In the ever-evolving financial landscape, forex trading stands as a lucrative opportunity for investors seeking to capitalize on currency fluctuations. Forex, short for foreign exchange, involves the buying and selling of different currencies, offering the potential for substantial returns. However, navigating the forex market effectively requires a strategic approach, a deep understanding of its complexities, and a keen eye for market opportunities.

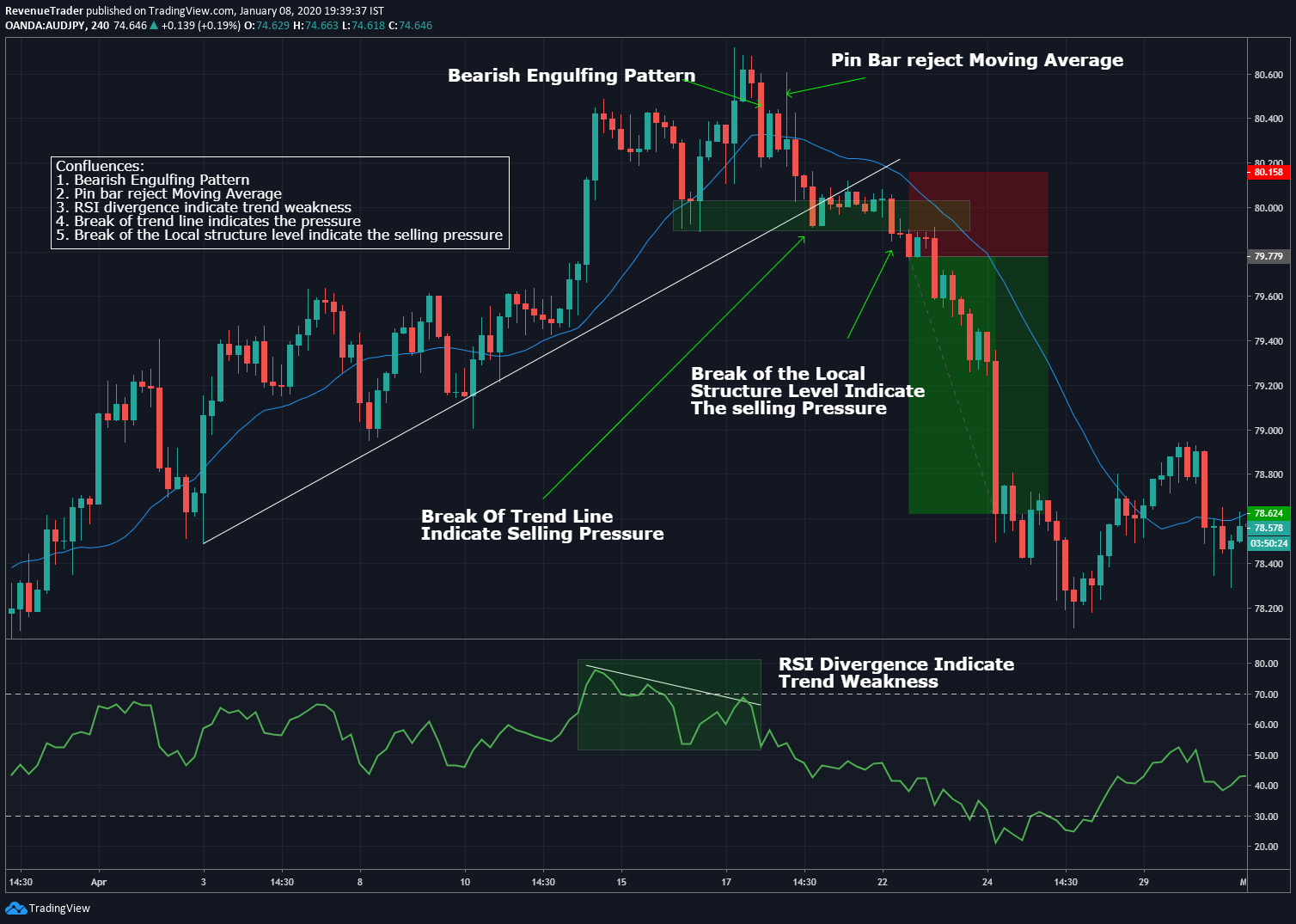

Image: traderevenuepro.com

This comprehensive guide will delve into the intricacies of forex trading, empowering you with the knowledge and strategies necessary to maximize your return on investment. From understanding the basics to mastering advanced techniques, we will equip you with the tools to make informed decisions and navigate the Forex market with confidence.

Understanding Forex Trading: The Basics

Forex trading operates on a decentralized global marketplace where currencies are exchanged 24 hours a day, five days a week. Unlike traditional stock or bond markets, forex trading does not involve a central exchange, with transactions occurring directly between buyers and sellers through a network of banks, brokers, and electronic platforms.

In its simplest form, forex trading involves identifying pairs of currencies and speculating on their relative value. When you buy or sell a currency pair, you are essentially forecasting whether one currency will increase or decrease in value against the other. If your predictions prove correct, you can realize substantial returns.

