Embrace Financial Empowerment: Introducing Micro Accounts

In an era where financial inclusion plays a pivotal role in empowering individuals, micro accounts emerge as a transformative solution. Designed specifically to cater to the unbanked and underbanked population, micro accounts offer a gateway to essential financial services, empowering individuals to take control of their finances and embark on a path towards financial stability. This comprehensive guide will delve into the world of micro accounts, providing valuable insights into their benefits, sign-up process, and the path to financial freedom they unlock.

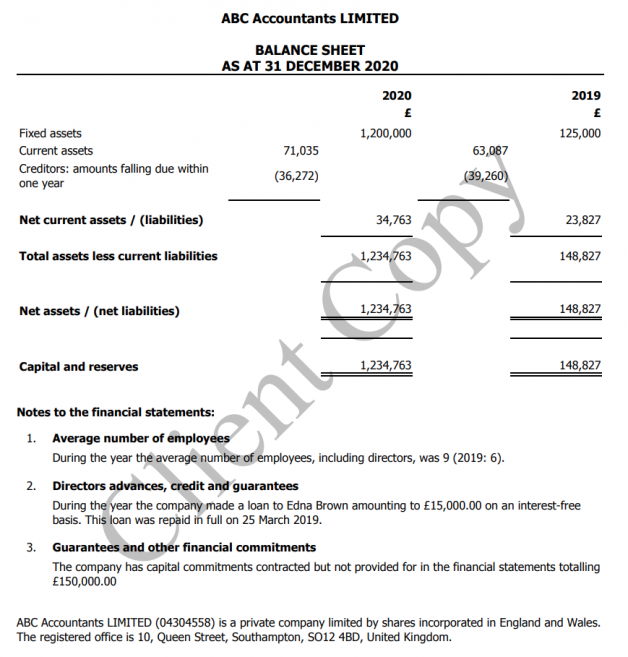

Image: www.informdirect.co.uk

Benefits of Micro Accounts: A Path to Financial Inclusion

Micro accounts are not merely bank accounts; they are gateways to financial inclusion, equipping individuals with the tools and knowledge to navigate the complexities of personal finance. These accounts allow individuals to securely store their money, make transactions, and access essential financial services such as bill payments, fund transfers, and savings. Furthermore, micro accounts empower individuals to build a credit history, a crucial step towards accessing larger financial products and services in the future.

A Step-by-Step Guide to Micro Account Sign Up

Signing up for a micro account is a straightforward process designed to prioritize accessibility and ease of use. To initiate the process, identify a reputable financial institution or non-profit organization that offers micro account services. Once you have selected a provider, gather the necessary documentation, typically including a government-issued ID and proof of address. Visit the financial institution or access their online platform and complete the application form, providing accurate and up-to-date information. The application process may involve a basic credit check or identity verification to ensure compliance and protect against fraud.

Expert Insights: Enhancing Your Financial Journey

Ms. Emily Carter, a financial literacy advocate, emphasizes the transformative power of micro accounts, stating:

“Micro accounts are not just savings accounts; they are empowerment tools that can transform lives. By providing access to basic financial services, micro accounts empower individuals to take control of their finances, break the cycle of poverty, and build a more secure future.”

Mr. David Anderson, a social entrepreneur working in financial inclusion initiatives, shares his insights:

“Financial inclusion is not just a buzzword; it is a fundamental human right. Micro accounts play a critical role in bridging the financial divide, ensuring that everyone has the opportunity to participate in the formal economy and achieve financial well-being.”

Image: xem-forex.com

Micro Account Sign Up

https://youtube.com/watch?v=F2WyJfIuESU

Embracing a Future of Financial Empowerment: The Way Forward

The road to financial empowerment begins with education and informed decision-making. Through this comprehensive guide, you have gained valuable insights into the benefits and sign-up process of micro accounts. Embracing these tools and leveraging the expertise shared by professionals will enable you to unlock your financial freedom and embark on a path towards financial stability and prosperity. Remember, financial empowerment is a journey, and every step you take brings you closer to achieving your financial goals.