Embarking on the forex trading journey can be both exhilarating and daunting. Navigating the dynamic markets requires not only knowledge but also experience. Forex trading simulators provide an invaluable solution, offering a risk-free environment where traders can hone their skills and strategies.

Image: forexvolatilityea1.blogspot.com

What is a Forex Trading Simulator?

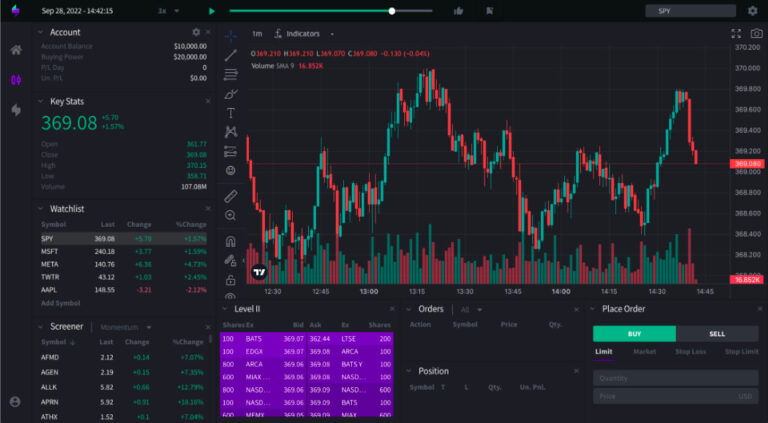

A forex trading simulator is an advanced software that replicates the real-world trading environment. It allows users to trade virtual currencies and track the performance of their trades, without risking any capital. Simulators provide an immersive experience, equipping traders with the necessary knowledge and confidence before entering live markets.

Benefits of Forex Trading Simulators

Risk-free Practice: Simulators eliminate the financial risks associated with live trading, allowing traders to experiment with different strategies and test their assumptions without fear of losses.

Real-time Market Data: Reputable simulators offer access to real-time market data, providing users with a realistic trading experience. Traders can follow price movements, monitor economic events, and analyze market trends.

Customizable Parameters: Simulators often allow traders to adjust various parameters, such as leverage, spread, and account size. This flexibility enables them to create scenarios tailored to their individual trading styles and risk tolerance.

Performance Analysis: Simulators provide detailed performance metrics, including profit and loss statements, risk-reward ratios, and trade history. This data helps traders identify areas for improvement and refine their strategies.

Emotional Control: Emotional trading is a common pitfall for new traders. Simulators offer a safe space to practice emotional control and develop a disciplined trading approach.

How to Choose a Forex Trading Simulator

Choosing the right forex trading simulator is crucial for a successful trading experience. Consider the following factors:

Market Data Quality: The simulator’s market data should be reliable and up-to-date to ensure realistic trading conditions.

Historical Data: Historical data availability allows traders to analyze past price movements and identify potential trading opportunities.

Analytical Tools: Look for simulators that provide a range of analytical tools, such as charts, indicators, and risk management calculators, to facilitate decision-making.

Ease of Use: The simulator should have a user-friendly interface and intuitive controls to enhance the trading experience.

Cost: Simulators range from free to premium options. Consider the features and benefits offered before committing to a subscription.

Image: tradersync.com

Forex Trading Simulator Free Download

Conclusion

Forex trading simulators are indispensable tools for traders of all levels. They provide a risk-free environment to practice trading strategies, develop emotional control, and analyze market trends. By harnessing the power of simulators, traders can gain the confidence and experience necessary to succeed in the dynamic world of forex trading.