Introduction

Image: cardinsider.com

In the era of globalization, international travel and cross-border financial transactions have become a necessity. However, managing foreign currency while traveling can often be a hassle. That’s where the HDFC Forex Card Online Transfer comes in as a game-changer, offering a convenient and secure way to handle your money abroad. From seamless currency conversion to swift and cost-effective transfers, let’s delve deep into the transformative power of HDFC Forex Card Online Transfer.

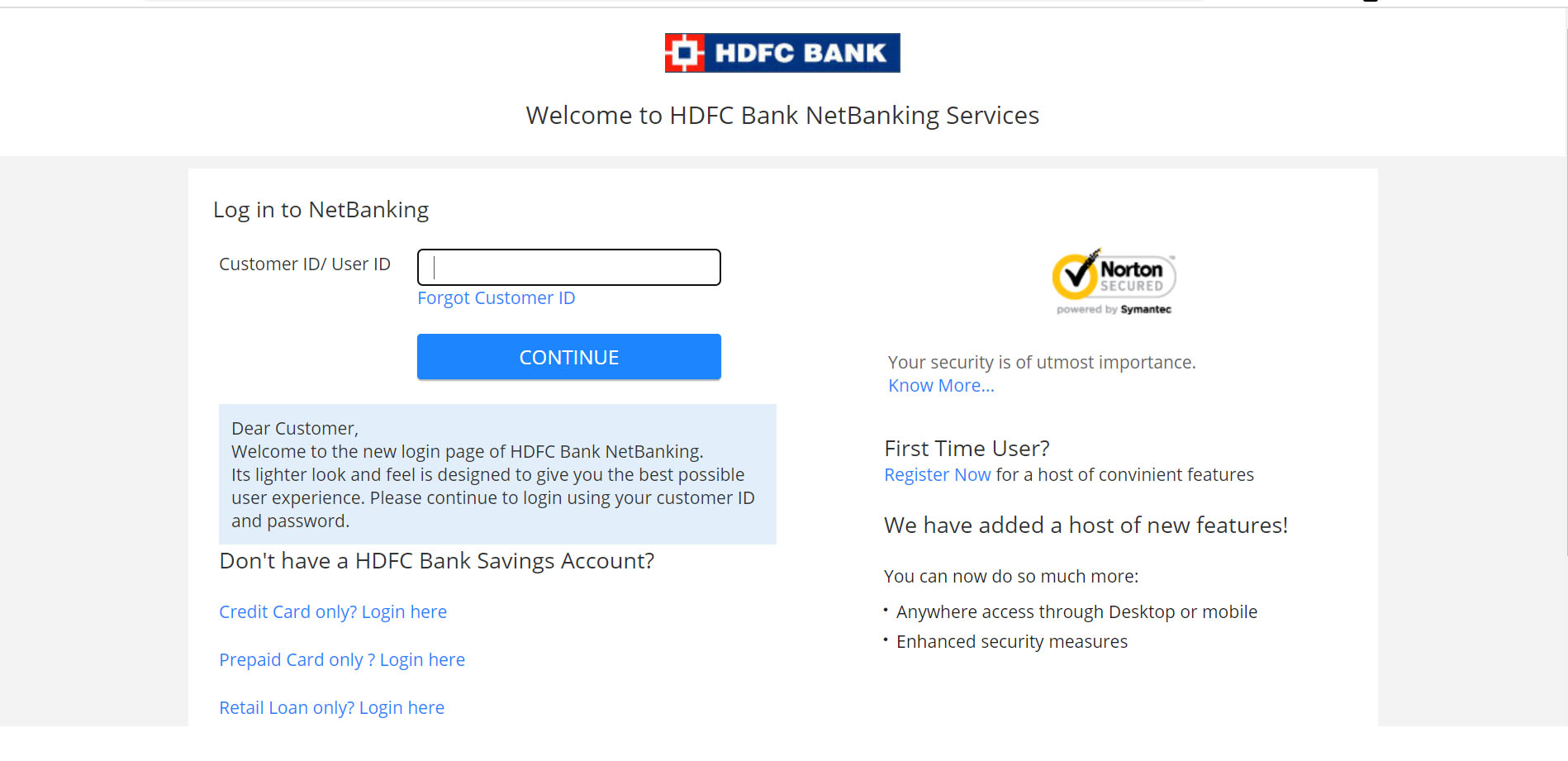

Understanding HDFC Forex Card Online Transfer

HDFC Forex Card is a prepaid card linked to multiple currencies, allowing you to carry a single card for all your international expenses. The Online Transfer feature empowers you to conveniently transfer funds from your linked bank account to your forex card anytime, anywhere. With instant transfer capabilities and competitive exchange rates, HDFC Forex Card Online Transfer simplifies international financial management.

Benefits that Elevate Your Experience

- Convenience and Accessibility: Manage your forex card online, eliminating the need for physical visits to exchange bureaus or bank branches.

- Competitive Exchange Rates: Benefit from favorable exchange rates, saving you money on international transactions.

- Instant Fund Transfer: Experience real-time fund transfers, ensuring you have access to your funds immediately upon need.

- Global Acceptance: The HDFC Forex Card is widely accepted at millions of merchant locations and ATMs worldwide, providing you with peace of mind.

- Comprehensive Security Measures: Rest assured that your transactions are protected by advanced security features, safeguarding your financial data and preventing fraud.

Practical Applications in the Real World

HDFC Forex Card Online Transfer serves as an invaluable tool for various scenarios, including:

- International Travel: Carry one card for multiple currencies, eliminating the need to carry cash or exchange currency at unfavorable rates.

- Online Shopping: Make international online purchases with ease, paying in the local currency and avoiding hidden charges.

- Overseas Education: Streamline the transfer of funds for educational expenses, ensuring timely payments and competitive exchange rates.

- Business Transactions: Simplify international business payments, reducing transaction costs and optimizing cross-border trade.

Expert Insights and Actionable Tips

- Plan in Advance: Determine your estimated expenses and transfer funds accordingly to avoid hefty withdrawal charges.

- Monitor Exchange Rates: Stay informed about currency fluctuations to make informed decisions and maximize your savings.

- Utilize Mobile Banking: Take advantage of HDFC’s mobile banking app for easy online transfers, account monitoring, and access to real-time exchange rates.

Conclusion

HDFC Forex Card Online Transfer empowers you to navigate the world of international finance with convenience, security, and cost-effectiveness. Whether you’re a seasoned traveler, a global entrepreneur, or simply someone who values hassle-free cross-border transactions, this innovative solution has the potential to revolutionize your financial experience. Embrace the ease and benefits of HDFC Forex Card Online Transfer and unlock a world of financial freedom.

Image: www.forex.academy

Hdfc Forex Card Online Transfer