Introduction

Embarking on the exciting journey of forex trading requires meticulous planning and a well-defined business plan. Whether you are an experienced trader or just starting out, a robust plan serves as a roadmap for your trading endeavors. This comprehensive guide will provide you with a sample business plan for forex trading, outlining essential elements and considerations to set your trading on a path to profitability.

Forex trading, the exchange of one currency for another, offers opportunities for capital appreciation and income generation. However, venturing into this market without a proper foundation can be perilous. A business plan serves as your guiding light, defining your trading strategies, risk management techniques, and overall business objectives.

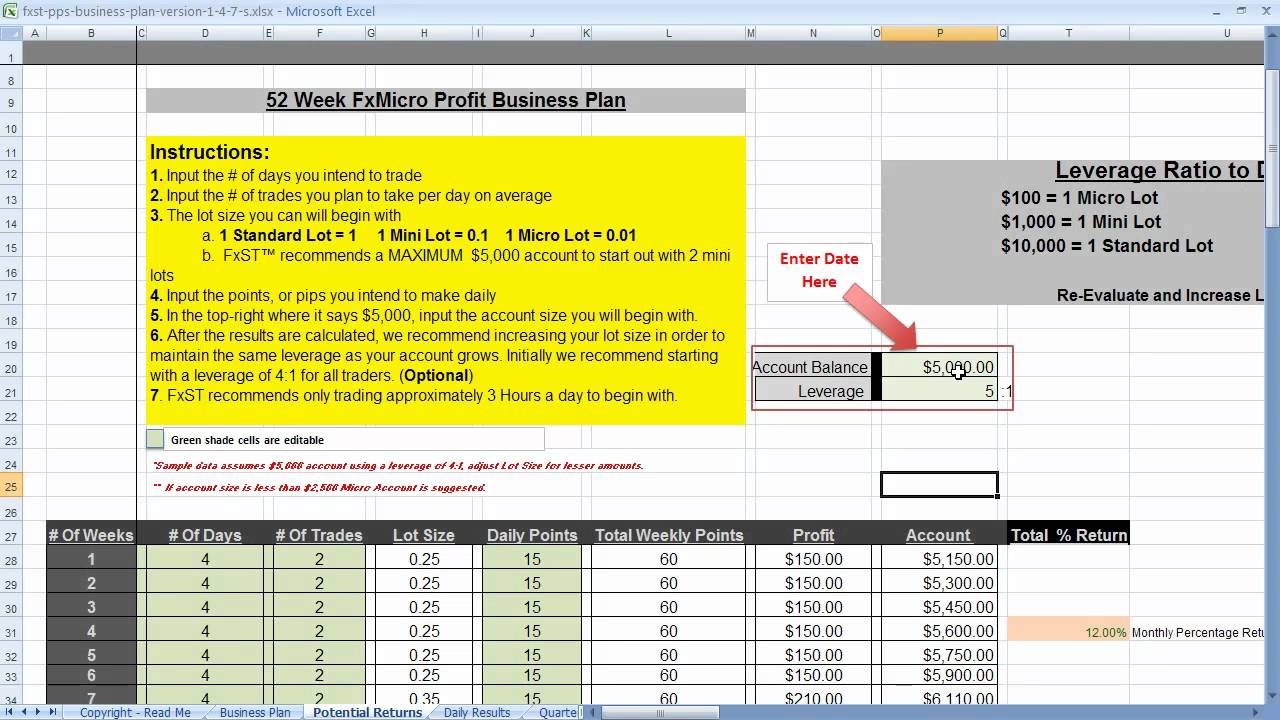

Image: www.youtube.com

I. Market Analysis: Understanding the Forex Landscape

The success of your forex trading depends on a thorough understanding of the market dynamics. Conduct extensive research on the currency pairs you intend to trade. Familiarize yourself with their historical price fluctuations, economic factors that affect them, and market news that influences their movements.

Keep your finger on the pulse of economic data releases, central bank announcements, and political events that can impact currency movements. Regular monitoring of economic calendars ensures that you are well-informed and can anticipate potential market shifts.

II. Trading Strategy: Defining Your Trading Approach

Develop a well-defined trading strategy that aligns with your risk tolerance and profit objectives. This strategy should outline the specific conditions that trigger your buy and sell decisions. Whether you opt for technical analysis, fundamental analysis, or a combination of both, ensure your strategy is backed by sound logic and historical data.

Clearly define your entry and exit points, trade size, stop-loss levels, and take-profit targets. A clearly outlined strategy provides a framework for disciplined trading and reduces impulsivity. Remember, sticking to the plan is crucial even in turbulent market conditions.

III. Risk Management: Mitigating Potential Losses

Risk management is the cornerstone of responsible trading. Determine your risk tolerance and implement strategies to minimize losses. Establish clear stop-loss levels for each trade to limit potential drawdowns.

Incorporate risk-reward ratios into your trading plan, ensuring that your potential profit outweighs your risk exposure. Diversify your trading portfolio across multiple currency pairs to minimize the impact of adverse movements in any single currency.

