Introduction

In a pivotal shift within the financial landscape, forex brokers are recognizing the transformative potential of Bitcoin, the most prominent cryptocurrency, by embracing it as a mainstream deposit option. This bold move underscores the evolving nature of currency trading, where digital assets are rapidly gaining traction.

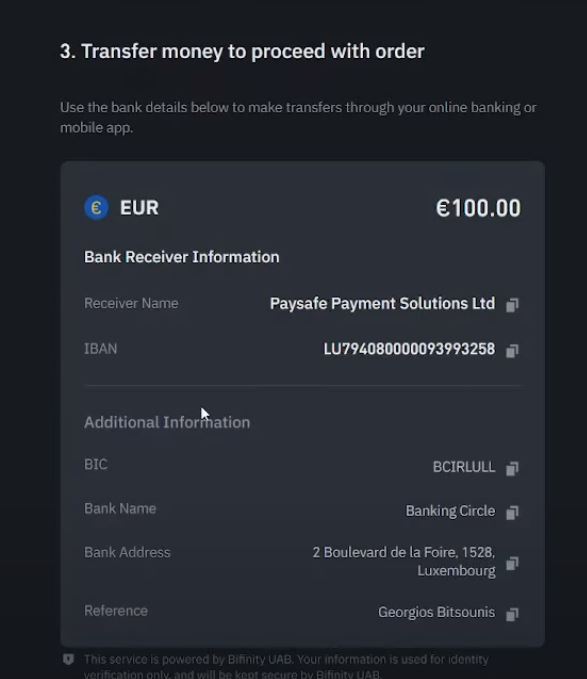

Image: bitsounisproject.com

The integration of Bitcoin deposits into forex trading platforms has significant implications for both traders and brokers alike. For traders, it provides the convenience and flexibility of utilizing a widely accepted cryptocurrency while simultaneously unlocking the potential for enhanced security and lower transaction costs. For brokers, it opens up a vast and growing market of crypto-savvy traders seeking more diverse investment options.

Delving into the Perks of Using Bitcoin for Forex Deposits

- Lightning-Fast Transactions: Compared to traditional bank transfers that can take days or even weeks to complete, Bitcoin transactions are processed in mere minutes, significantly expediting the deposit process.

- Lower Transfer Fees: Unlike hefty bank fees, Bitcoin transfers often incur minimal transaction costs, offering significant savings for traders, especially those making frequent or large deposits.

- Enhanced Security: Utilizing a decentralized blockchain network, Bitcoin transactions boast high levels of security, eliminating the risk of fraudulent activities that may arise in centralized financial systems.

- Global Accessibility: Untethered by geographic boundaries, Bitcoin’s global reach allows traders from different corners of the world to easily deposit funds into their forex accounts.

Exploring the Regulatory Landscape and Broker Considerations

As regulatory frameworks for cryptocurrencies continue to evolve, forex brokers must navigate a complex landscape. Adherence to anti-money laundering (AML) and know-your-customer (KYC) regulations is paramount to mitigate potential risks associated with cryptocurrencies.

Brokers must also robustly assess and incorporate robust security measures to safeguard traders’ Bitcoin deposits. This includes implementing secure storage solutions, employing multi-factor authentication, and adhering to strict cybersecurity protocols.

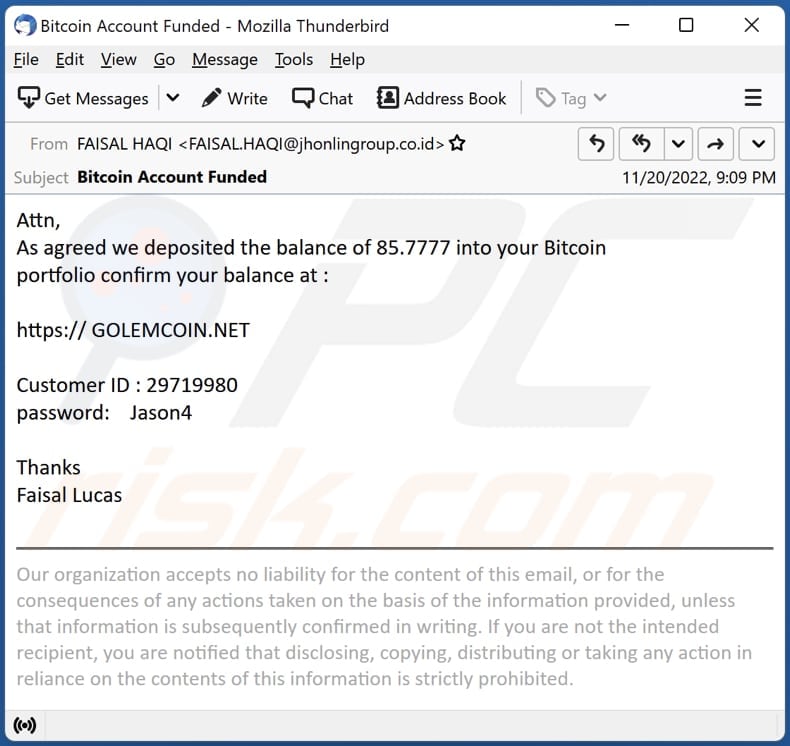

Image: www.pcrisk.pl

Forex Broker Accept Bitcoin Deposit

Conclusion

The incorporation of Bitcoin deposits by forex brokers marks a significant step towards the mainstream adoption of cryptocurrencies in the financial markets. As the regulatory environment continues to mature and brokers enhance their risk management strategies, Bitcoin is poised to become an even more ubiquitous deposit option.

The convergence of forex trading and Bitcoin creates a compelling opportunity for both traders and brokers. Traders benefit from the convenience, lower costs, and increased security of Bitcoin deposits, while brokers gain access to a vast and expanding market of crypto-savvy investors. As the financial world embraces digital transformation, the integration of Bitcoin into forex trading is a testament to the evolving nature of currency markets where innovation and accessibility intertwine.