As UPSC candidates, understanding the fundamentals of economics and finance is paramount. One crucial aspect to grasp is the concept of forex reserves and their relevance to India’s economic standing. In this comprehensive guide, we will delve into the intricacies of India’s forex reserves, their impact on the nation’s financial resilience, and how this knowledge can empower you in your UPSC endeavors.

Image: www.youtube.com

Understanding Forex Reserves

Foreign exchange reserves refer to the assets held by a country’s central bank in foreign currencies, typically U.S. dollars, euros, and other major currencies. These reserves serve as a financial cushion, providing the country with the ability to meet its international obligations like import payments, debt servicing, and currency stabilization.

Significance of India’s Forex Reserves

India’s forex reserves play a pivotal role in maintaining economic stability. They provide the following benefits:

- Import Cover: Adequate forex reserves ensure that India can pay for essential imports, such as oil, fertilizers, and machinery, without experiencing any shortfalls.

- Debt Servicing: The reserves help India fulfill its financial obligations to foreign creditors, maintaining its creditworthiness and preventing potential defaults.

- Currency Stability: Forex reserves allow the Reserve Bank of India (RBI) to intervene in the foreign exchange market to control fluctuations in the value of the Indian rupee, thereby mitigating exchange rate volatility.

- Confidence Booster: Substantial forex reserves instill confidence among foreign investors and rating agencies, attracting foreign capital and enhancing India’s overall economic credibility.

Recent Trends and Developments

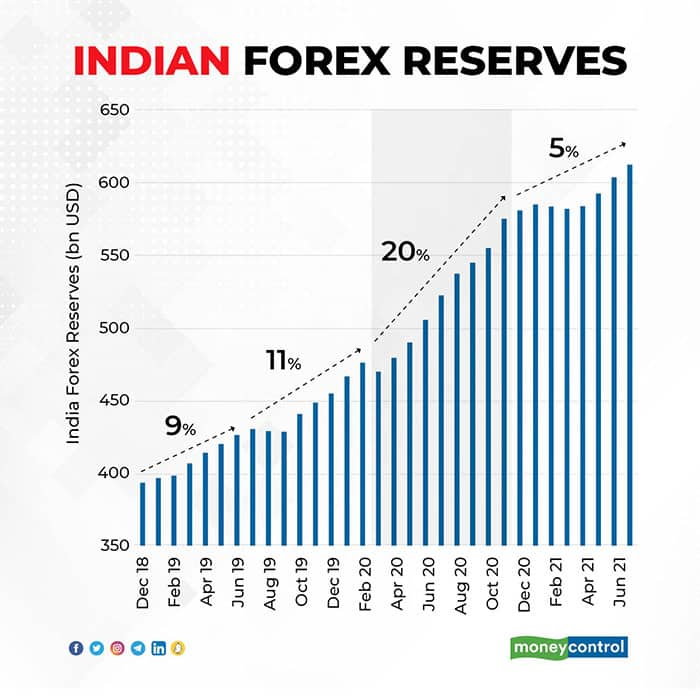

India’s forex reserves have witnessed significant fluctuations in recent years. Factors such as capital inflows, trade imbalances, and global economic conditions have influenced their levels. The RBI’s active management of foreign exchange inflows and outflows has helped maintain a comfortable buffer of reserves, despite market volatility.

Additionally, India has been actively diversifying its forex reserves by investing in assets such as gold and International Monetary Fund (IMF) Special Drawing Rights (SDRs). This diversification strategy aims to reduce currency risks and enhance the stability of the reserves.

Image: www.moneycontrol.com

Expert Tips and Advice

For UPSC aspirants seeking to excel in this topic, here are some valuable tips:

- Understand the Basics: Grasp the fundamental concepts of forex reserves, their composition, and their significance to India’s economy.

- Stay Updated: Regularly monitor news and financial publications to keep abreast of the latest trends and developments in forex reserve management in India.

- Analyze Trends: Study the historical trends in India’s forex reserves to identify patterns and understand the factors that influence their fluctuations.

- Link to Current Affairs: Integrate current events related to forex reserves in your answers to UPSC questions, demonstrating your comprehensive understanding.

- Prepare Advanced Concepts: Explore advanced topics such as optimal forex reserve levels, exchange rate management, and the role of forex reserves in international trade and finance.

FAQs

Q: What is the ideal level of forex reserves for India?

A: There is no universal formula, but India aims to maintain an adequate level to cover a certain number of months of imports and support foreign currency obligations.

Q: How does the RBI manage forex reserves?

A: The RBI buys and sells foreign currencies in the market, intervenes in forward markets, and invests in financial instruments to manage the level and stability of forex reserves.

Q: Why is it important to diversify forex reserves?

A: Diversification helps reduce currency risks and enhances the stability of the reserves by spreading investments across different assets and currencies.

Forex Reserve Of India Upsc

Conclusion

Understanding the intricacies of India’s forex reserves is essential for UPSC aspirants seeking to excel in economics and finance. By grasping the significance, monitoring trends, and utilizing expert advice, you can master this topic and demonstrate your comprehensive knowledge in UPSC examinations. Please share your thoughts and questions on this topic in the comments section, and we look forward to engaging in further discussions with fellow aspirants and experts.