Embarking on a financial odyssey in the dynamic realm of foreign exchange (forex) necessitates a well-defined business plan, a roadmap to guide your venture towards meteoric success. Within this document, aspiring forex entrepreneurs will delve into the intricacies of crafting a robust business plan that will serve as the cornerstone of their financial endeavors.

Image: www.youtube.com

Unveiling the Forex Frontier: An Arena of Potential

The forex market, a vast and ever-evolving landscape, beckons with the allure of boundless opportunities. Comprehending the fundamentals of this multifaceted market is imperative for navigating its complexities. Forex encompasses the buying and selling of currency pairs, where speculators endeavor to capitalize on currency fluctuations. These fluctuations arise from geopolitical events, economic data releases, central bank policies, and market sentiment.

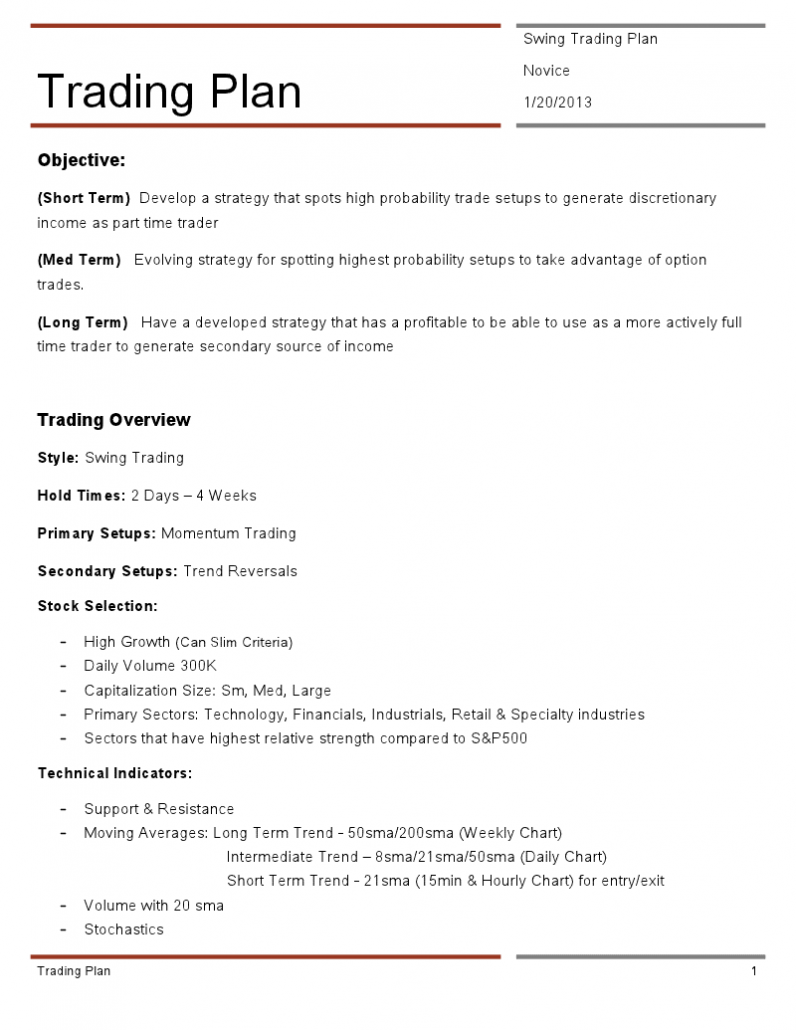

Harnessing the potential of the forex market requires a strategic blueprint. A business plan serves as the guiding star, outlining your objectives, market positioning, operating procedures, financial projections, and risk management strategies. By meticulously crafting this document, you lay the groundwork for a prosperous future in the forex arena.

Crafting a Business Plan in the Forex Crucible

1. Defining Your Objectives:

Foresight demands aligning your aspirations with the objectives of your forex venture. Envision your future, articulating your goals for growth, market share dominance, and financial prowess.

2. Pinpointing Your Market Niche:

Identify your target audience within the vast forex market. Comprehend their investment preferences, risk tolerance, and geographical distribution. This market segmentation will tailor your products and services to resonate with specific customer demographics.

3. Defining Your Service Offerings:

Determine the scope of your forex services. Will you offer currency trading, market analysis, advisory services, or a combination thereof? Identifying your core competencies and aligning them with market demand is paramount.

4. Establishing a Robust Operating Structure:

Delineate your operational framework, encompassing legal entity formation, regulatory compliance, and technological infrastructure. Select the optimal business structure that aligns with your goals and risk appetite.

5. Projecting Financial Strength:

Meticulously craft financial projections that forecast revenue streams, expenses, and profitability. Investors and lending institutions will scrutinize these projections, so accuracy and transparency are crucial.

6. Mitigating Risks with Precision:

Identify potential risks inherent in forex trading and devise comprehensive strategies to mitigate them. This risk management plan should address market volatility, currency fluctuations, cyber threats, and operational risks.

7. Marketing and Customer Acquisition:

Develop a tailored marketing strategy that targets your identified market niche. Leverage a mix of online advertising, content marketing, and strategic partnerships to raise awareness and acquire new customers.

8. Assembling a Winning Team:

Recognize the significance of assembling a team of seasoned professionals who possess the requisite knowledge, experience, and passion for forex trading. Establish clear roles and responsibilities to foster a cohesive work environment.

The Power of a Well-crafted Forex Business Plan

A well-crafted forex business plan unlocks a plethora of advantages:

- Clarity of Vision: It serves as a guiding light, ensuring that your venture remains focused and aligned with your objectives.

- Market Validation: By conducting thorough market research, you gain invaluable insights into your target market and their needs.

- Investor Confidence: Potential investors seek assurance that your business has a sound foundation and a promising future. A robust business plan instills confidence and increases the likelihood of securing funding.

- Risk Mitigation: Identifying and addressing potential risks proactively minimizes the impact of adverse events on your business.

- Operational Efficiency: A well-defined operating structure streamlines your operations, reduces redundancies, and enhances productivity.

- Adaptability: The dynamic nature of the forex market necessitates adaptability. Your business plan provides a framework for navigating market shifts and making informed adjustments.

Image: iposodib.web.fc2.com

Business Plan For Forex Company

Final Thoughts: Embracing a Transformative Journey

Crafting a comprehensive business plan is not a mere compliance exercise; it’s an opportunity to envision your path to success and meticulously lay the groundwork for a thriving forex enterprise. By embracing the comprehensive approach outlined within this article, you empower your venture with the tools to navigate the complexities of the forex market and emerge as a formidable player.