Embrace Precision and Prediction in Forex Trading

Foreign exchange (Forex) trading is a fast-paced and dynamic market where success lies in predicting price movements and making informed decisions. Technical indicators play a crucial role in empowering traders with insights into market trends. Among them, the moving average (MA) strategy stands out as a valuable tool for identifying trading opportunities and maximizing profits.

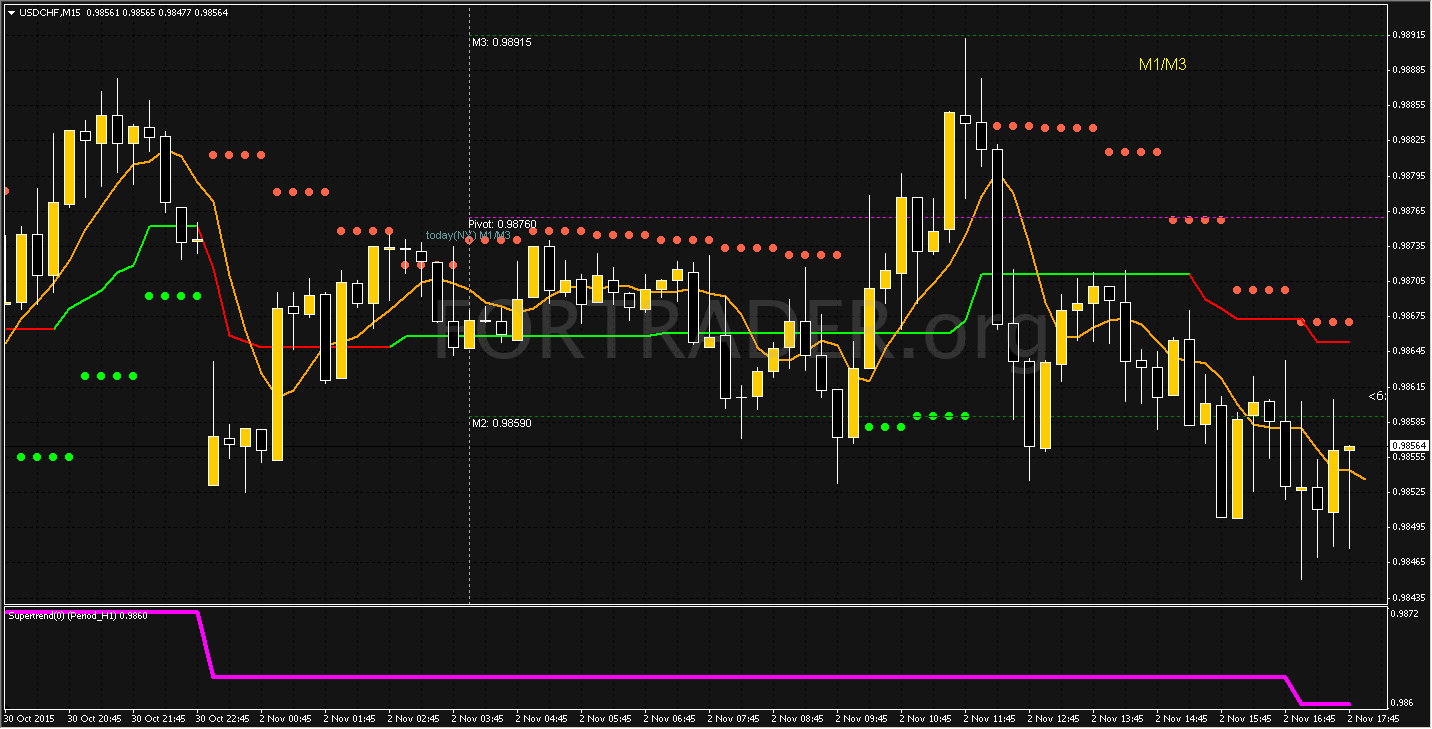

Image: reportd224.web.fc2.com

Moving Averages: What They Are and How They Work

A moving average is a technical indicator that smoothes out price data over a specific period of time, eliminating random fluctuations and revealing the underlying trend. By calculating the average price of a security over the past N periods (known as the “lookback period”), moving averages provide traders with a clearer view of market direction.

The Power of Moving Averages in Forex Trading

Moving averages offer a powerful advantage in Forex trading by:

- Identifying Market Trends: MAs can help traders determine whether a currency pair is in an uptrend, downtrend, or ranging.

- Spotting Trading Opportunities: Crossover points between different MAs (e.g., 50-day MA and 200-day MA) can signal potential entry and exit points.

- Measuring Volatility: Wider MAs indicate higher volatility, while narrower MAs suggest lower volatility.

- Confirming Market Momentum: MAs provide confirmation of existing market trends, helping traders avoid false signals.

Expert Tips and Strategies for Using MAs

- Choose the Right Time Frames: Different time frames (intraday, daily, weekly) can provide insights into short-term and long-term trends.

- Combine Multiple MAs: Using multiple MAs (e.g., 50-day, 100-day, 200-day) can enhance trend confirmation.

- Use Multiple Indicators: Combine MAs with other technical indicators (e.g., Bollinger Bands, Fibonacci retracements) to validate signals.

- Monitor for False Breakouts: MAs can sometimes produce false breakouts. Be patient and wait for confirmation before making trading decisions.

Image: www.pinterest.com

FAQs on Moving Average Strategy

Q: What is the best moving average period to use?

A: The optimal period depends on the time frame and trading strategy. Experiment with different periods to find what works best.

Q: Can moving averages predict the future?

A: MAs do not predict the future but rather identify potential areas of support and resistance based on historical data.

Q: Is it possible to lose money using moving averages?

A: Yes, like any trading strategy, MAs have limitations and can lead to losses if used improperly. Risk management techniques are crucial.

Forex Moving Average Strategy Pdf

Conclusion

In the complex world of Forex trading, the moving average strategy pdf provides invaluable guidance, empowering traders with the knowledge and tools to make informed decisions. By mastering the nuances of MAs, you can unlock the potential of this powerful indicator, increase your trading accuracy, and take your Forex trading to the next level.

Are you ready to delve deeper into the world of moving average strategies? Explore our comprehensive PDF guide today and gain the edge you need to succeed in Forex trading!