![Trading Plan Template for 2024 [Free PDF | Sheets Download]](https://howtotrade.com/wp-content/uploads/2022/05/trading-plan-infographic-418x1024.jpg)

Image: howtotrade.com

IV. Capital Management: Optimizing Trading Capital

Determine the optimal amount of capital to allocate to your forex trading. Avoid risking more than you can afford to lose and allocate a percentage of your trading capital to each trade. Avoid overleveraging by maintaining a prudent debt-to-equity ratio.

Establish clear withdrawal guidelines to preserve your trading capital and avoid emotional decision-making during market fluctuations. Discipline yourself to adhere to the trading plan and protect your hard-earned funds.

V. Technology and Execution: Optimizing Trading Execution

Invest in a reliable trading platform that provides accurate and timely quotes, advanced charting tools, and risk management features. Ensure your platform supports your trading strategy and allows for seamless order execution.

Develop a contingency plan for potential technical difficulties or market disruptions. Determine alternative trading platforms or backup plans to minimize the impact of unforeseen events.

VI. Monitoring and Evaluation: Tracking Progress and Adjusting

Establish a system for regular monitoring and evaluation of your trading performance. Track your trades, analyze your profitability, and identify areas for improvement.

Adjust your trading plan as needed based on market conditions, changes in your risk tolerance, or refined strategies. Regular evaluation and adaptation are key ingredients for continuous improvement and long-term success.

VII. Conclusion: Embracing the Trading Journey

Forex trading presents both opportunities and challenges. With a well-crafted business plan, you can navigate this complex market, mitigate risks, and achieve your financial goals. Remember, success in forex trading requires discipline, knowledge, and a commitment to continuous learning.

Use this business plan template as a starting point for your own trading journey. Tailor it to your specific circumstances, objectives, and risk tolerance. Embrace the learning curve, adapt to changing market dynamics, and strive for continuous improvement.

踏上外汇交易的激动人心的旅程,需要细致的规划和一份明确的商业计划。无论您是经验丰富的交易者还是刚刚起步,一个强有力的计划都是您交易努力的路线图。本综合指南将为您提供外汇交易的商业计划样本,概述关键要素和注意事项,让您的交易走上获利之路。

外汇交易,一种货币与另一种货币的兑换,为资本升值和创收提供了机会。然而,在没有适当基础的情况下贸然进入这个市场是危险的。一份商业计划书作为您的指导灯,定义了您的交易策略、风险管理技术和整体业务目标。

一.市场分析:了解外汇格局

您外汇交易的成功取决于对市场动态的透彻理解。对您打算交易的货币对进行广泛的研究。熟悉它们的历史价格波动、影响它们变化的经济因素以及影响它们走势的市场消息。

持续关注经济数据发布、央行公告和可能影响汇率的政治事件。定期监控经济日历,确保您信息灵通,并能预测潜在的市场变化。

二.交易策略:定义您的交易方法

制定一个明确的交易策略,与其风险承受力和获利目标保持一致。该策略应概述触发您买卖决策的具体条件。无论您选择技术分析、基本面分析还是两者兼施,确保您的策略具有合理的逻辑和历史数据支持。

明确定义您的进场点和出场点、交易规模、止损位和获利目标。一个明确的策略为自律交易提供了框架,减少了冲动性。请记住,即使在动荡的市场条件下,坚持计划至关重要。

三.风险管理:减轻潜在损失

风险管理是负责任交易的基石。确定您的风险承受能力并实施策略以最大程度地减少损失。为每笔交易设定明确的止损位以限制潜在亏损。

将风险收益率纳入您的交易计划,确保您的潜在利润超过您的风险敞口。通过跨多个货币对分散您的交易组合,以最大程度地减少任何单一货币不利变动的影响。

四.资本管理:优化交易资本

确定分配给外汇交易的最佳资本金额。避免投资超出您承受损失能力的金额,并将您的交易资本的一定百分比分配给每笔交易。通过维持合理的债务权益比率,避免过度杠杆化。

制定明确的退出准则以保留您的交易资本,并避免在市场波动期间做出情绪化决定。自律地遵守交易计划,保护您辛苦赚来的资金。

五.技术和执行:优化交易执行

投资一个可靠的交易平台,提供准确及时的报价、先进的图表工具和风险管理功能。确保您的平台支持您的交易策略,并允许无缝执行订单。

制定一个针对潜在技术困难或市场中断的应急计划。确定备用交易平台或备用计划,以最大程度地减少不可预见事件的影响。

六.监测和评估:跟踪并调整进度

建立一个系统,定期监测和评估您的交易表现。跟踪您的交易、分析您的盈利能力并确定需要改进的领域。

根据市场状况、风险承受力的变化或经过改进的策略,根据需要调整您的交易计划。定期评估和调整是持续改进和长期成功的关键要素。

Forex Trading Business Plan Sample

https://youtube.com/watch?v=dDEQovHV1Ps

七.结论:拥抱交易之旅

外汇交易既有机遇也有挑战。通过精心设计的商业计划,您可以驾驭这个复杂的市场、减轻风险并实现您的财务目标。请记住,外汇交易的成功需要自律、知识和对持续学习的承诺。

使用这个商业计划模板作为您自己交易之旅的起点。根据您特定的情况、目标和风险承受能力量身定制。接受学习曲线、适应不断变化的市场动态并力求持续改进。