Introduction: Global Titans Locked in Fierce Competition

Prepare yourself for an enthralling exploration into the realm of global finance as we delve into the extraordinary battle between two colossal marketplaces: the foreign exchange (forex) market and the stock market. These financial giants, operating on a scale that dwarfs most economic sectors, engage in a relentless struggle for supremacy, their every move reverberating throughout the world’s economies. In this article, we embark on a journey to unravel the intricate tapestry of these two titans, examining their historical roots, dimensions, advantages, and challenges, ultimately revealing the compelling reasons why this rivalry continues to captivate financial experts and investors alike.

Image: www.freeforexcoach.com

Forex Market: The Unceasing Dance of Currency Exchange

In the global financial arena, the forex market reigns supreme as the colossal venue where currencies from far-flung corners of the earth converge to engage in an incessant ballet of buying, selling, and trading. This financial behemoth, far surpassing all other markets in terms of sheer volume and liquidity, orchestrates an astronomical daily turnover exceeding an astounding $5 trillion, a figure that dwarfs the combined trading activity of all global stock exchanges. This remarkable liquidity and instant trade settlement endow the forex market with unmatched agility, allowing traders to swiftly seize fleeting opportunities as currencies fluctuate in value.

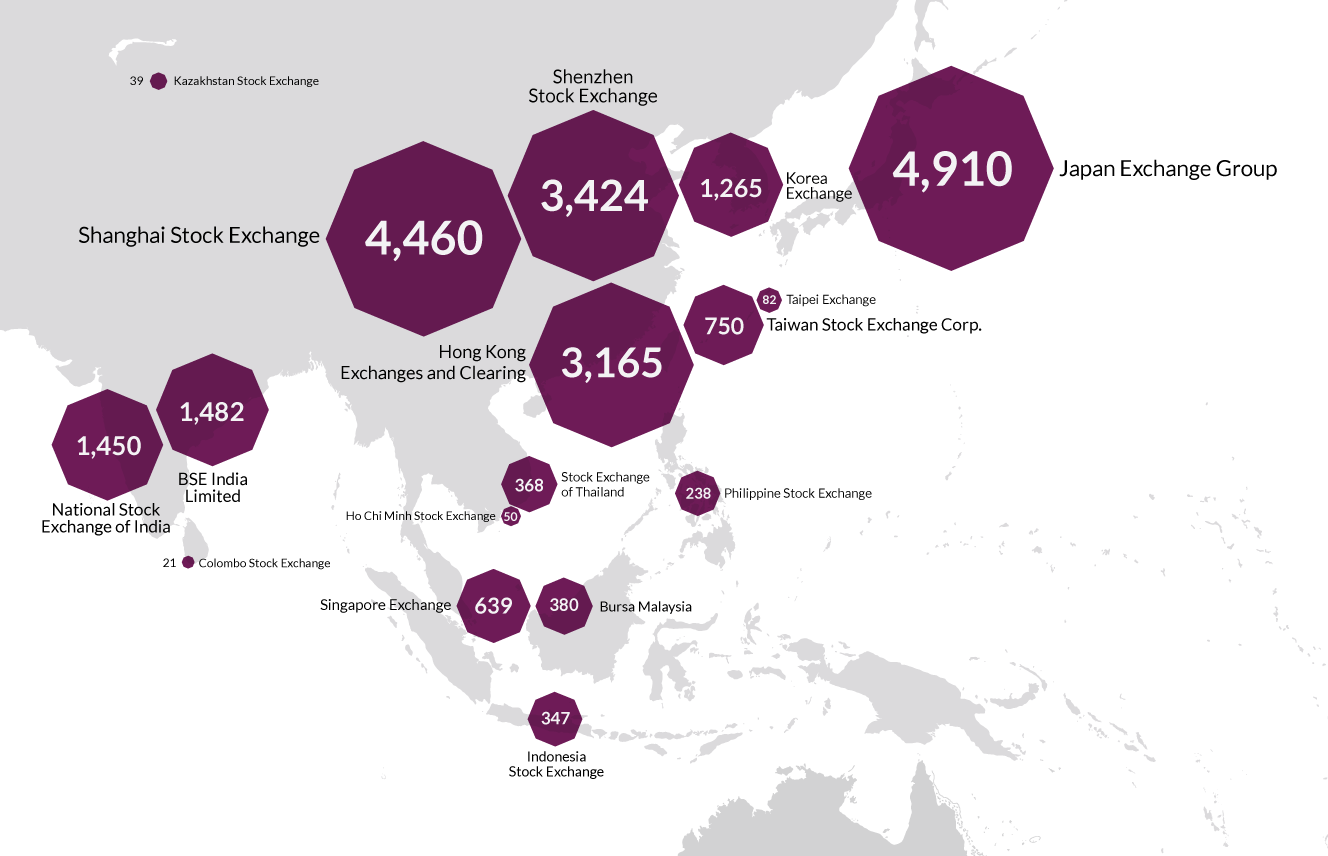

Stock Market: Epicenter of Equity Investments

In stark contrast to the fluid panorama of currency exchange, the stock market presents a distinct realm where ownership stakes in publicly traded companies are vigorously bought and sold. This venerable institution serves as the heartbeat of capitalism, facilitating the flow of funds into the arteries of global businesses, fostering innovation, economic growth, and prosperity. The stock market, a mesmerizing mirror reflecting the collective psyche of investors, embodies both the dreams and anxieties of those seeking financial success.

