Begin your forex trading journey with an explosive strategy—the forex opening range breakout strategy. This strategy empowers traders to harness the initial market volatility at the start of each trading day to generate lucrative intraday profits.

Image: 8941891.blogspot.com

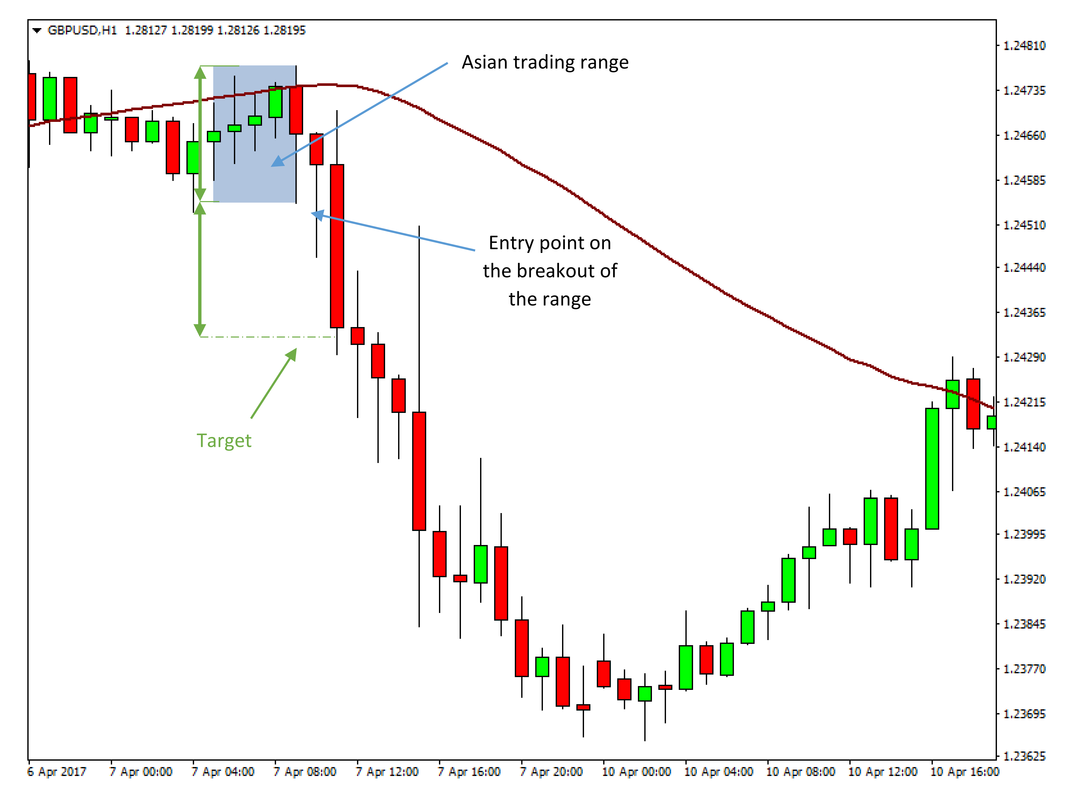

The opening range of a trading day is defined as the difference between the highest and lowest prices traded during the first 15-30 minutes after the market opens. This range often sets the tone for the day’s subsequent price action, making it an invaluable indicator for breakout traders.

Power of Breakout Trading

Breakout trading involves identifying and capitalizing on breakouts from established price ranges. When the price breaks above or below a specified range, it indicates a potential shift in market sentiment and the initiation of a new trend.

The opening range breakout strategy capitalizes on this concept by assuming that a breakout above or below the opening range signifies increased momentum in that direction and provides an entry point for profitable trades.

Identifying Breakout Opportunities

-

Define the Range: Begin by identifying the opening range of the trading day, calculated as the difference between the day’s highest and lowest prices within the first 15-30 minutes.

-

Watch for Breakouts: Monitor the price action closely and watch for a breakout above the highest or below the lowest price of the opening range.

-

Confirm Momentum: Ensure that the breakout is accompanied by increasing volume, which provides confirmation that the move is driven by strong market forces.

-

Execute the Trade: Once the breakout is confirmed, enter a trade in the direction of the breakout, placing your stop loss just outside the opening range.

Profitable Trade Management

-

Target Setting: Establish realistic profit targets based on the volatility of the market and the opening range.

-

Risk Management: Determine your risk tolerance and set your stop loss accordingly to minimize potential losses.

-

Flexible Exit: Monitor the trade closely and adjust your exit strategy as per market conditions, considering factors like price action, news, and technical indicators.

-

Partial Exits: Consider using partial exits to secure profits while maintaining exposure to potential further gains.

Image: rfxsignals.com

Forex Opening Range Breakout Strategy

Enrich Your Trading Skills

-

Market Analysis: Improve your understanding of the forex market by analyzing price charts, economic data, and market news.

-

Technical Proficiency: Enhance your technical trading skills by studying chart patterns, support and resistance levels, and momentum indicators.

-

Discipline and Psychology: Develop the self-discipline necessary for successful trading, controlling emotions and adhering to trading plans.

-

Continuous Learning: Embrace ongoing learning to stay updated on market trends and trading strategies, expanding your knowledge horizons.