Forex Trading Volume: A Thermometer of Global Financial Markets

Image: forextradingwhatisit.blogspot.com

Imagine being able to measure the pulse of the global financial system. The daily forex trading volume is like that thermometer, reflecting the movements of trillions of dollars around the world. In 2018, this dynamic market hit unprecedented heights, with a staggering average daily volume of $5.1 trillion.

Unveiling the Significance of Forex Trading Volume

Forex, short for foreign exchange, represents the exchange of one currency for another. This mammoth market serves as a crucial venue for governments, businesses, and individuals to facilitate trade, invest across borders, and manage currency risks. The daily trading volume is a key indicator of market activity, reflecting investor sentiment, economic growth, and global financial stability.

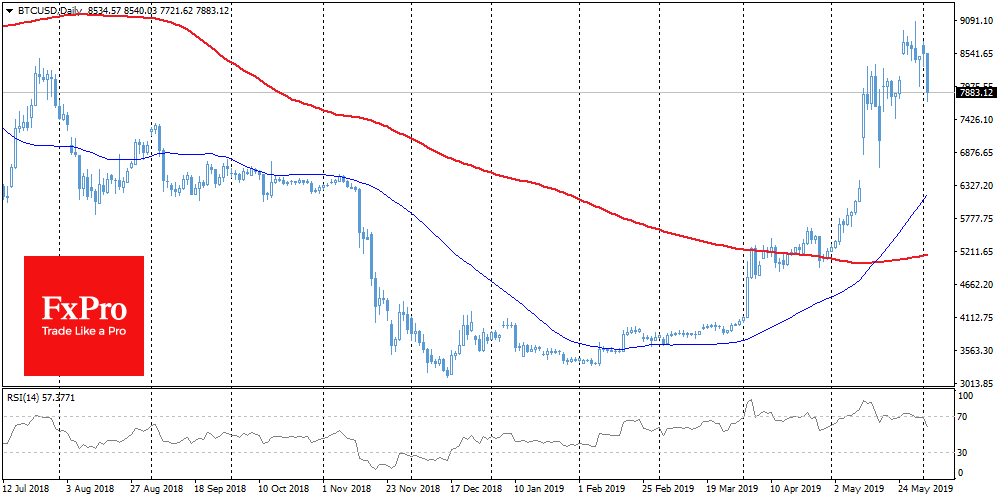

Rewind to 2018: Forex Trading Volume Erupts

The year 2018 witnessed an unprecedented surge in forex trading activity. Record-breaking volumes were driven by several factors, including:

-

Interest Rate Volatility: Central banks’ decisions on interest rates significantly impacted currency values, attracting significant trading activity.

-

Political and Economic Uncertainty: Global events such as Brexit, trade tensions between the US and China, and political turmoil in Europe fueled volatility in currency markets.

-

Technological Advancements: The rapid adoption of mobile trading platforms and automated trading systems made forex more accessible and convenient for a wider range of participants.

Delving into the Impact of High Trading Volume

The high trading volume in 2018 brought both opportunities and challenges:

-

Increased Market Liquidity: With more participants and larger volumes, forex markets became even more liquid, allowing traders to enter and exit positions quickly and efficiently.

-

Enhanced Price Discovery: The increased activity led to better price transparency, providing traders with more accurate information on currency values.

-

Increased Market Volatility: The influx of trading activity also amplified market volatility, potentially increasing the risks for traders, particularly those with less experience.

Expert Insights on Navigating High Trading Volumes

Navigating high trading volumes requires a strategic approach and a deep understanding of market dynamics. Experts suggest:

-

Monitor Macroeconomic Factors: Stay informed about global economic and political events that can impact currency values and overall market sentiment.

-

Manage Risk Prudently: Always use proper risk management techniques such as stop-loss orders and position sizing to minimize potential losses.

-

Seek Professional Guidance: Consider seeking advice from experienced forex traders or financial professionals to enhance your trading decisions.

A Snapshot into the Future of Forex Trading Volume

Looking ahead, experts predict the forex trading volume to continue its upward trajectory, with a potential increase of up to 10% over the next two years. The technological advancements, growing global interconnectedness, and dynamic nature of the global financial landscape will all contribute to this ongoing growth.

Empowering Traders with Key Insights

Understanding forex trading volume is paramount for any participant in the financial markets. The 2018 record-breaking volumes provide valuable insights into market behavior and can guide traders in making informed decisions. By staying updated on the latest market data and employing proven strategies, traders can harness the opportunities while mitigating potential risks in this ever-evolving global financial arena.

Image: www.boomandcrashstrategy.com

Forex Trading Volume Per Day 2018