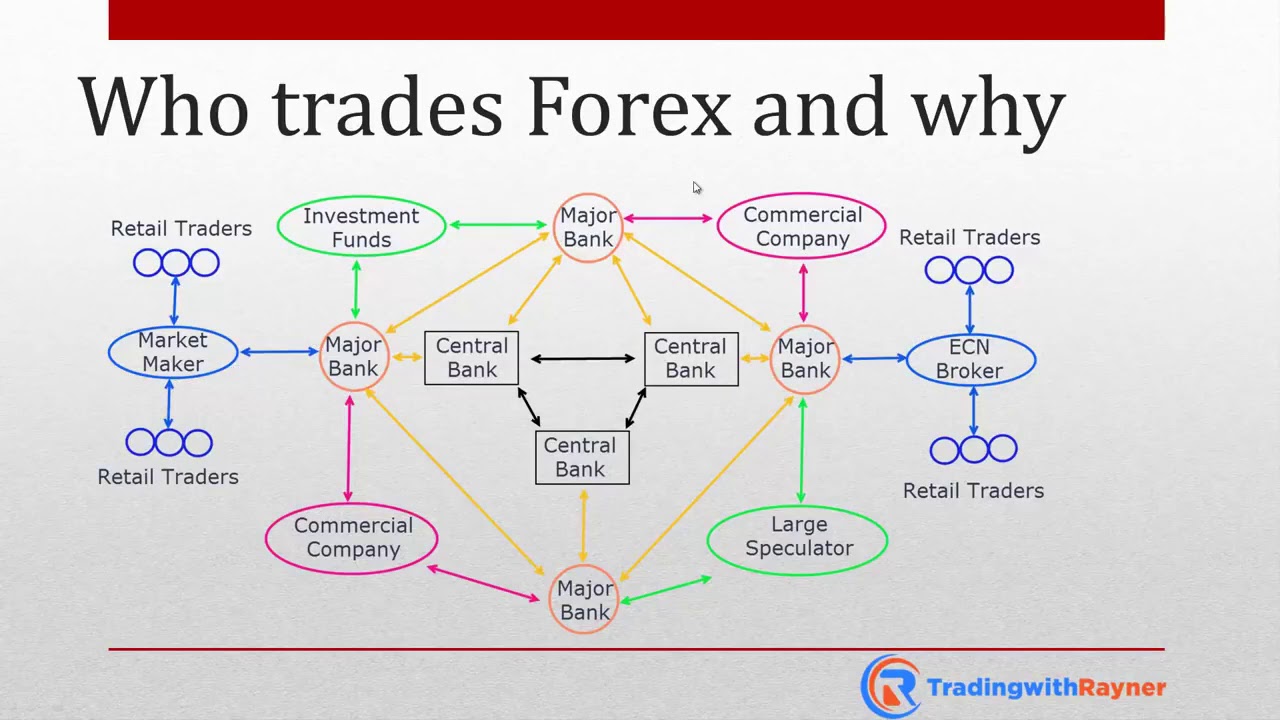

Forex traders, ranging from central banks to retail investors, speculate on these exchange rate movements, buying and selling currencies in the hope of profiting from fluctuations. The result is a global marketplace where currencies are traded around the clock, determining the price of goods and services across borders.

Section 3: The Forex Market in Action: Real-World Applications

Forex money transfer plays a pivotal role in facilitating global commerce. Businesses use forex services to convert currencies when importing or exporting goods and services, ensuring they can transact with customers and suppliers worldwide. For individuals, forex money transfer enables travel, remittance payments, and cross-border investments.

In a globalized economy, where businesses and individuals alike operate across borders, the ability to convert currencies seamlessly and efficiently is essential. Forex money transfer provides this vital service, greasing the wheels of commerce and connecting people and businesses worldwide.

Image: www.youtube.com

Section 4: Mastering Forex Transfers: A Step-by-Step Guide

Navigating the forex market can seem daunting, but with the right knowledge and approach, individuals and businesses can execute forex transfers with confidence. Here is a simplified step-by-step guide to help you get started:

-

Choose a Reputable Provider: Select a licensed and regulated forex provider with a proven track record of reliability and customer service.

-

Determine the Exchange Rate: Monitor exchange rate movements and determine the most favorable rate for your transaction.

-

Provide Necessary Information: Provide the provider with your personal or business information, the amount you wish to transfer, and the desired currencies.

-

Initiate the Transfer: Once the details are confirmed, the provider will initiate the transfer, typically within 1-3 business days.

-

Monitor and Confirm: Track the transfer using the provider’s tracking tools, and once it is complete, verify that the recipient has received the funds.

Section 5: Embracing Technological Advancements: The Rise of Digital Forex

The advent of digital technologies has significantly transformed forex money transfer. Online platforms and mobile apps now allow individuals and businesses to execute forex transactions from the comfort of their own homes or devices.

Digital forex services offer several advantages, including lower transaction fees, real-time exchange rate updates, and convenient 24/7 accessibility. As technology continues to evolve, we can expect further innovations in digital forex, making cross-border money transfers even more seamless and efficient.

Section 6: Risks and Mitigation: Navigating the Forex Market Prudently

While forex money transfer offers numerous benefits, it’s essential to be aware of the potential risks involved. Exchange rate fluctuations can impact the value of a transaction, and sudden market movements could lead to unexpected losses.

To mitigate these risks, consider the following strategies:

-

Research Market Conditions: Stay updated on economic news and geopolitical events that may influence exchange rates.

-

Diversify Currency Holdings: Don’t concentrate all your funds in a single currency. Spread your exposure across multiple currencies to reduce volatility risk.

-

Use Limit Orders: Place limit orders to execute transactions at predetermined exchange rates, protecting yourself against adverse price movements.

How Does Forex Money Transfer Work

Conclusion: Empowering Global Commerce and Connecting the World

Forex money transfer is an indispensable tool for global commerce, facilitating seamless exchange of currencies and powering cross-border transactions. Whether it’s large-scale business deals or individuals sending remittances home, forex services provide a vital lifeline.

By embracing the complexities of the forex market, individuals and businesses can tap into its power, unlock global opportunities, and connect with the world effortlessly. As the financial landscape evolves, forex money transfer will continue to play a transformative role, driving economic growth and fostering global interconnections.