In the dynamic and ever-evolving financial landscape, where opportunities and challenges intertwine, forex trading stands as a powerful tool for astute investors seeking exponential returns. Amidst the plethora of automated trading solutions available, Forex Flex EA emerges as a beacon of excellence, offering traders a comprehensive and customizable platform to navigate the complexities of the forex market. This in-depth guide delves into the world of Forex Flex EA, unveiling its intricacies, providing unparalleled insights into its optimal configurations, and empowering traders with the knowledge to unlock the full potential of this groundbreaking software.

Image: elitecurrensea.com

The Essence of Forex Flex EA: A Symphony of Automation, Intelligence, and Profitability

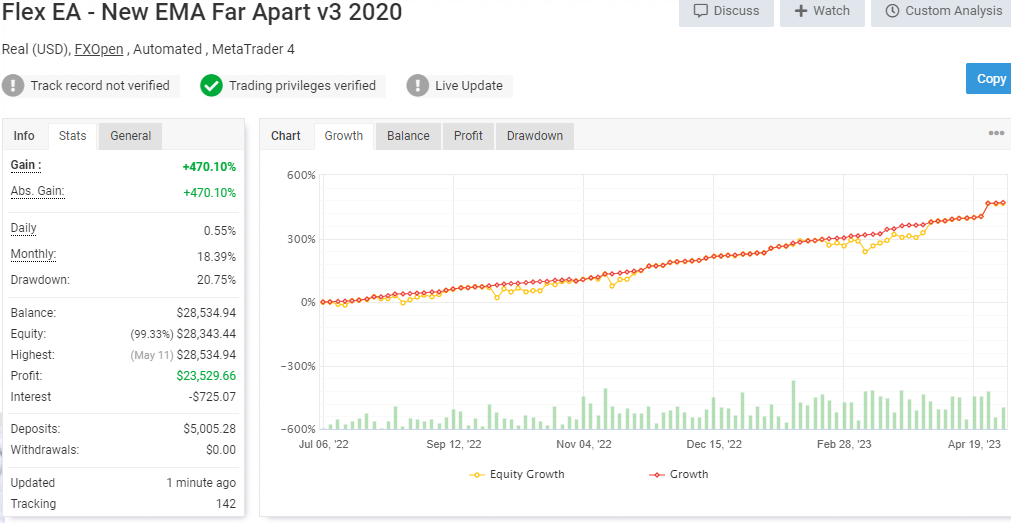

Forex Flex EA embodies the epitome of automated trading, seamlessly integrating cutting-edge algorithms, sophisticated risk management strategies, and an intuitive user interface to orchestrate a symphony of profit-generating opportunities. Designed by a team of seasoned traders with an unwavering commitment to innovation, this expert advisor (EA) has meticulously analyzed market data, historical trends, and trading patterns to craft a robust and adaptable trading system. Forex Flex EA’s repertoire encompasses a vast array of trading strategies, empowering traders of all skill levels to harness the power of automation and unlock the door to consistent profitability.

Unveiling the Secrets: A Comprehensive Guide to Forex Flex EA’s Best Settings

To harness the full capabilities of Forex Flex EA, a meticulous approach to selecting its optimal settings is paramount. This comprehensive guide unravels the intricacies of each parameter, providing traders with a roadmap to tailor the EA’s functionality to their unique trading style and risk appetite.

-

Trading Pairs: A Strategic Selection for Optimal Performance

Forex Flex EA’s versatility extends to a wide range of currency pairs, allowing traders to capitalize on opportunities across diverse markets. The optimal trading pairs often exhibit high liquidity and pronounced volatility, presenting ample opportunities for profitable trades.

-

Image: softwareforexeageneratorprofessional.blogspot.comTime Frames: Embracing the Rhythm of the Market

Time frames play a crucial role in shaping Forex Flex EA’s trading cadence. Traders can select from an array of time frames, from the scalping speed of M1 to the broader perspective of daily charts, enabling them to adapt to different market conditions and trading styles.

-

Trading Volume: Striking a Balance between Risk and Reward

Trading volume represents the number of units traded per position, directly influencing the potential profit and risk associated with each trade. Finding the optimal trading volume requires a careful evaluation of account balance, risk tolerance, and market conditions.

-

Take Profit and Stop Loss: Safeguarding Profits and Minimizing Drawdowns

Take profit and stop loss levels serve as crucial parameters in managing risk and securing profits. Setting appropriate values for these levels ensures that winning trades are closed at opportune moments while limiting potential losses.

-

Trailing Stop: Enhancing Profitability with Dynamic Adjustments

Trailing stop functionality allows traders to lock in profits while allowing favorable trades to run longer. Forex Flex EA’s advanced trailing stop algorithm dynamically adjusts stop loss levels based on market movements, maximizing profit potential.

Empowering Traders: Expert Insights and Actionable Tips for Unleashing Forex Flex EA’s Prowess

To maximize the efficacy of Forex Flex EA, harnessing the wisdom of seasoned traders is invaluable. Here are actionable tips gleaned from expert insights:

-

Embracing Dynamic Settings: Adapting to Evolving Market Conditions

Market conditions are inherently fluid, necessitating traders to fine-tune Forex Flex EA’s settings periodically. Regular reviews and adjustments based on prevailing trends and volatility levels ensure optimal performance in diverse market environments.

-

Understanding Risk Tolerance: Defining Personal Boundaries

Traders must carefully assess their risk tolerance before engaging in automated trading. Forex Flex EA’s versatility allows for customization of risk parameters, empowering traders to align the EA’s behavior with their unique risk appetite.

-

Leveraging Backtesting and Optimization: Refining Strategies for Enhanced Performance

Historical data provides a valuable testing ground for refining Forex Flex EA’s settings. Backtesting allows traders to evaluate the EA’s performance under different market conditions and optimize its parameters for maximum profitability.

Forex Flex Ea Best Settings

Conclusion: The Path to Automated Trading Success

Forex Flex EA represents a transformative tool for traders seeking to automate their trading strategies, minimize risk, and maximize profitability. By carefully selecting the optimal settings, traders can unleash the full potential of this cutting-edge software, tailoring it to their trading style and risk tolerance. Embracing the insights shared within