Introduction

In the realm of international travel and global business, the HDFC Multi-Currency Forex Card emerges as an indispensable tool. Finely crafted with a plethora of tailored benefits, this card transcends the boundaries of traditional currency exchange, empowering its holders to navigate the intricacies of foreign financial transactions with finesse and ease. Its multi-faceted advantages cater to the diverse needs of globetrotters, discerning travelers, and business professionals, making it an ideal companion for ventures beyond familiar shores.

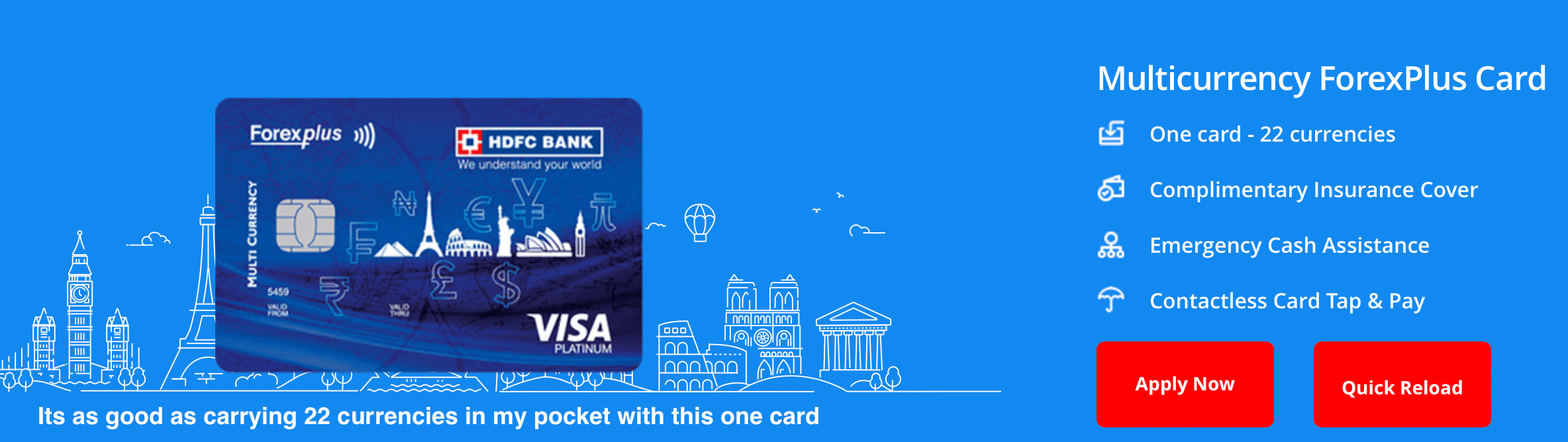

Image: payehuvyva.web.fc2.com

This comprehensive guide delves into the myriad benefits of the HDFC Multi-Currency Forex Card, shedding light on its transformative features. Armed with this knowledge, you will be fully equipped to harness the card’s potential and transcend the challenges of global finance, ensuring seamless and rewarding experiences in the world’s financial landscape.

Unveiling the Benefits of the HDFC Multi-Currency Forex Card

1. Multi-Currency Convenience: Unlocking a World of Ease

The HDFC Multi-Currency Forex Card liberates you from the constraints of single-currency cards, allowing you to seamlessly transact in multiple currencies without encountering exorbitant exchange rate markups or additional conversion fees. This feature proves invaluable when traversing borders or conducting business in regions with varying currencies, eliminating the need for multiple cards or tedious currency exchanges.

2. Competitive Exchange Rates: Maximizing Your Financial Gains

HDFC’s commitment to customer satisfaction extends to offering competitive exchange rates, ensuring that you receive the best possible value for your hard-earned money. By leveraging HDFC’s extensive network and partnerships, you can enjoy favorable exchange rates that empower you to maximize your purchasing power and safeguard your financial well-being during international transactions.

Image: windsorwhock2002.blogspot.com

3. Zero Markup on Currency Conversions: Embark on Cost-Effective Transactions

Unlike traditional currency exchange methods that impose hidden markups on conversion rates, the HDFC Multi-Currency Forex Card proudly boasts zero markup charges. This customer-centric approach ensures transparent and cost-effective transactions, enabling you to allocate your funds efficiently without being burdened by inflated exchange rates.

4. Global Acceptance: Unparalleled Accessibility Across the Globe

The HDFC Multi-Currency Forex Card enjoys widespread acceptance at millions of merchant establishments and ATMs around the world, ensuring that you can confidently make purchases and withdraw cash in over 200 countries and territories. This global reach empowers you to embrace the freedom of international travel and business ventures without the limitations of currency restrictions.

5. 24/7 Customer Support: Resolving Queries with Prompt Assistance

HDFC understands that global financial transactions can sometimes present unforeseen challenges. To address such situations, the bank provides dedicated 24/7 customer support, ensuring that your concerns are promptly resolved, and your financial journey remains smooth and stress-free. Whether you encounter difficulties abroad or have queries regarding your account, this round-the-clock support system guarantees peace of mind and timely assistance.

6. EMV Chip and PIN Security: Safeguarding Your Transactions

The HDFC Multi-Currency Forex Card incorporates advanced EMV chip and PIN technology, providing enhanced security measures to protect your financial information and prevent unauthorized transactions. This industry-leading security feature adds an extra layer of protection to your card, giving you confidence in the secure handling of your funds.

Hdfc Multi Currency Forex Card Benefits

7. Real-Time Transaction Tracking: Monitoring Your Finances with Ease

With the HDFC Multi-Currency Forex Card, you gain access to real-time transaction tracking, allowing you to closely monitor your spending and account activity. Through convenient SMS alerts and online