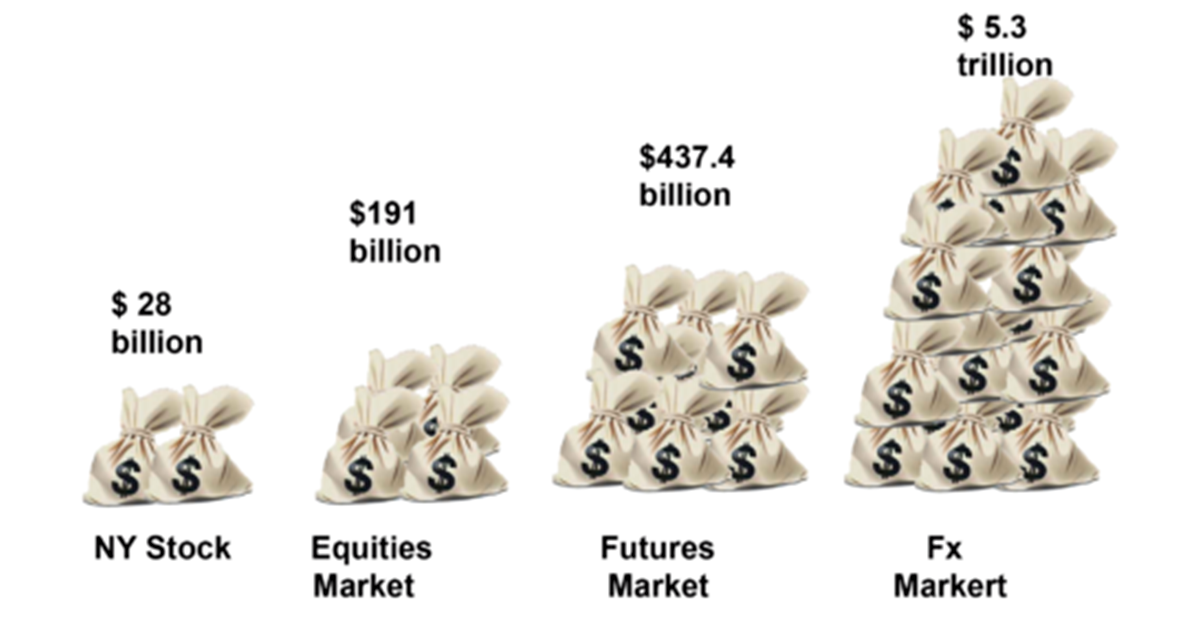

Size Comparison: A Clash of Volumes

As we juxtapose the sheer proportions of these behemoths, a striking disparity emerges. The forex market, an arena of titanic proportions, commands a staggering daily trading volume of over $5 trillion, eclipsing the stock market’s comparatively modest daily turnover of $200 billion. This marked difference in volume underscores the distinct nature of these marketplaces, with the forex market reigning supreme in currency exchange and the stock market dominating the realm of equity investments.

Image: forexbiblesystemv3.blogspot.com

Advantages of the Forex Market: Liquidity and Leverage

The forex market boasts an array of compelling advantages, enticing a vast and diverse community of traders. Its unparalleled liquidity, born from the sheer volume of transactions, empowers traders to enter and exit positions with remarkable ease, minimizing slippage and ensuring seamless execution of trades. This liquid environment also paves the way for round-the-clock trading, enabling traders to capitalize on market movements regardless of geographical constraints or time zones.

Leverage, a double-edged sword in the hands of skilled traders, presents another alluring advantage within the forex market. This potent financial tool amplifies both profits and losses, offering the potential for magnified returns. However, it is crucial for traders to exercise prudence and discipline when employing leverage, as the risks associated with leveraged trading can be substantial.

Advantages of the Stock Market: Stability and Dividends

The stock market, while exhibiting lower liquidity and restricted trading hours compared to its forex counterpart, offers distinct advantages that appeal to a broad spectrum of investors. Stocks, representing fractional ownership in publicly traded companies, provide investors with a stake in the growth and profitability of these enterprises. This long-term investment strategy often yields steady returns through dividends, regular payments distributed to shareholders from a company’s profits.

The inherent stability of stock investments, particularly in blue-chip companies with a proven track record of performance, offers a haven for risk-averse investors seeking to preserve capital and generate consistent returns. Moreover, the stock market provides a vast selection of investment options, catering to diverse risk appetites and investment goals.

Challenges Faced by Forex and Stock Market

Despite their monumental size and influence, both the forex and stock markets are not immune to challenges. The forex market, a decentralized and largely unregulated arena, presents inherent risks associated with currency volatility and potential fraud. Lack of transparency in certain segments of the market can create uncertainty and increase the risk of manipulation.

The stock market, while subject to regulatory oversight, is susceptible to bouts of volatility triggered by economic downturns, geopolitical events, and market sentiments. Additionally, stock market participants must navigate diverse regulatory frameworks across different jurisdictions, which can add complexity and increase compliance costs.

Forex Vs Stock Market Size

Conclusion: A Tale of Two Markets, Each with its Own Enigmas

As we bring this exploration to a close, it becomes abundantly clear that the forex and stock markets, while both operating in the financial realm, present distinct characteristics and cater to diverse investor profiles. The forex market, with its boundless liquidity, leverage, and round-the-clock accessibility, offers immense opportunities for traders seeking short-term gains. Conversely, the stock market, with its inherent stability, dividend payouts, and long-term investment potential, appeals to investors prioritizing capital preservation and steady returns.

Understanding the nuances of these two financial titans, along with the inherent risks and rewards associated with each, is paramount to making informed investment decisions. Whether you are a seasoned market veteran or embarking on your financial journey, a thorough grasp of the forex and stock markets empowers you to navigate the complexities of the global financial landscape and pursue your investment goals with greater confidence and clarity.