In the ever-evolving world of finance, Bitcoin and Forex stand as formidable titans, each promising unique advantages. While one has emerged as a beacon of digital disruption, the other boasts long-standing dominance in global markets. In this article, we will delve into the depths of these two financial behemoths, contrasting their essential attributes and exploring which option may be best suited for your investment aspirations.

Image: www.forexgdp.com

As we embark on this financial odyssey, a personal anecdote shall serve as our compass. It was in the depths of the 2008 financial crisis that I first stumbled upon the enigmatic realm of Bitcoin. Its decentralized nature and the allure of a system immune to the clutches of central banks ignited within me a sense of hope amidst the turmoil. Fast forward a decade, and Bitcoin has shattered expectations, transforming from a marginalized concept into a global phenomenon, challenging the very foundations of traditional finance.

Decentralization vs. Centralization: A Tale of Autonomy and Regulation

At the heart of Bitcoin’s allure lies its decentralized architecture, a stark contrast to the centralized structure of Forex. Bitcoin operates on a peer-to-peer network, devoid of any governing body or central authority. Each transaction is meticulously recorded on a distributed ledger, the blockchain, ensuring immutability and transparency.

Forex, on the other hand, plays out on a centralized stage, with central banks acting as the quarterbacks, calling the shots on currency values and monetary policy. Such centralized control introduces a layer of risk, as the whims and interventions of these monetary authorities can significantly impact market dynamics.

Volatility vs. Stability: A Dance of Risk and Reward

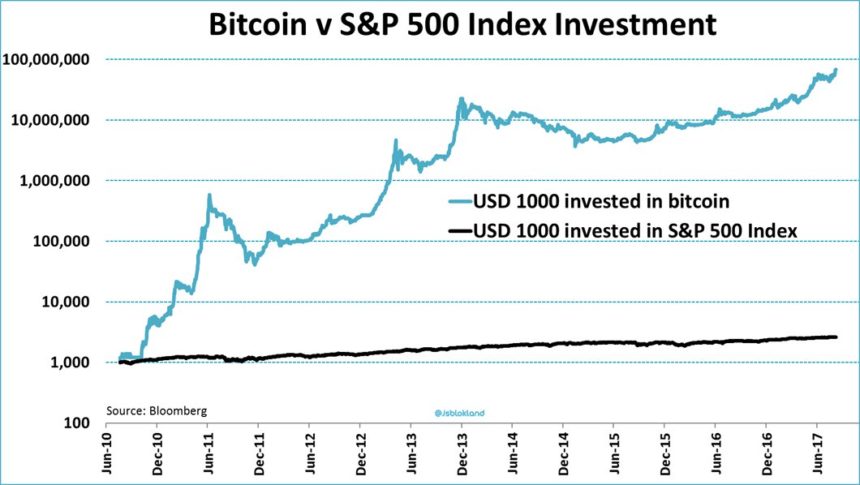

The decentralized nature of Bitcoin comes with a flip side: volatility. Bitcoin’s price swings can be dramatic, offering the potential for both substantial gains and heart-pounding losses. This volatility, while exhilarating for some, may send shivers down the spines of risk-averse investors.

Forex, conversely, enjoys a reputation for relative stability. Central bank interventions, along with the sheer size and liquidity of the market, act as shock absorbers, mitigating extreme price fluctuations. For those seeking a more predictable investment environment, Forex may be a more alluring option.

Transaction Fees vs. Currency Exchange Rates: A Matter of Cents and Dollars

When it comes to transaction fees, Bitcoin and Forex have contrasting approaches. Bitcoin transactions incur fees that vary based on network traffic and transaction size. During periods of high demand, these fees can soar, placing a significant burden on users.

Forex transactions, on the other hand, involve currency exchange rates set by market forces. While these rates fluctuate, they are generally lower than Bitcoin transaction fees, especially for large-scale transactions. For investors regularly navigating currency conversions, Forex may offer a more cost-effective solution.

Image: freerepublic.com

Accessibility vs. Complexity: Unlocking the Gates of Finance

Bitcoin and Forex differ greatly in terms of accessibility. Bitcoin’s open and permissionless nature means that anyone with an internet connection can participate in the network. However, understanding the intricacies of Bitcoin technology and safeguarding digital assets can be daunting for newcomers.

Forex, in contrast, requires a higher level of financial literacy and access to brokerage services. The complex nature of currency markets and the need for specialized knowledge may create barriers to entry for novice investors.

Conclusion: A Choice Guided by Investment Goals

The pursuit of financial success often demands thoughtful consideration and a deep understanding of available options. Bitcoin and Forex stand as distinct choices, each with its own allure and potential pitfalls. Whether you seek the uncharted waters of decentralized finance or the relative stability of established markets, your investment goals and risk tolerance should serve as your guiding stars.

Are you intrigued by the groundbreaking potential of Bitcoin, willing to brave its volatility for the promise of substantial gains? Or does the stability and accessibility of Forex align more closely with your financial aspirations? The choice is yours, a testament to the dynamic and ever-evolving landscape of global finance.

Bitcoin Vs Forex Which Is Better

FAQs: Demystifying Bitcoin and Forex

Q: Can I use Bitcoin for everyday purchases?

A: While Bitcoin is gradually gaining acceptance, its use as a medium of exchange remains limited compared to traditional currencies.

Q: Is Forex a suitable investment for beginners?

A: Due to its complexity and the need for specialized knowledge, Forex may be more appropriate for experienced investors.

Q: Is Bitcoin more valuable than Forex?

A: The value of Bitcoin and Forex fluctuate independently, and their relative worth depends on market forces and investor sentiment.