Step into the World of Foreign Exchange: Exploring the Forex Officer Profession

The realm of international finance demands professionals who possess both analytical acumen and a deep understanding of global currency markets. Enter the Forex Officer, an integral player whose expertise empowers banks and financial institutions to navigate the complex landscape of foreign exchange. In this comprehensive guide, we delve into the responsibilities, career prospects, and essential skills required to excel in this dynamic role.

Image: www.template.net

A Comprehensive Overview of the Forex Officer Role

A Forex Officer, also known as a foreign exchange dealer or currency trader, is primarily responsible for executing foreign exchange transactions on behalf of clients. Their daily tasks involve monitoring currency market fluctuations, advising clients on currency exchange strategies, and managing risk associated with currency conversions. Forex Officers possess a comprehensive understanding of economic indicators, global events, and central bank policies that influence currency valuations.

Responsibilities of a Forex Officer

- Advising clients on optimal currency exchange strategies

- Executing foreign exchange transactions promptly and efficiently

- Monitoring currency market movements and identifying trading opportunities

- Managing risk exposure and ensuring compliance with regulatory requirements

- Providing insightful market analysis and currency forecasts

- Maintaining strong relationships with clients, banks, and financial institutions

Career Path and Opportunities

A career as a Forex Officer offers individuals with a strong foundation in finance and economics a rewarding path. Entry-level positions typically require a bachelor’s degree in a related field, such as finance, economics, or business. With experience and proven success, Forex Officers can advance to senior roles, including head traders or risk managers. Career opportunities exist in banks, financial institutions, hedge funds, and other organizations that require expertise in foreign exchange.

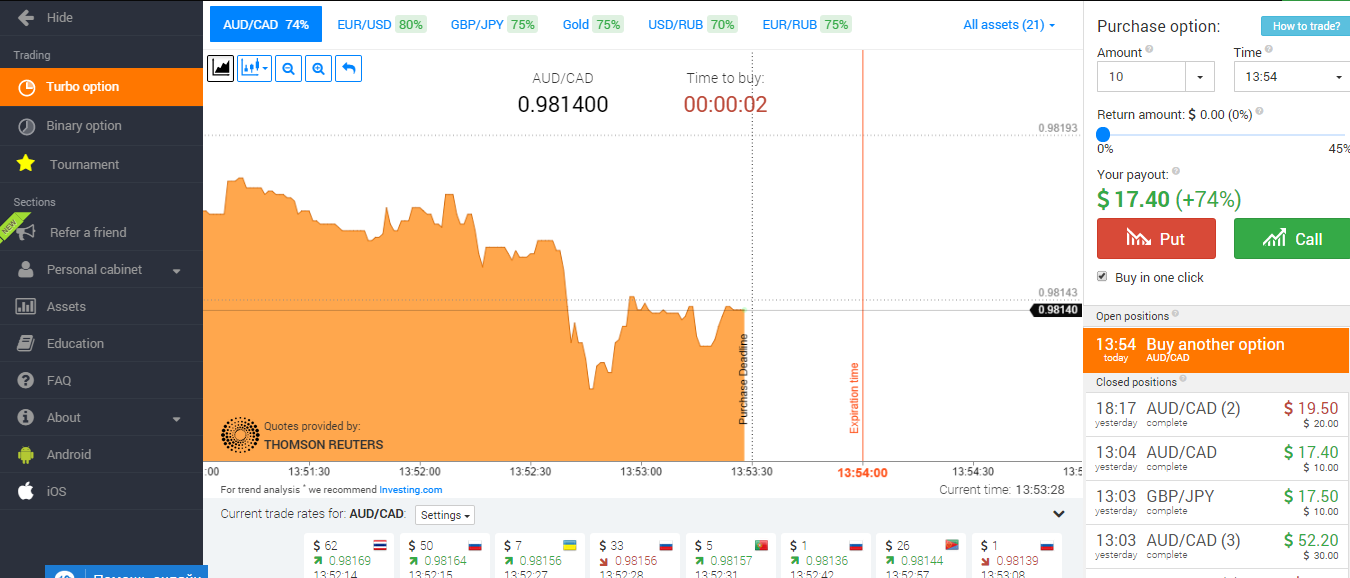

Image: etibavubanako.web.fc2.com

Essential Skills for Forex Officers

- Strong analytical and problem-solving skills

- Proficiency in financial analysis and risk management

- Excellent communication and negotiation abilities

- Understanding of economic principles and global financial markets

- Knowledge of trading platforms and currency exchange systems

- Ability to work independently and as part of a team

Latest Trends Shaping the Forex Industry

The Forex industry is constantly evolving, driven by technological advancements and global economic shifts. Some of the key trends shaping the industry include:

- The rise of algorithmic trading and artificial intelligence (AI)

- Increased demand for risk management and regulatory compliance

- Growth in emerging market currencies and cross-border investments

- Impact of macroeconomic events and geopolitical tensions on currency markets

Tips and Expert Advice for Aspiring Forex Officers

- Gain a solid understanding of financial markets and economic principles

- Develop analytical and problem-solving skills

- Practice using trading platforms and currency exchange systems

- Build a strong network within the financial industry

- Seek mentorship and guidance from experienced Forex professionals

FAQ on Forex Officers

Q: What is the difference between a Forex Officer and a Currency Trader?

A: While both roles involve trading foreign currencies, Forex Officers primarily execute transactions on behalf of clients, while Currency Traders trade currencies for their own accounts or for hedge funds.

Q: What is the average salary of a Forex Officer?

A: The salary of a Forex Officer varies depending on experience, location, and the size of the organization. According to Glassdoor, the average salary for a Forex Officer in the United States is around $100,000.

Forex Officer In Bank Job Description

Conclusion

The role of a Forex Officer is pivotal in facilitating global commerce and managing currency risk. By understanding the responsibilities, career path, and essential skills required for this profession, individuals can assess their suitability and pursue a rewarding career in the dynamic world of foreign exchange.

We invite you to explore other articles on our platform to further enhance your understanding of Forex trading and the financial industry. With our commitment to providing informative and engaging content, we strive to empower readers with the knowledge and insights necessary for their professional and personal growth.