In the labyrinth of financial markets, chart pattern technical analysis serves as a beacon, illuminating the path toward informed trading decisions. It’s the art of deciphering price patterns that emerge on charts over time, allowing traders to anticipate market movements and increase their chances of success. Whether you’re navigating the volatile waters of forex or the complex terrain of stock trading, chart pattern technical analysis empowers you with invaluable insights.

Image: www.pinterest.fr

Head and Shoulders: A Crown of Caution

Picture a mountain rising from two hills. In the realm of chart patterns, this silhouette represents the Head and Shoulders formation, signaling a bearish trend reversal. The left shoulder marks the first peak, followed by a higher head. The right shoulder portrays a fall, with a neckline drawn beneath the two valleys. Breaking below this neckline confirms a downtrend, offering a timely warning for traders to adjust their positions.

Triangles: Triangulating Trends

Triangle patterns manifest in symmetrical, ascending, and descending forms. As prices consolidate within converging trend lines, it’s a sign of indecision in the market. The breakout point signals a continuation or reversal of the prevailing trend. Ascending triangles hint at bullish momentum, while descending triangles suggest a bearish shift.

Double and Triple Tops/Bottoms: The Peaks and Troughs of Indecision

A double or triple top (or bottom) signals reversal and continuation patterns. When prices reach a high (or low) twice (or thrice) but fail to break out, forming a peak (or trough), it indicates a shift in market sentiment. A breakout above the peak confirms a bullish trend continuation, while a break below the trough signals a bearish reversal.

Image: entryhub.blogspot.com

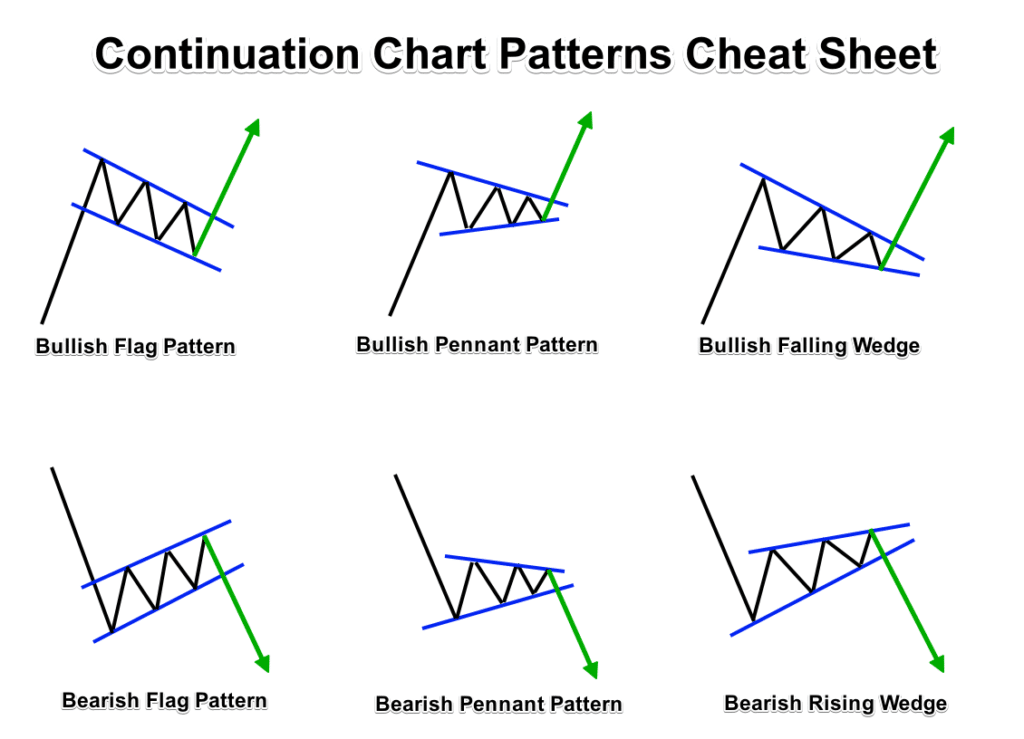

Flags and Pennants: Pausing Before the Surge

Resembling a flag on a pole, a flag pattern forms when prices consolidate within a defined range after a sharp move. The breakout from the upper or lower trend line suggests a continuation of the prior trend. Pennants, similar to flags, have converging trend lines but represent shorter consolidation periods.

Chart Pattern Technical Analysis For Forex & Stock Trading

Conclusion

Chart pattern technical analysis is an indispensable tool in the financial trader’s arsenal. By recognizing and interpreting these patterns, investors can decipher the market’s sentiment, anticipate price movements, and make informed trading decisions. Whether you’re a forex trader seeking to ride currency waves or a stock trader navigating the complexities of the market, chart pattern technical analysis provides a valuable compass, guiding you towards success in the ever-evolving financial landscape.