Planning an international adventure can be an exhilarating and daunting task, especially when it comes to managing your finances abroad. Introducing the HDFC ISIC Forex Card, a convenient solution designed to ease your currency woes and elevate your global experiences.

Image: isic.co.in

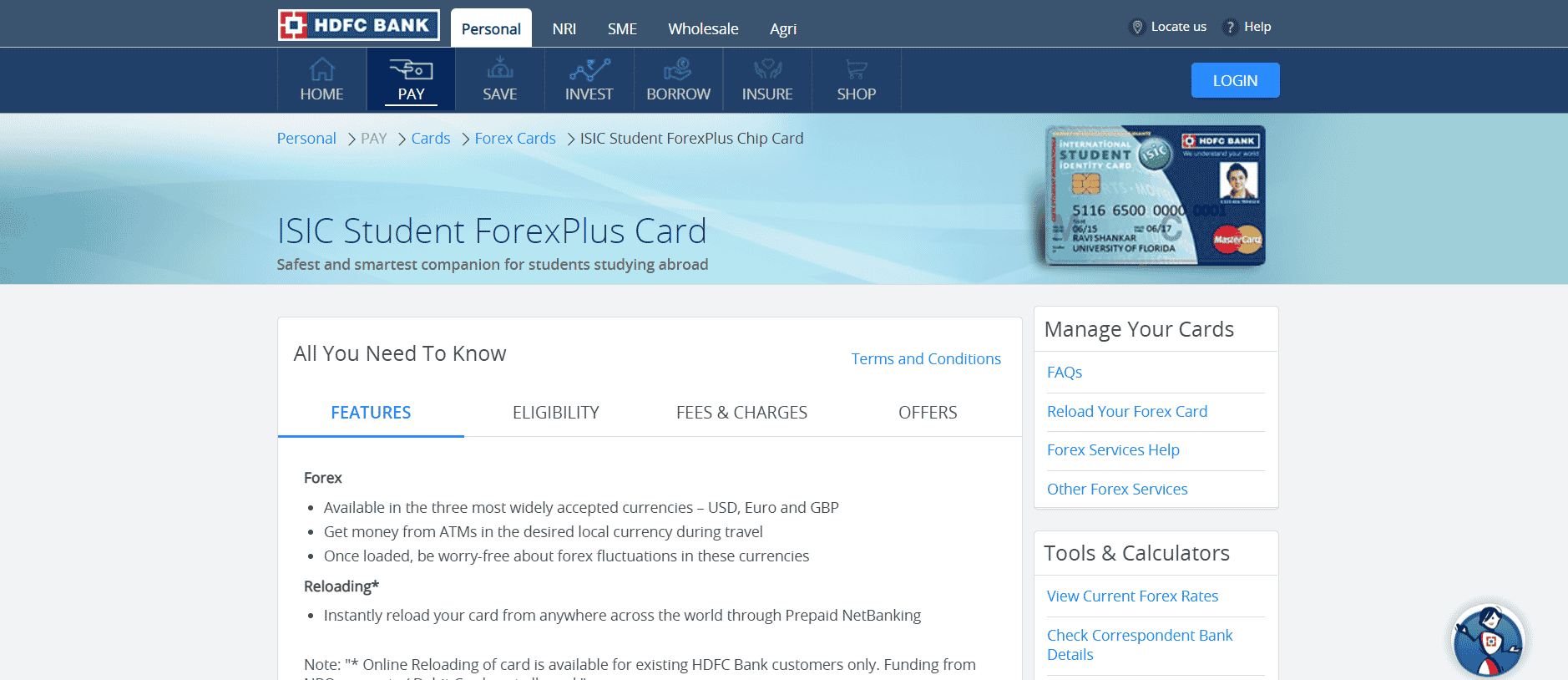

The HDFC ISIC Forex Card is a prepaid card linked to multiple currencies, allowing you to seamlessly make purchases, withdraw cash, or online transactions virtually anywhere in the world. Its association with the International Student Identity Card (ISIC) further enhances its appeal, offering exclusive benefits and discounts to students traveling abroad.

Multiple Currency Convenience for Effortless Global Spending

The HDFC ISIC Forex Card offers the unparalleled convenience of using multiple currencies at your disposal. Load your card with up to 21 currencies and switch between them at the touch of a button or through its dedicated mobile app. This eliminates the hassle of carrying different currencies and the associated exchange rate fluctuations.

The card’s competitive exchange rates and minimal transaction fees ensure you get the most out of your money. Whether you’re shopping for souvenirs in a bustling market or dining at a local restaurant, you can rest assured that you’re making the most of your travel budget.

Enhanced Security for Peace of Mind

Recognizing the importance of financial security, HDFC has equipped the ISIC Forex Card with advanced safety features. The card is PIN-protected and enabled with chip technology, reducing the risk of unauthorized access or fraud. Additionally, its mobile app offers real-time transaction alerts and allows you to freeze or unblock your card instantly, giving you complete control over your finances.

HDFC’s customer support team is available 24/7 to assist you with any queries or emergencies, providing peace of mind during your global adventures.

Exclusive Travel Perks for Students

As an ISIC cardholder, you’re entitled to a range of exclusive benefits and discounts tailored to students. These perks extend beyond currency management, offering savings on flights, accommodations, and local attractions. By utilizing these benefits, you can maximize your travel experiences and create unforgettable memories without breaking the bank.

Image: moneymint.com

Expert Advice for Seamless Global Finances

To ensure a seamless travel experience, consider these expert tips:

- Load your HDFC ISIC Forex Card with a combination of currencies based on your itinerary and spend pattern.

- Activate the mobile app to track your transactions, view real-time exchange rates, and manage your account on the go.

By following these tips, you can optimize the functionality of your HDFC ISIC Forex Card and make your global adventures a breeze.

FAQs for Your Convenience

Q: What countries can I use my HDFC ISIC Forex Card in?

A: The card is accepted in over 200 countries and regions worldwide.

Q: Can I use my card to withdraw cash?

A: Yes, you can withdraw cash from ATMs in local currencies.

Q: Are there any fees associated with using the HDFC ISIC Forex Card?

A: Minimal transaction fees may apply, and ATM withdrawal fees may vary depending on the location.

Hdfc Isic Forex Card Review

Conclusion

The HDFC ISIC Forex Card is an indispensable companion for globetrotters seeking a convenient, secure, and rewarding way to manage their finances abroad. Its multiple currency capabilities, enhanced security features, exclusive travel perks, and expert advice make it the perfect choice for students and travelers alike.

Are you ready to elevate your global explorations with the HDFC ISIC Forex Card?