In the fast-paced world of financial markets, speed, efficiency, and automation are paramount. Brokerage APIs (Application Programming Interfaces) have emerged as transformative tools that empower traders with unparalleled control and flexibility over their trading strategies. By leveraging APIs, traders can seamlessly integrate their brokerage accounts with external applications and software, unlocking a world of possibilities that enhance their trading experiences.

Image: osquant.com

APIs are software intermediaries that facilitate communication between different applications and systems. In the context of brokerage, APIs allow traders to automate various trading tasks, access real-time market data, and execute trades directly from third-party platforms. This integration streamlines workflows, reduces manual effort, and enables traders to focus on strategic decision-making.

Benefits of Brokerage with API

The integration of brokerage with API offers a myriad of advantages for traders:

- Automation: Automate repetitive tasks such as order entry, position management, and risk monitoring, freeing up time for analysis and strategy development.

- Customization: Tailor trading platforms and tools to specific needs, enhancing user experience and efficiency.

- Real-time Data Access: Access real-time market data, news, and analysis from multiple sources, providing comprehensive insights for informed trading decisions.

- Direct Trade Execution: Execute trades directly from third-party platforms or custom-built applications, ensuring seamless and timely execution.

- Advanced Analytics: Integrate trading data with analytics tools to analyze performance, identify trading patterns, and optimize strategies.

Use Cases and Applications

Brokerage APIs find widespread application in various trading scenarios:

- Algorithmic Trading: Develop and deploy automated trading strategies based on complex algorithms and historical data analysis.

- Portfolio Management: Monitor and manage portfolios in real-time, track performance, and rebalance assets based on defined criteria.

- Risk Management: Set up automated risk monitoring systems, track exposure levels, and implement risk-mitigation strategies.

- Trading Signal Integrations: Integrate with trading signal providers to receive automated buy and sell recommendations.

- Data Analysis and Visualization: Export trading data to custom platforms for in-depth analysis, visualization, and forecasting.

Choosing the Right Brokerage with API

Selecting the right brokerage with API is crucial for successful integration and trading. Consider the following factors:

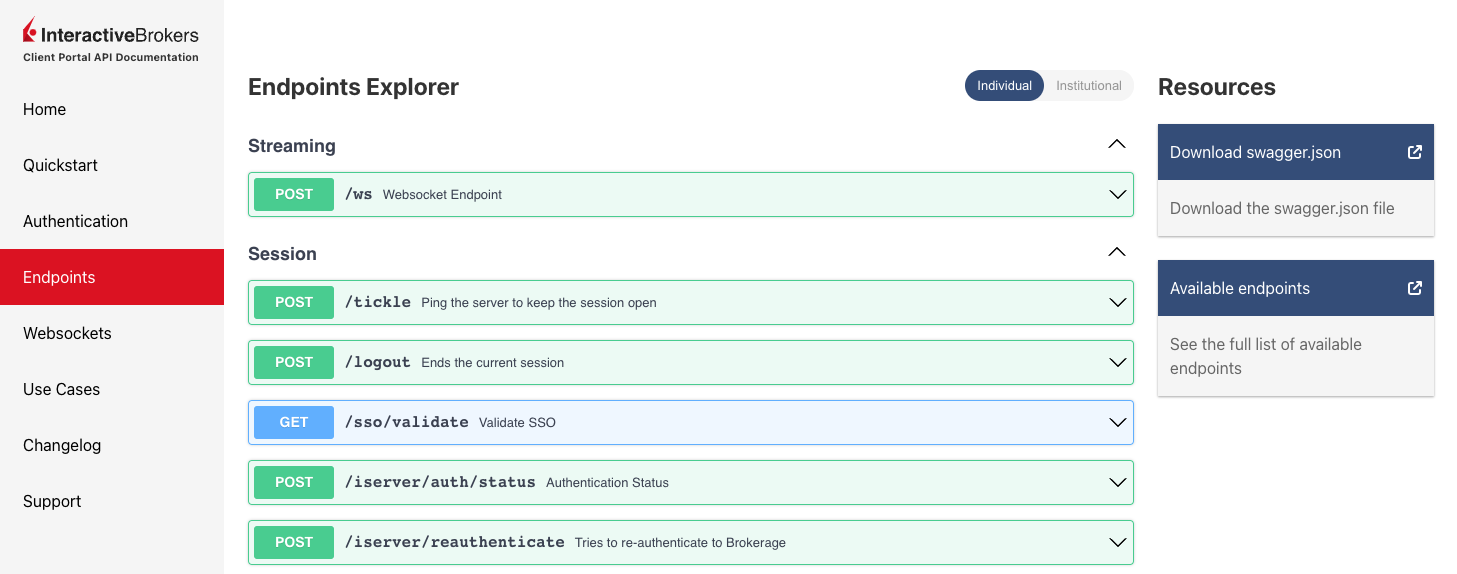

- API Documentation and Support: Comprehensive and well-documented APIs with dedicated support ensure ease of implementation and troubleshooting.

- Security Features: Robust security measures to safeguard sensitive trading information and prevent unauthorized access.

- Trading Fees and Commission Structure: Understand the cost structure associated with API trading, including order handling fees and minimum trading requirements.

- Market Coverage and Order Types: Ensure the API supports the desired asset classes, markets, and order types for your trading strategies.

- Customer Service: Responsive and knowledgeable customer support to assist with integration and address any technical issues.

Image: www.upstart.com

Brokerage With Api

Conclusion

Brokerage APIs have revolutionized the trading landscape, providing traders with unprecedented control, automation, and customization capabilities. By harnessing the power of APIs, traders can enhance their trading experiences, optimize strategies, and achieve greater success in the dynamic financial markets. Choosing the right brokerage with API and leveraging its features effectively can empower traders to navigate the markets with confidence and efficiency.