Currency Pairs and Exchange Rates

Forex traders engage in transactions involving currency pairs, representing the value of one currency relative to another. Each pair is denoted by a three-letter code, with the first letter representing the base currency (the one being bought) and the second letter indicating the quote currency (the one being sold). For example, the EUR/USD currency pair indicates the value of one euro (EUR) in terms of US dollars (USD).

Exchange rates, expressed as the price of one currency against another, determine the profitability of a trade. Traders seek to buy a currency pair when they expect the base currency to appreciate against the quote currency and sell when they anticipate the opposite.

Factors Influencing Exchange Rates

A myriad of factors influences exchange rates, making it crucial for traders to stay abreast of global economic, political, and financial developments. Economic data such as interest rates, inflation, and gross domestic product (GDP) can significantly impact currency values. Political events, news, and trade agreements can also cause short-term or even long-term shifts in exchange rates.

Understanding these factors and their potential impact is essential for effective forex trading. By monitoring economic indicators, political developments, and market movements, traders can make informed decisions and identify potential opportunities.

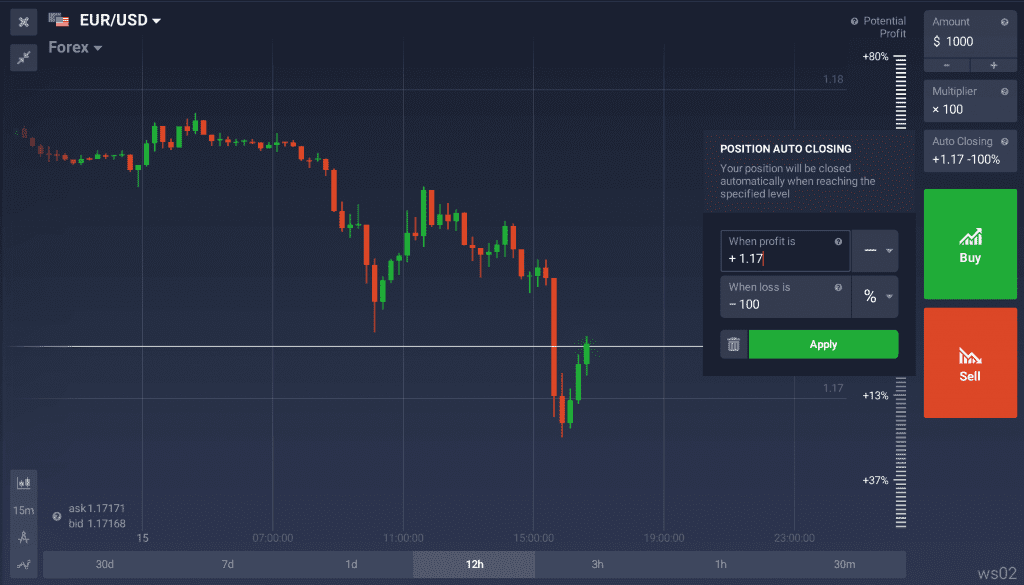

Image: blog.iqoption.com

Major Currency Pairs and Market Trends

Traders often focus on major currency pairs, which account for a significant portion of global forex trading volume. These pairs include EUR/USD, USD/JPY, GBP/USD, USD/CHF, and AUD/USD.

Understanding the long-term trends and patterns of major currency pairs is paramount for successful forex trading. Traders should analyze historical price data, market news, and economic indicators to identify potential trading opportunities. By leveraging technical analysis, traders can uncover patterns and trends that can guide their decision-making.

Risk Management: Minimizing Losses

While Forex trading offers substantial profit potential, it also carries inherent risks. Managing these risks effectively is crucial for long-term success. Understanding the instruments and strategies available to manage risk can help traders protect their capital and minimize potential losses.

Stop-loss orders, limit orders, and position sizing are some of the tools available to traders to manage risk and enhance their overall trading strategy.

Trading Psychology and Discipline

In the fast-paced and dynamic world of forex trading, it is imperative to maintain a clear and disciplined mind. Developing a trading plan and adhering to it can help traders stay focused and make rational decisions.

Understanding psychological biases and emotional pitfalls is equally important. Fear, greed, and overconfidence can cloud judgment and lead to poor trading decisions. A disciplined approach, coupled with risk management techniques, can help traders overcome emotional obstacles and maximize their return on investment.

Advanced Trading Techniques for Maximum Returns

Seasoned traders often employ advanced techniques to enhance their profitability. These techniques include position trading, swing trading, and scalping.

Position trading involves holding trades over extended periods to benefit from significant market trends. Swing traders aim to capitalize on short-term price fluctuations and reversals, while scalpers take numerous small trades in a short-term timeframe.

Understanding these advanced techniques and leveraging them effectively can help experienced traders optimize their returns and navigate the forex market with greater precision.

Forex Trading Return On Investment

https://youtube.com/watch?v=3-0_DvDixYg

Conclusion

The world of forex trading presents a compelling opportunity for knowledgeable and strategic investors. By embracing the principles outlined in this guide, you can enhance your understanding of the forex market, manage risks effectively, and maximize your return on investment.

Remember, successful forex trading requires a combination of knowledge, skill, discipline, and risk management. By diligently applying the concepts presented here, you can unlock the potential of forex trading and embark on a rewarding journey of financial growth.